Mains Points

- What was already a complicated crop, has now worsened with the most intense frost seen in CS in the last decade – the impacts of which are still being measured.

- So far it is nothing new, the point is to model the impacts of both drought and cold to measure the result in the production of sugar and ethanol.

- A reduction in availability of both is expected.

Starting from the end

- We are already going to advance the results of our analyses, leading to a review of the crop.

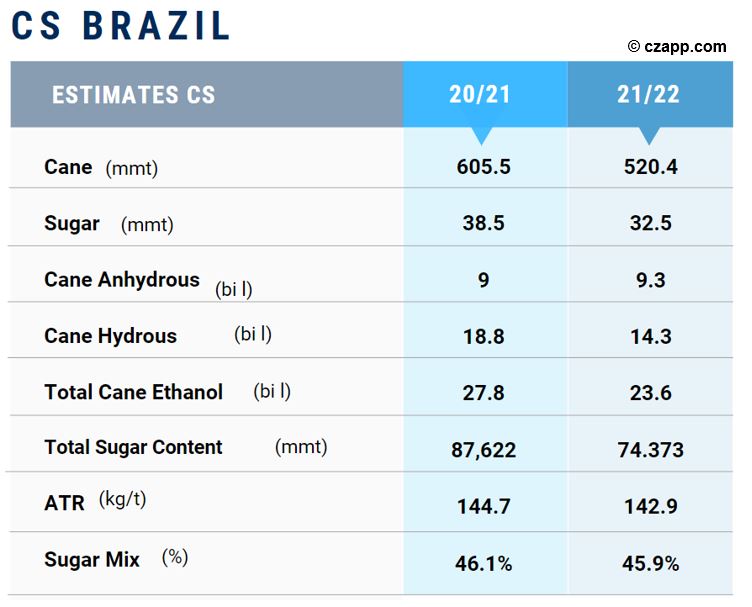

- In the table below you can see that our current estimate for sugar is 32.5mmt as a result of an expected reduction in crushing from 535mmt to 520mmt.

- All our assumptions and impacts on CS sugar availability can be found in the sections below

Agricultural Productivity Defines Sugarcane…

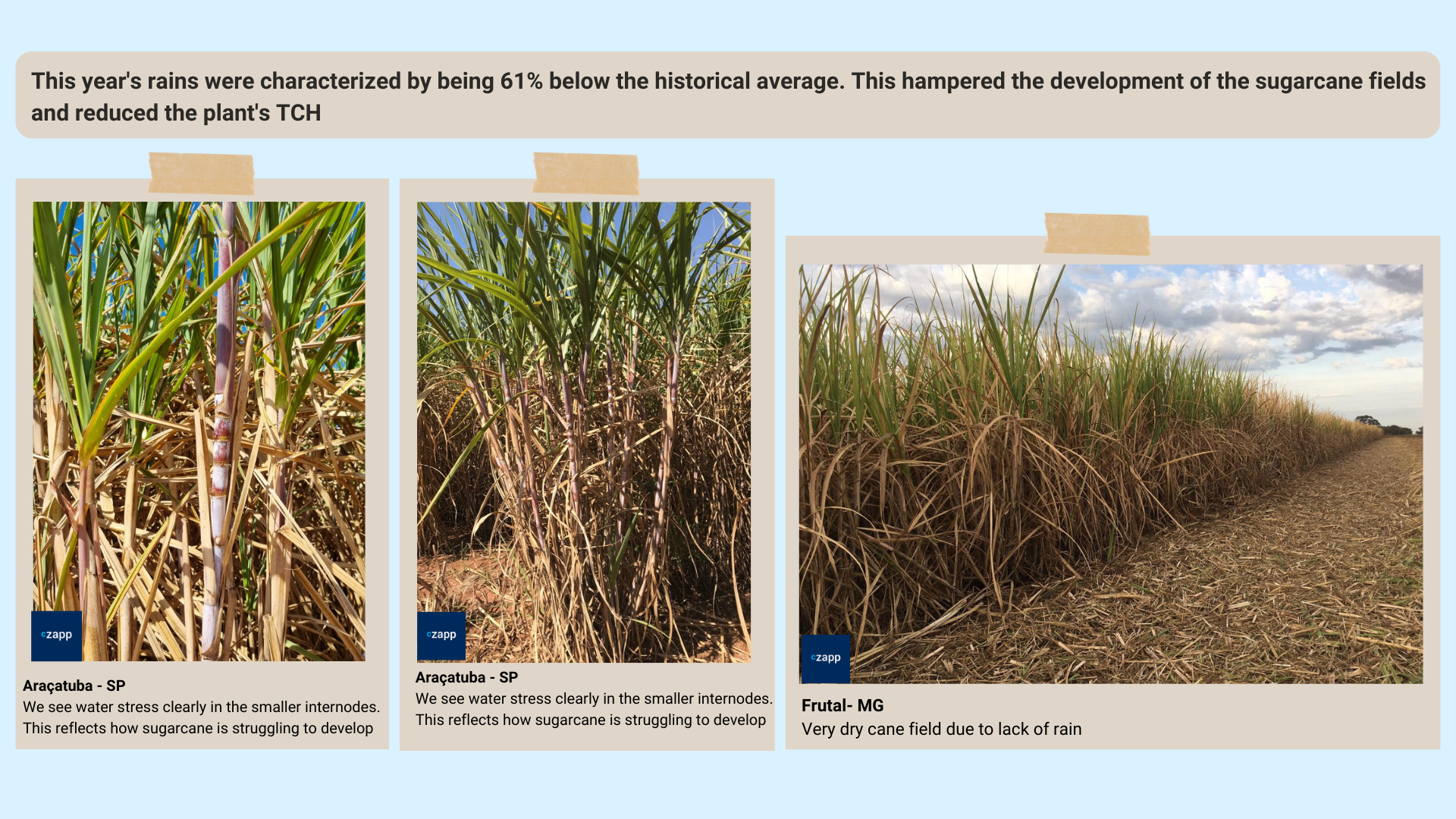

- Despite the fact that sugarcane is a resilient crop to adverse weather, the persistent drought recorded since last year has placed significant pressure on the development of sugarcane fields.

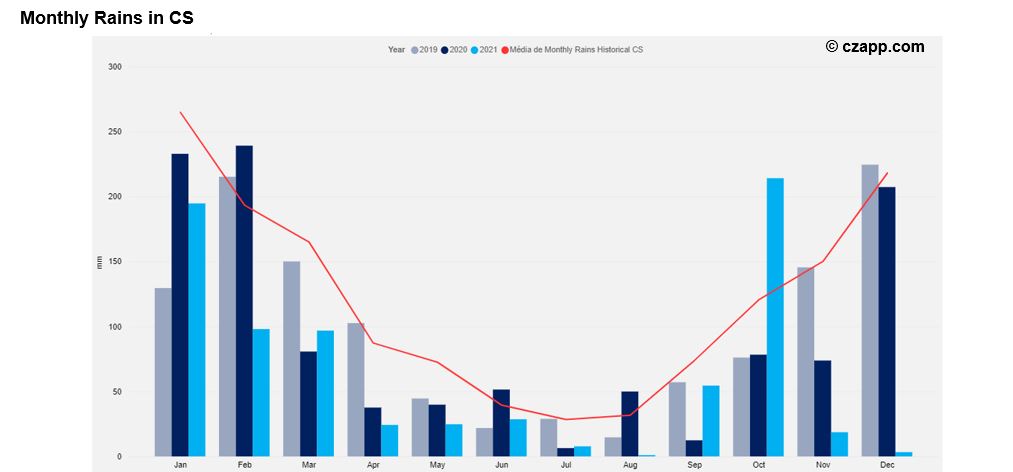

- The rains at the beginning of the year (Jan-Mar) are essential for the development of sugarcane fields, and in this cycle they were 38% below the average – the driest first quarter of the decade, even more than that seen in 2014, the year of the last great fall in crop in the Center South (CS).

- To make matters worse, the weather continued to be dry and on the cumulative, from April to July, it rained -61% than the average for the CS region – again, the driest period in the last 10 years.

- The result of this drought is a significant impact on agricultural productivity, which together with the expected area, determines the availability of sugarcane.

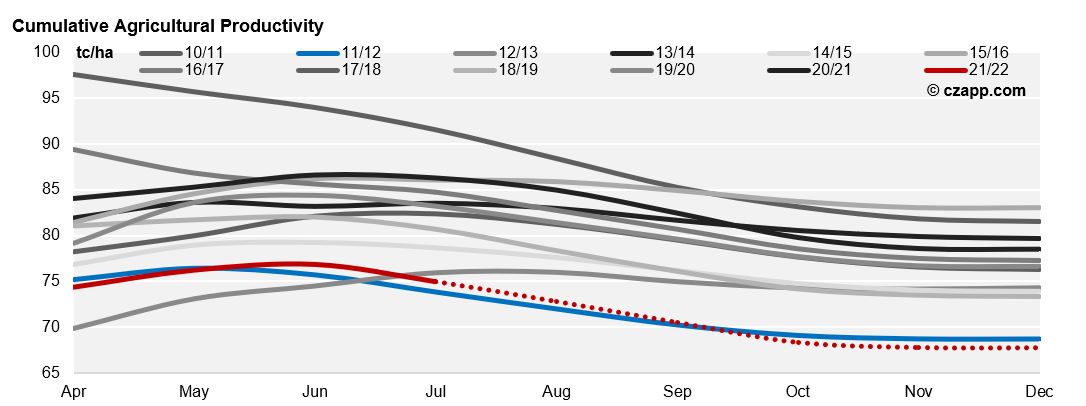

- Until July, the data show that the TCH (ton cane/ha) decreased by 13% compared to last year, going from 86.3tc/ha to 75tc/ha – it is the sharpest retraction for the period since the 2011/12 crop.

- With the frosts in June and July (the latter being the worst and strongest of the decade, as mentioned by several suppliers and mills) they only added more concern to a sugarcane field already very stressed by the drought.

- Putting these factors together, we believe that the drop in agricultural productivity should be around 13.5%, taking the effective harvesting of CS to 520mmt.

- The effects of the frost are still being measured, and at the moment we have not ruled out any further downside risk for this number.

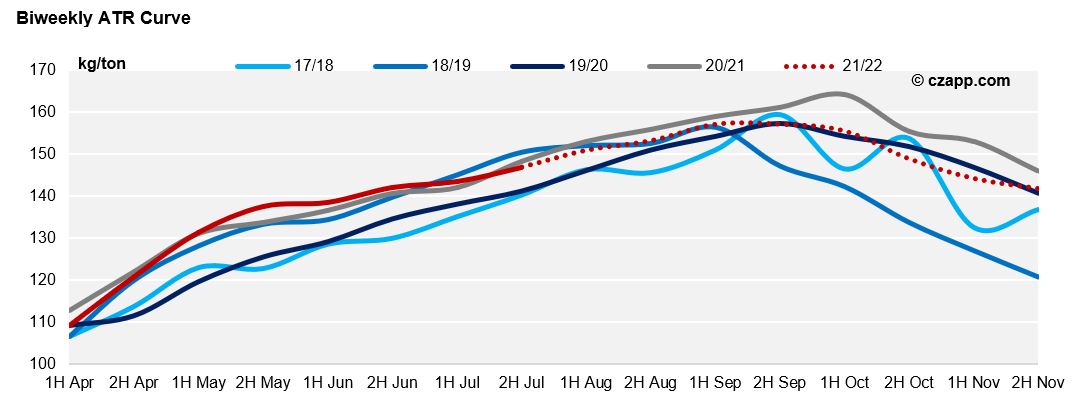

…ATR and Mix, The Sugar

- In addition to the impact on agricultural productivity, frosts also impact the ATR.

- Affected sugarcane fields that had to be harvested ahead of time have a negative impact on ATR.

- This was seen in the last update of production in the Center South , with a retraction in the concentration of sugar in sugarcane.

- We believe that this trend should continue in the next fortnights, reducing the ATR projection from 144.7kg/ton to 143kg/ton.

- This means less sucrose available, affecting the expected final sugar production in CS.

- In addition to the lower ATR, the sugar mix has been consistently a little lower than last year’s curve – probably due to the quality of the plant.

- With a small mix reduction from 46.3% to 45.9% – and obviously the lower crushing mentioned above – we estimate that sugar production in the Center South should total 32.5mmt.

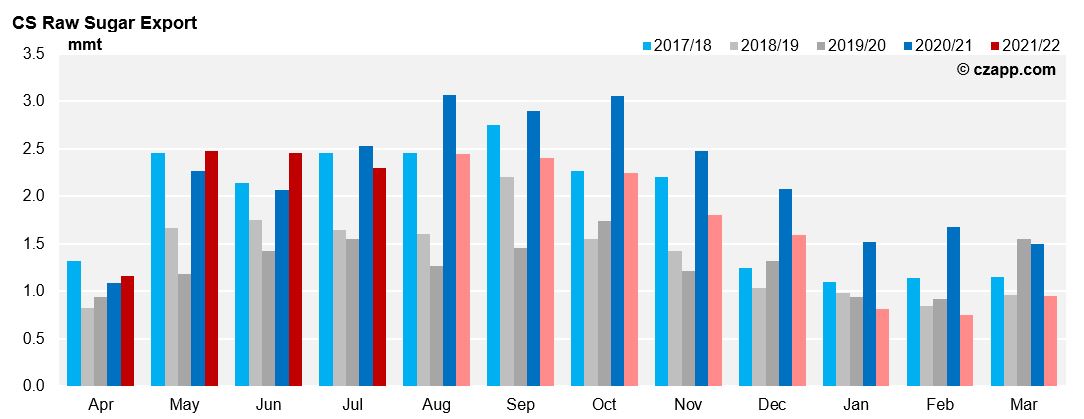

How is availability?

- With the retraction in the estimate of sugar production, we estimate that the availability of raw sugar will drop by around 1mmt compared to the previous projection.

- Expected exports should be 5mmt lower than last year, totaling 21.4mmt.

- An availability deficit in Q1’22 is already expected, and this revision only adds to the view of a tighter market early next year.

- That’s what we haven’t even started talking about 2022, a longer analysis for another publication…

- Spoiler: the outlook is not positive…

Some Images and Reports from the Field

Reports that you might like:

Dashboards that you might like: