Insight Focus

- China imported a record amount of liquid sugar and premix powder in June.

- High sugar prices mean officials probably won’t restrict flows.

- But weak domestic demand and squeezed profits might.

Chinese imports of liquid sugar and premix sugar powder hit a new record in June 2023. Will this trigger official restrictions?

We tend to think the answer is no. Why?

June Reached Record High

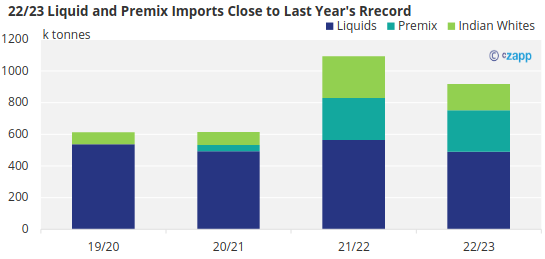

With less than 3 months remaining in 2022/23 season, raw sugar imports continue to disappoint. However, imports of liquid sugar and premix powder seem likely to reach/break last year’s record – 1.1m tonnes in total.

*Liquid and premix are converted to dry weight and sugar content only, the same applies hereinafter

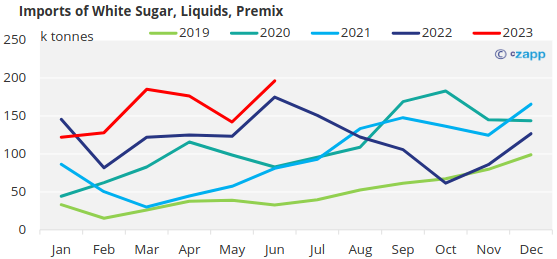

In June, when raw sugar imports were zero once again, the other three made up for its absence and reached a new high of 196k tonnes in sugar equivalent terms.

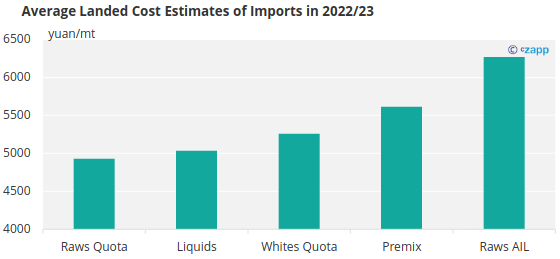

Given the import costs, this makes sense as liquids and premix pay zero import duty and are unregulated. All imports should have made a handsome profit with domestic prices rising from 5620 yuan/mt to 7320 yuan/mt during this time. The early bird catches the worm.

Will Officials Step In?

It’s old news that the sugar industry is lobbying to regulate liquid sugar and premix powder imports, as well as the premix production in bonded area. A couple weeks ago rumours flew that actions will be taken soon.

However, we don’t think this will happen while the domestic sugar price sticks above 7000 yuan/mt. Even if the government does not try to suppress prices, it clearly does not want them to rise again. The margin increases to 15% for the remaining two ZCE white sugar contracts – Sep and Nov – in 2023 is telling.

Direct Import Origins: Thailand and Vietnam

The question remains over the availability of liquid sugar and premixes, as well as consumer demand.

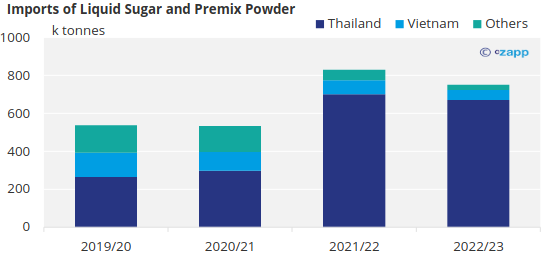

Thailand and Vietnam dominate the exports of liquid sugar and premix powder to China, accounting for 96%. The flow should continue as Thailand’s sugar availability is higher this year.

Bonded Zone: Switching from India to Brazil?

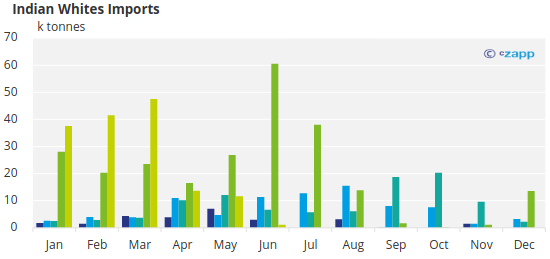

Premix powder imports into bonded zones have attracted the spotlight this year. The flow is drying out with the Indian exports reaching limits. And we are unlikely to see Indian sugar showing up in the world market by H1 2024.

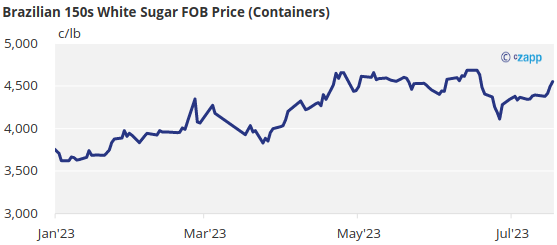

Some premix producers are turning to Brazilian whites. 45 shipping days are less popular with producers who have always had policy concerns. However, the price difference of nearly 1000 yuan/mt does give the margin.

But what’s more worrying for premix producers is that the consumer demand is going down. Some end users decided to adjust the formulas further and cultivate a consumer taste for HFCS (high fructose corn syrup) in the products.

Today’s F55 HFCS is quoted at 3500yuan/mt, which is 4545 yuan/mt in sugar equivalent, 36% cheaper than Guangxi white sugar.