- It looks like 20/21 could end sooner than expected, 3 mills have stopped this fortnight.

- This is due to the strong crushing pace result of the dry spell.

- It also takes a toll on cane harvested from now on as a drop in agricultural yield.

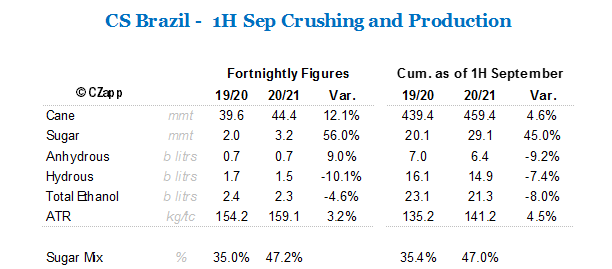

Summary Table 1H September

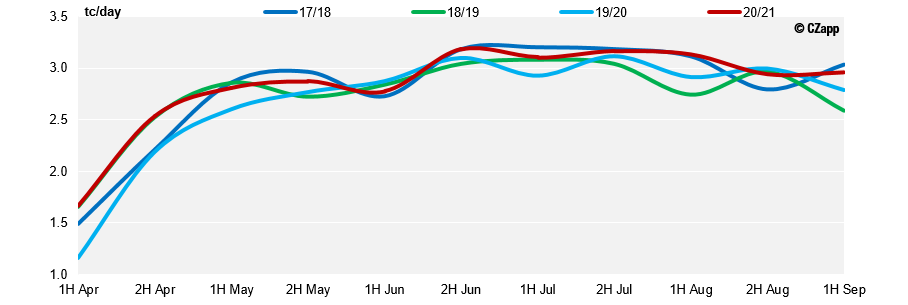

Pushing the Pace of Operations

- In this fortnight, crush was able to progress without interruptions due to excellent weather conditions.

- Total crush was 44mmt – 12% higher yoy – taking total cumulative crush to 459mmt, which is the highest on record for the period

CS Daily Crush per Fortnight – keeping the pace

- We reiterate that the crush level is a reflection of dry weather and not necessarily cane availability.

- According to UNICA, 3 mills have reported the early end of operations already in the 1H of September.

- And we are afraid that could be the case for several mills in the upcoming fortnights.

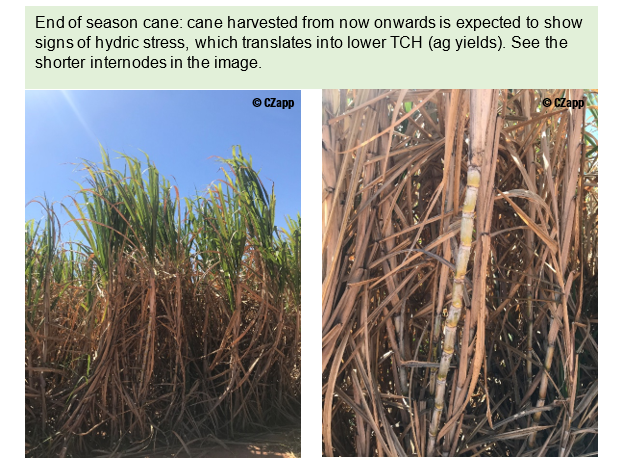

Cane Health

- Even though UNICA states in its report that the crush is around 75% done – which would translate into a total projected for the season of over 610mmt – we find ourselves a bit sceptical of a crush higher than last year.

- So far, ag yields data have not showed the impact of the drier weather due to the cane stage and cane age – younger canes have been responsible for a great share of the harvest so far.

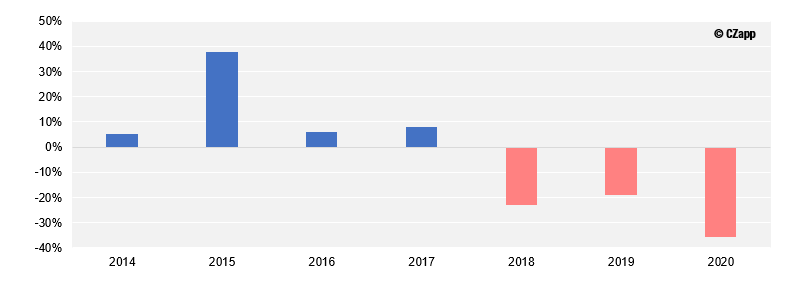

CS Variation from Hist. Average Rains – from April until September, rains this season are 36% lower

- However, since April rains are 36% below historical average.

- This pattern affects specially cane to be harvested at the end of the season.

- Is a sudden end to 2020/21 season in the works?

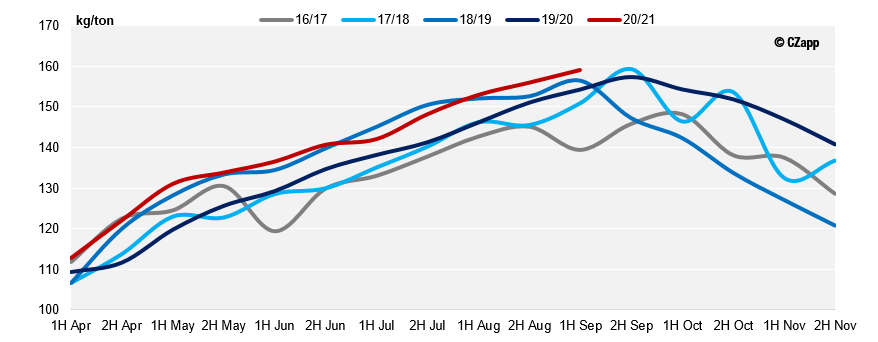

ATR Keeps Rising

- On the other hand, dry weather helps the sugar concentration in cane, ATR reached 159.1kg/ton in the 1H of September – this is the highest levels since 2010 and a 3.2% increase yoy.

- The combination of high ATR, good pace of operations and production mix maximized to sugar output, the sweetener production reached a cumulative of 29mmt.

CS Fortnightly ATR – Highest level since 2010

- Mills are expected to remain maximizing cane allocation to sugar production.

Ethanol Market

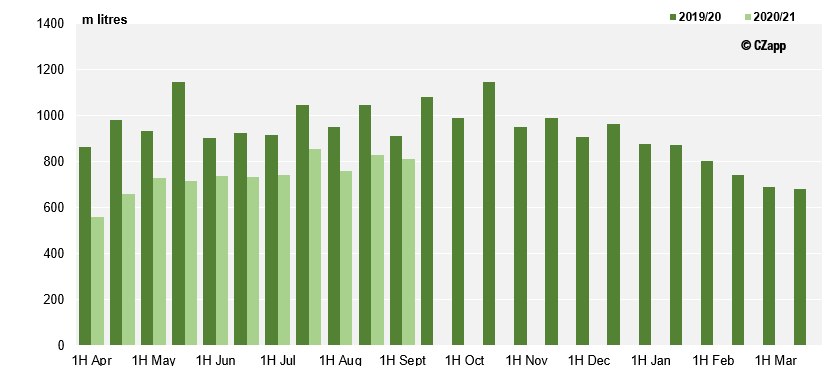

- In the 1H September, mills reported 813mi litres of total hydrous ethanol sales.

- It seems as hydrous reached a ceiling in sales, having averaged around 800mi litres per fortnight in the past 2 months.

CS Monthly Hydrous Domestic Sales – slow recovery