Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

Insight Focus

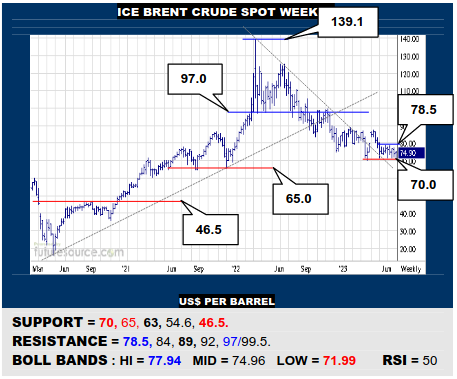

- Brent needs break above $78.50 to target triple digits again.

- If Dollar is defeated in 105 region, beware oil weakness too.

- Brent falling through $70 could lead to further weakness in the low $60s.

ICE BRENT CRUDE OIL SPOT WEEKLY

The weekly scene shows the ’22 downtrend escape has endured by way of the May-Jun ranging but still needs a clear cut breakaway over 78.5 to really hone the turn and step up the sights towards triple digits again. Alas, if the Dollar defeated the 105’s, do beware 70 succumbing here to undermine the trend exit and press on down to the low 60’s.

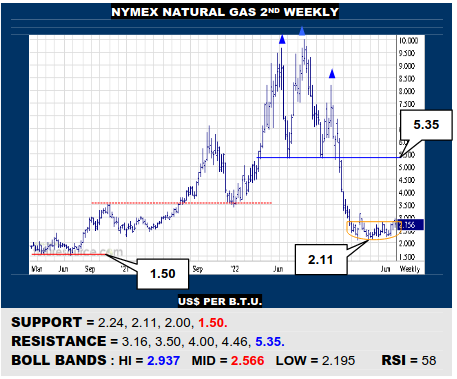

NYMEX NATURAL GAS 2ND WEEKLY

Repeated suggestions of ’23 becoming a saucer shaped base still cannot deliver a decisive getaway over the 2.80’s to shore things up. If that did finally occur, Nat Gas doesn’t appear to face much obstruction across the 3’s and 4’s until a massive top at 5.35 but the false starts keep the 2.11 support on alert for fear of a further brief slip to 1.50.

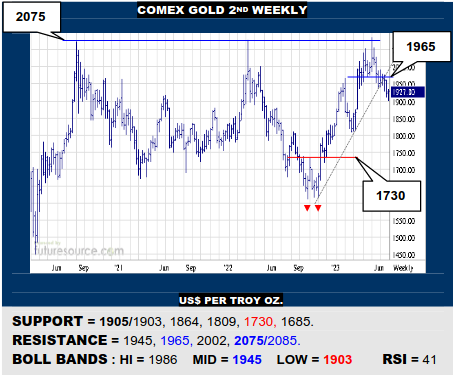

COMEX GOLD 2ND WEEKLY

A Q2 uptrend failure has initially been caught by the lesser 38.2% Fib retracement (1905) aided by the lower Bollinger band (1903). All the same, Gold must at least react over its mid band (1945) and soon the 1965 top border to really capitalize on this pick-up. Failure in the mid 1900’s would otherwise warn of risk on down to 1809 and even 1730.

LME COPPER 3-MONTHS WEEKLY

The Jun swell fizzled well shy of the mid term H&S neckline (9000) and Copper has fallen back quite sharply but was trying to find its feet near the lower Bollinger this week (8171). If it can, stay open minded to a second try towards that 9K obstacle. If not, loss of 8141 would threaten 7850 for the risk of a further step down to the 7340 monthly base rim.

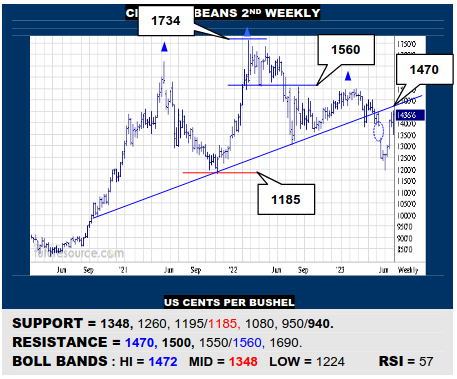

CBOT SOYBEANS 2ND WEEKLY

A stark rebound from the 1200 vicinity has filled the May gap and Beans are nearing the 1470 neckline of the big ‘20’s H&S top. If able to bust through into the 1500’s, this reaction would appear to stick and 1560 would look like a springboard to the 1700’s. Leery of failure meantime though so watch the mid band (1348) as a tripwire back to 1200 again.

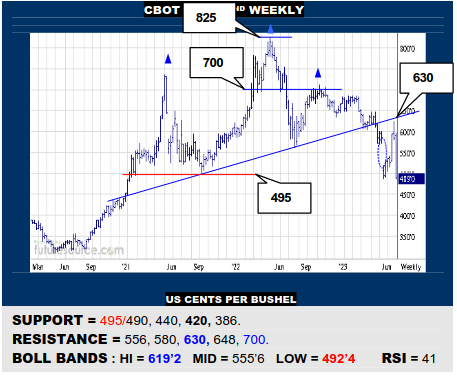

CBOT CORN 2ND WEEKLY

Corn on the other hand saw a near miss of its big H&S neckline (630) from which it has then plunged back down to the prior 490’s support. Cautious of its ability to catch this second dive and, if not, be prepared for follow through losses into the 440-420 monthly support before trying to dig in again. Must hold the 490’s to pique hopes for a hastier bounce.

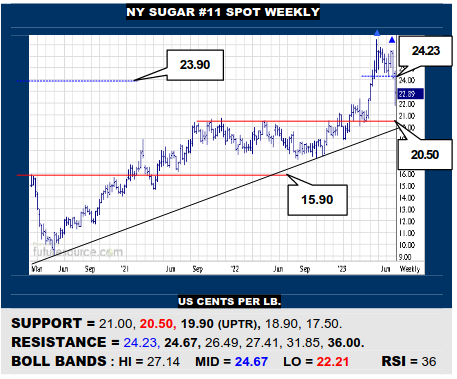

NY SUGAR #11 SPOT WEEKLY

Falling out of the 24’s through the 23.90 monthly pivot resolved a Q2 dual top from which Sugar has dropped away towards a beckoning 21₵ top projection. Cater for a little overspill to better 20.50 support where the bracing should be much stiffer to guard the ‘20’s uptrend (19.90). Must otherwise reflex over 24.23 to pull off a much swifter catch.

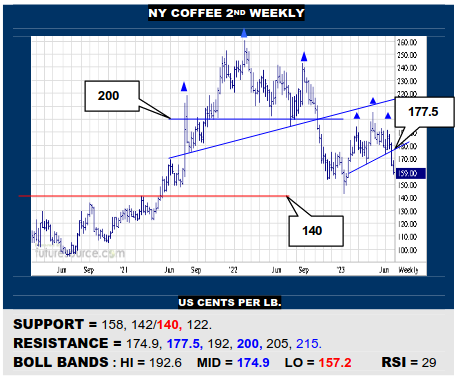

NY COFFEE 2ND WEEKLY

The ’23 H&S is tucked neatly in under an even bigger ‘21/’22 H&S north of 200 to put Coffee on a very frail defensive footing here. Technically the latest H&S is pointing on down to renewed testing of the pre-’21 base rim at 140 before there would be expectation of a better chance for a landing. Otherwise must pop 178 to actually disrupt the top overhead.

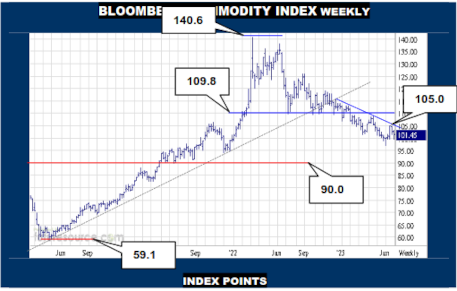

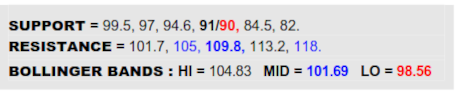

BLOOMBERG COMMODITY INDEX WEEKLY

Just when the macro seems to be waning, yet another little shaft of light hits the tunnel as the Dollar was blocked by its nearby top rim at 103.4 this week, giving the B-Berg a nudge back up Friday. Even so, this must soon carry the mid band (101.7) to give more reassurance and swivel the sights onto 105 again with a mind to the ’23 action developing more along the lines of a base, a subsequent emergence over 109.8 reshuffling to a much more pro-commodity outlook. Alas, if the Dollar still found a way clear of 103.4 to leave the 105 figure well overhead here, it would be premature to rule out further retrenchment to much bigger 91/90 support, the latter a Fib retracement of the early ‘20’s advance.

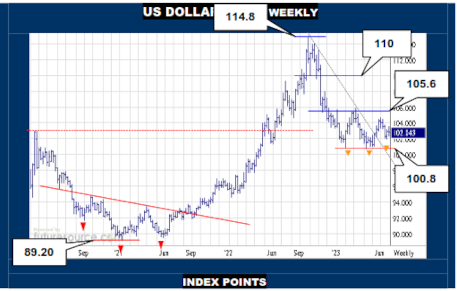

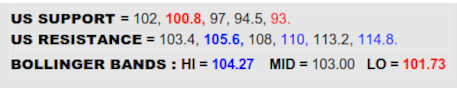

US DOLLAR INDEX WEEKLY

Jun had been shaping up quite well for the Dollar as it retrieved a dip near 102 to comfortably preserve the prior downtrend escape but Fridays’ refusal at the immediate daily top rim of 103.4 sets things back a bit. If able to swiftly rectify this and punch through, so the basing vibe of ’23 would grow and an ultimate emergence over 105.6 would complete an inverse H&S type of pattern that would infer belief in a further round of Fed rate hikes to drive back up to 110. The balance is wavering meantime though with that 103.4 stumble and the 100.8 troughs cannot be deemed immune to further attack with the risk of cracking a new aperture down to the 93’s.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.