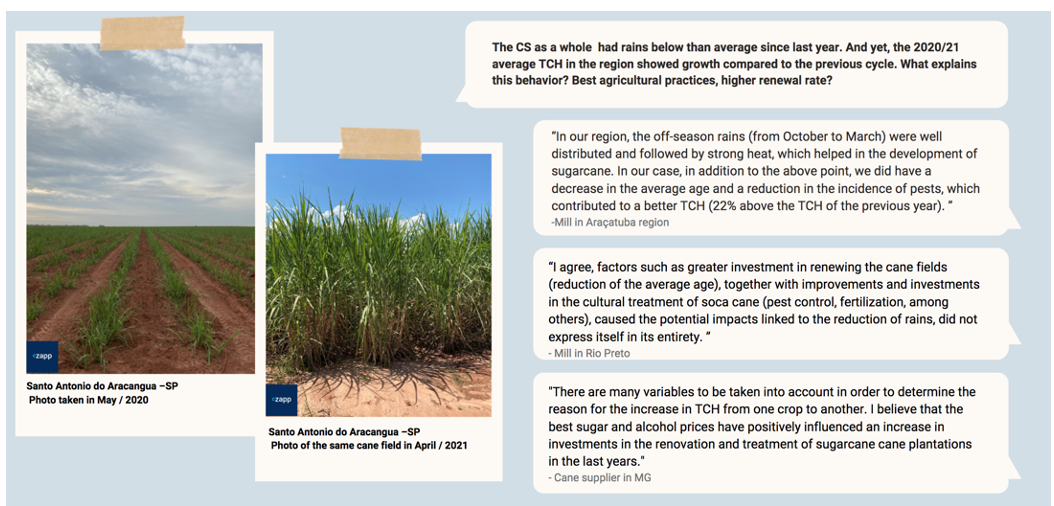

- That the dry weather in the CS Brazil affected the sugarcane fields in the region is nothing new.

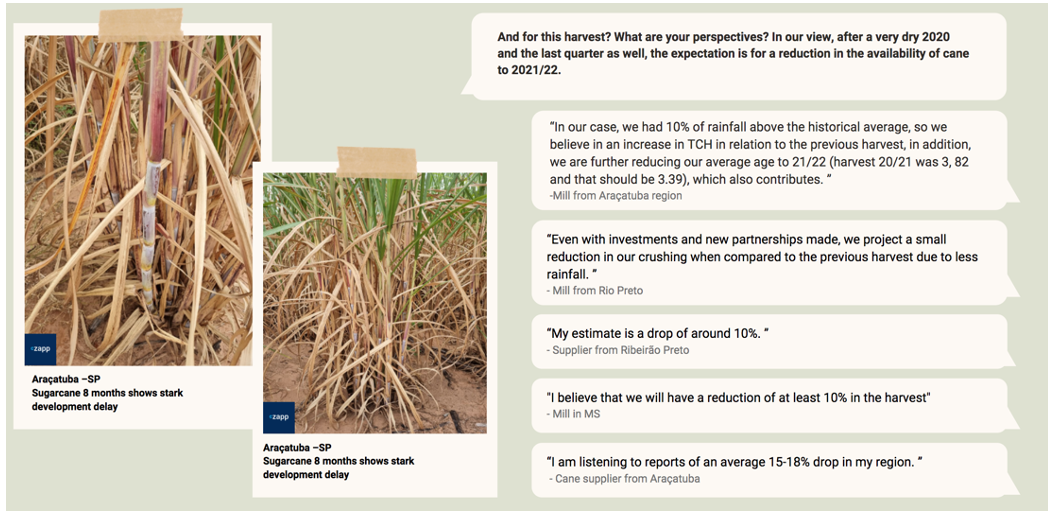

- The big question is how much we can expect from the crop failure (realistically) and what expected impact on the availability of sugar and ethanol.

- For that, we listened suppliers and agricultural specialist of the mills to understand the feeling in the field, and of course give our estimates at the end

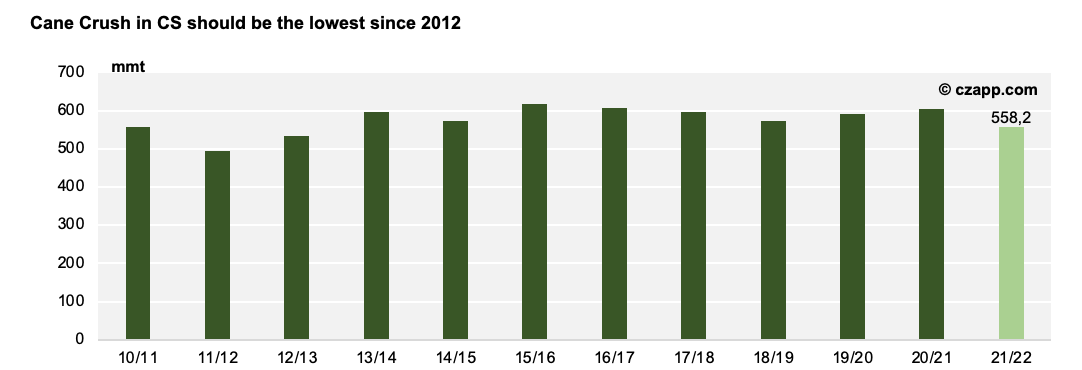

Lowest Cane Crush in Almost a Decade

- Situation in the CS cane fields is critical – our field analysts have seen many areas where the cane does not seem to have developed, with half the internodes that would be expected and in addition to cane fields with flaws.

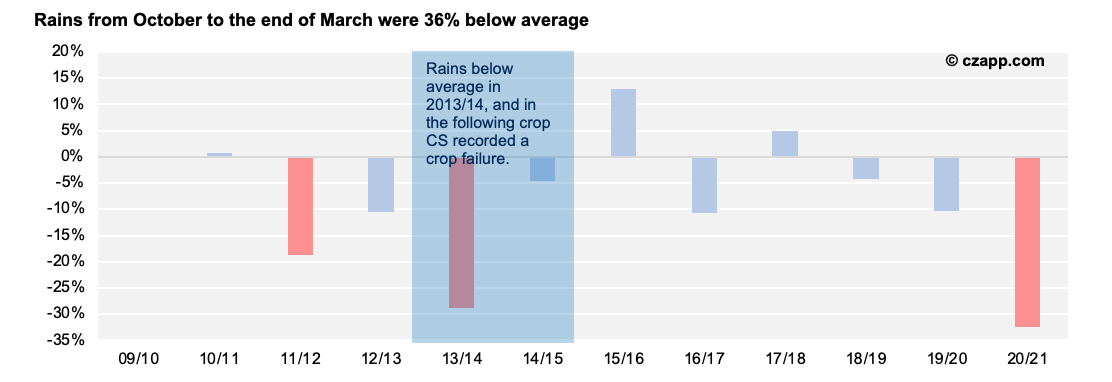

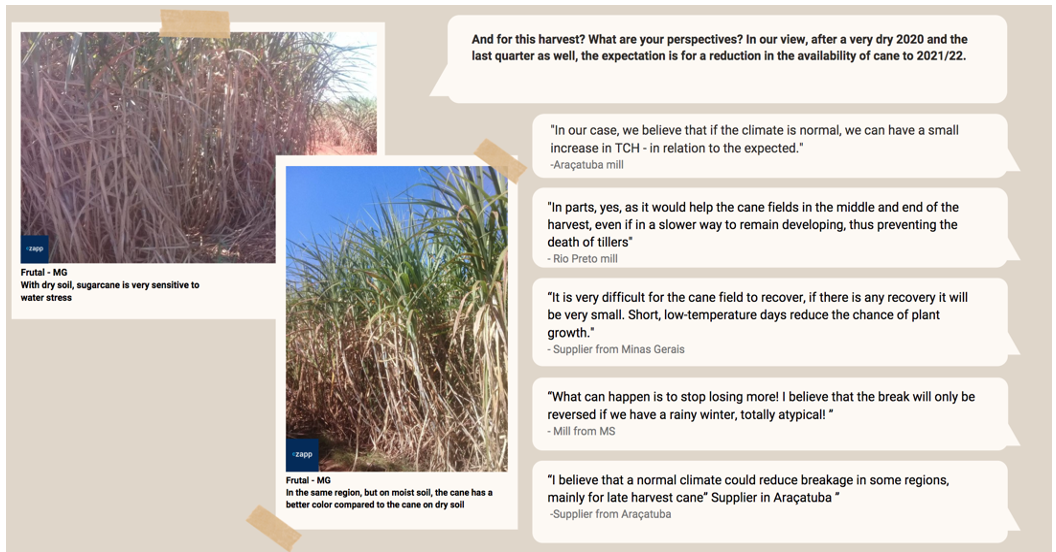

- Accumulated rains since last October were on average 36% below the normal history for the CS region – the biggest drought seen in more than a decade.

- The cane field must also be older, since the renewal calendar last year was hampered by the drought.

- On the other hand, the cultural treatment of the cane fields has been better in the last 2 years – something allowed by the better cash generation of the mills – which helps to limit losses in productivity.

- Anyway, the extremely adverse weather combined with last year’s fires left their mark and our expectation today is a 7% drop in agricultural productivity (TCH).

- This puts the crush in the CS below 560mmt.

- We reinforcea that rainier winter, or at least normal rains from now on, may mean a slight recovery of the cane field to be harvested at the end of the crop – October onwards.

Relax! Not everything is lost

- Wait, not all the sugar is lost!

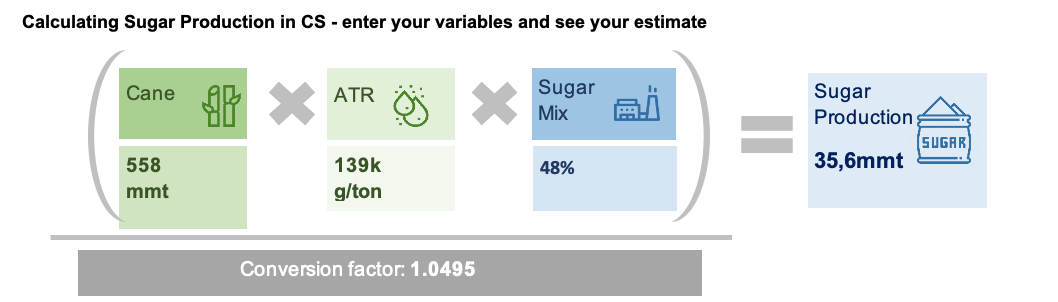

- A drier weather also means a higher ATR than initially estimated – 139kg / ton.

- Higher sucrose in the cane helps to partially offset the reduction in crushing.

- In addition to the higher ATR, we should also remember that approximately 80% of the raw sugar production is already priced and committed, therefore, the mills must do their utmost to be able to honor their commitments.

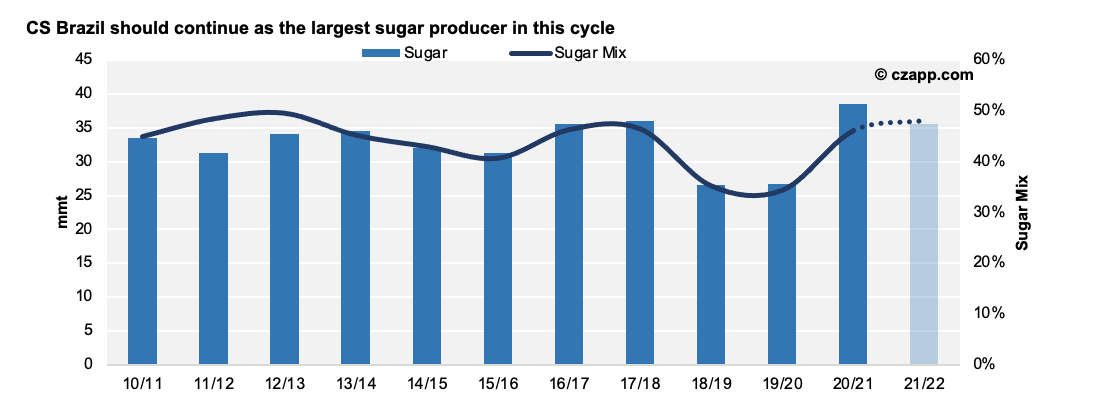

- We believe that the CS should reach at least 48% sugar mix in 21/22.

- Based on the assumptions above, sugar production in the CS should be around 35.6mmt – or 360kmt below the previous estimate.

- Looking at the availability of raw sugar for the world market, it remains very close to what we are running on our balance sheets with a reduction of just 240kmt.

- Ethanol … well, that is a topic for another session.

Concern is unanimous

- We listened to suppliers/ mills in different regions and compiled the main points of their responses.

- The common point in all of them is the same: concern with sugarcane development, unanimity that there will be a crop failure, but they are not sure of the extent – yet.

Summary of our Estimates