- Although the 2H March figures officially closes the 19/20 season, the data actually indicates what mills planning and already doing of 20/21.

- Weak hydrous sales due to quarantine restrictions and a higher sugar mix for the period corroborates with the idea of a max sugar season.

- For the moment, we sustain our forecast of 593mmtc, mix of 46.5% and sugar output of 35.7mmt.

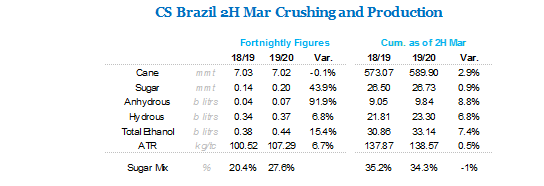

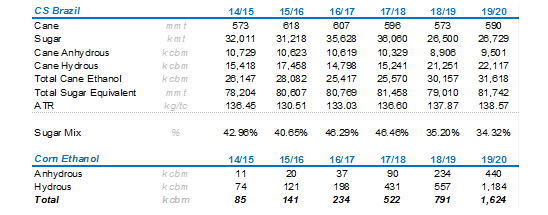

Summary Table

Ending Figures…

- The 2019/20 season is now officially over.

- Crush saw a 3% increase due to higher cane availability, possible due to better agricultural yields.

- 2019/20 was the season where CS Brazil had the lowest sugar mix in 24 years, with mills allocating as much as possible cane towards ethanol production.

- And, a season of high ATR (sugar content) possible due to a dry weather throughout 2019.

- But now we look towards the highly challenging 2020/21 …

… a peak into the new season

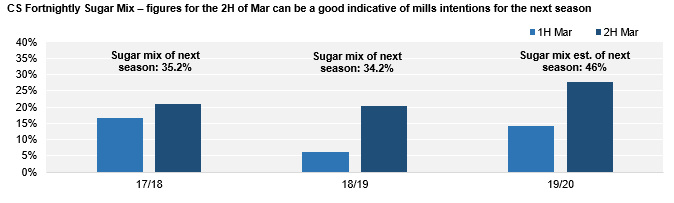

- Although March crush is new season, UNICA accounts as old since officially the season in Brazil is from Apr-Mar.

- Therefore, figures for the 2H of Mar can be a good indicative of mills intentions for the next season.

- This sugar mix figures for 2H of Mar showed an indication that mills are willing to produce more sugar this season, coming at 27% – a significant shift from the 20% from previous years..

- Mills do no start the season at max sugar.

- They build gradually the mix as cane quality improves – at the beginning of the season, ATR (sugar content) is low which makes it difficult to produce a lot of sugar.

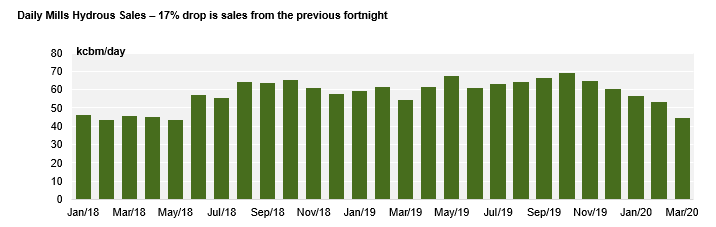

Ethanol Market

- Hydrous mills sales data of the 2H of Mar already shows the effects of the lockdown.

- During the 2H of March, hydrous sales fell by 18% when compared to the 1H of the month

- The downward trend is expected to be seen in the upcoming months as quarantine measures limits consumer demand.

- We will know for sure the impact on total duel demand once ANP publishes March figures – expected only at the end of the month.

- Nonetheless, we hear multiple reports from distributors and gas stations that sales have fallen up to 70%.

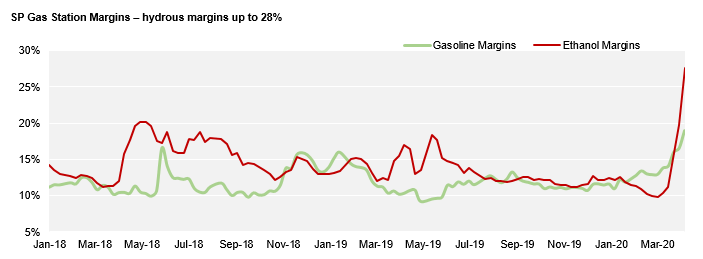

- One interesting proxy to look now is gas station margins.

- Due to fall in sales volume, gas stations are having to compensate by increasing their margins.

- However, even with the steep increase in hydrous margins price parity fell to 66% last week.

- This helps keep what is left of demand turned towards the biofuel.