- Weather is negatively impacting cane development, especially in the 2H of the season.

- However, the same dry spell is increasing sugar concentration in the plant.

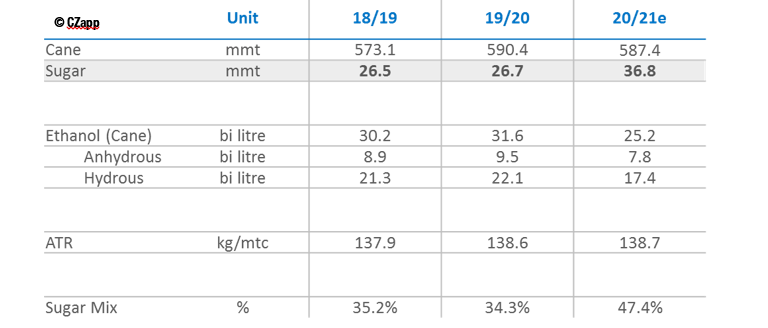

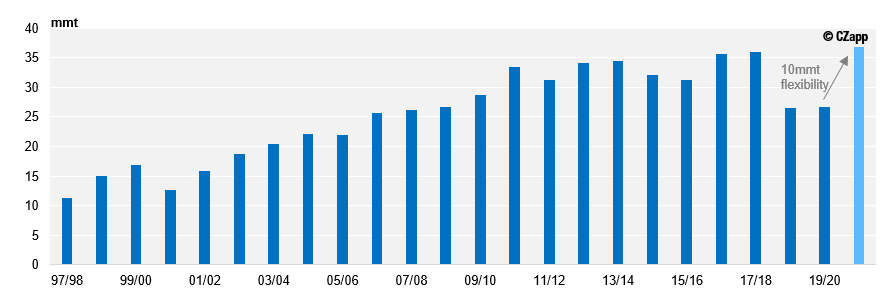

- The result is ATR offsetting a reduction in ag. yields and CS Brazil at a record sugar output – 36.8mmt.

CS Summary of Estimates

Poor rains, poor cane

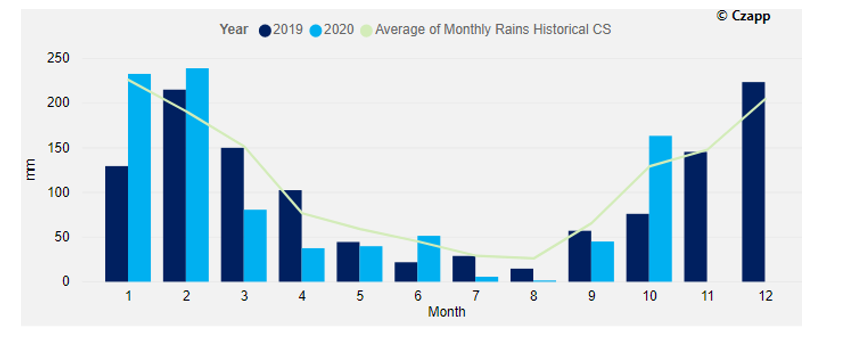

CS Brazil Monthly Rains – poor rains since March

- Rains in CS Brazil have been below average for the past 3 months, hindering 2H cane crop development

- Although cane is a fairly resilient crop, it depends on rains on average in order to develop properly.

- So far, agricultural yields (TCH) have been higher than last year, but cane harvested until now got the amount of rain needed for their development.

- Our concern is the cane being harvested from August onwards.

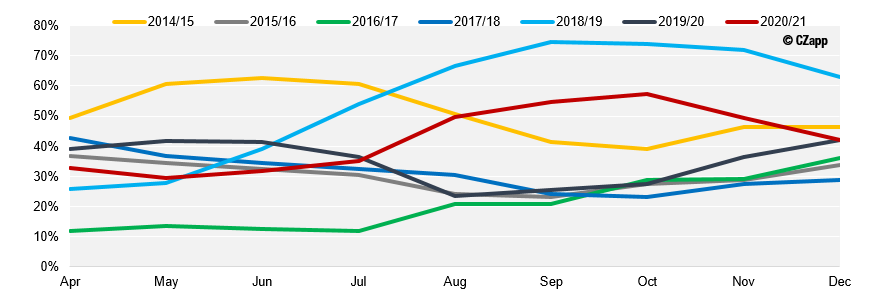

Cane Development vs. Rains

- The chart above is a little tricky but bear with us.

- It is a proxy to analyze by month what’s the growth percentage that has been affected by poor rains.

- For instance, cane harvested so far in the season has suffered with poor rains only 30% of its development – so it’s still within normal parameters for development.

- However, cane harvested from August onwards will have over 50% of its development period affected by poor rains, which should translate in some agricultural yield loss.

- This has led us to revise our cane crush down to 587mmt – vs. our previous 595mmt estimate.

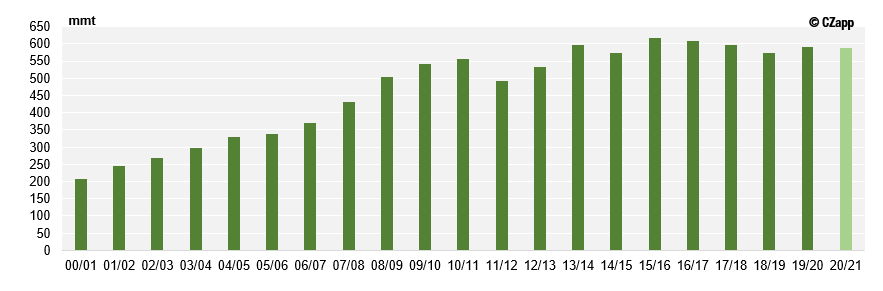

CS Cane Crush – slightly below last year

Poor rains, lucky ATR

- Although poor rains are bad for cane development, leading to lower agricultural yields, it is beneficial for sugar concentration, higher ATR (cane sugar content).

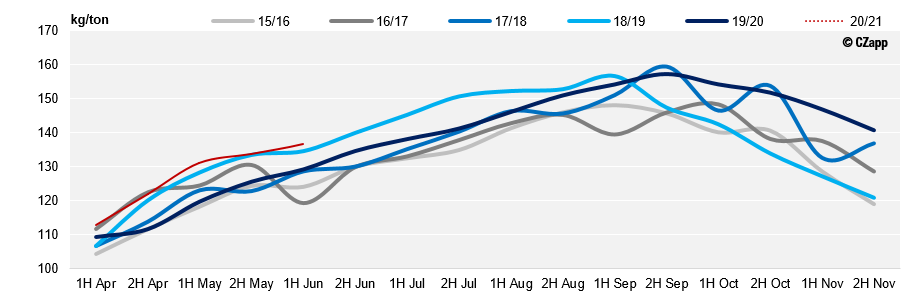

- So far ATR has been one of the highest of the past 14 years, with cumulative figures until 2H of July reaching 131kg/ton.

CS Fortnightly ATR – dry weather has allowed for high ATR

- We believe there is upside for this figure depending on the volume of rains going forward.

- Nonetheless, currently our estimate points to an ATR slightly above last year at 138.75kg/ton.

More Sugar

- Even though we have revised our cane number by almost 10mmt, our sugar production forecast has increased to roughly 36.8mmt (vs. 36.5mmt we had as a previous estimate) – which is a record for CS sugar output.

- What has compensated a lower crush forecast is the quality of the cane, i.e. a higher ATR.

CS Sugar Production – back to No.1

- However, we have not turned a blind eye to the upcoming risks.

- The season is 50% done, therefore depending on the incentives production strategy can still shift.

- Have a look at these reports for more insight on the medium-term risks:

- CS Brazil – The Risk Around Max Sugar.

- Brazil Ethanol : Fuel Demand Recovery, Less so for Hydrous