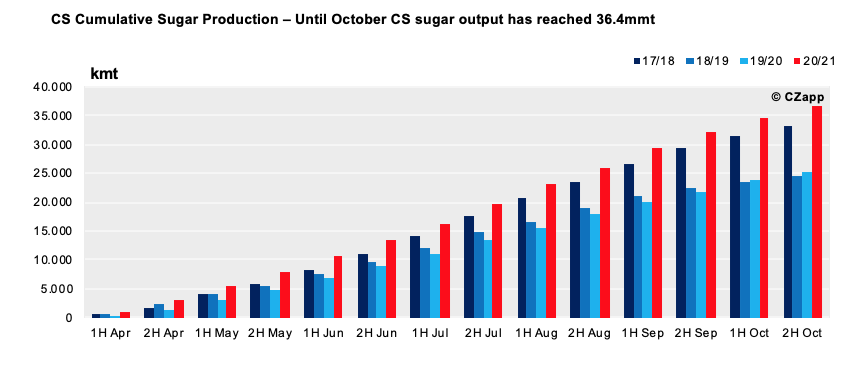

- Sugarcane crushing and sugar production reached record levels – 564.9 mmt and 36.4mmt, respectively.

- So far, 63 plants have finished their operations.

- Development concerns for next season are on the table.

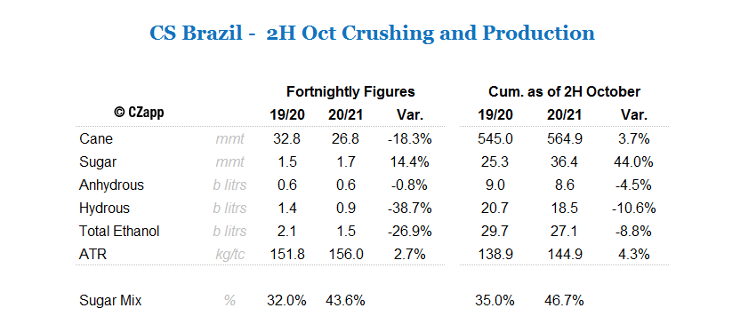

Summary Table 2H October

Close to the end

- Although the crush in the fortnight was 18% below yoy, cumulative crush is 4% above last season at 564.9mmtc – a record for the period.

- Despite the lower crush, another fortnight of strong ATR allowed sugar prodcution to reach 1.7mmt taking total sugar output so far to 36.4mmt.

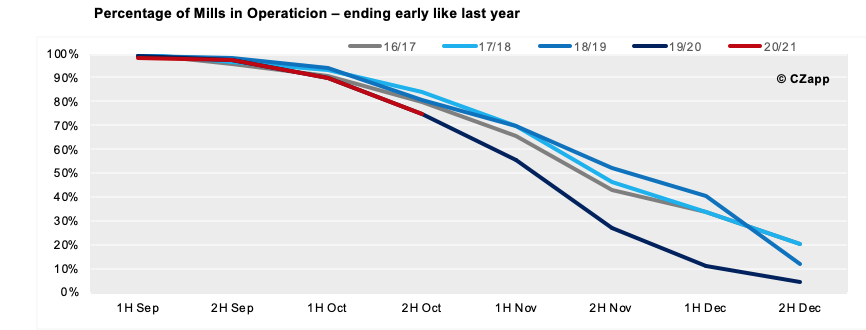

- Mills have started to slow down the pace of crush

- Similar to last season, CS is moving towards an early closure.

- By the end of October, 63 plants have finished their activities.

• In this fortnight, the signs of the dry spell experienced throughout the 20/21 season started to become more evident for the first time.

• October preliminary data puts agricultural yields (tc / ha) down by 4.3%, resulting in a TCH Average of 64.6.

• We don’t see crush surpassing 595mmt.

Development Concerns for 21/22

- The dry spell also is cause for concerns for 21/22 season.

- Some areas have cumulative rains since April down by 48%.

- With the signs of the impact of the drought, we raise the flag once again for the risk of sugarcane development.

- If the rains in the coming months are below average, the availability of sugarcane on 21/22 runs the risk of being below the current projection of 580mmt

Ethanol Market

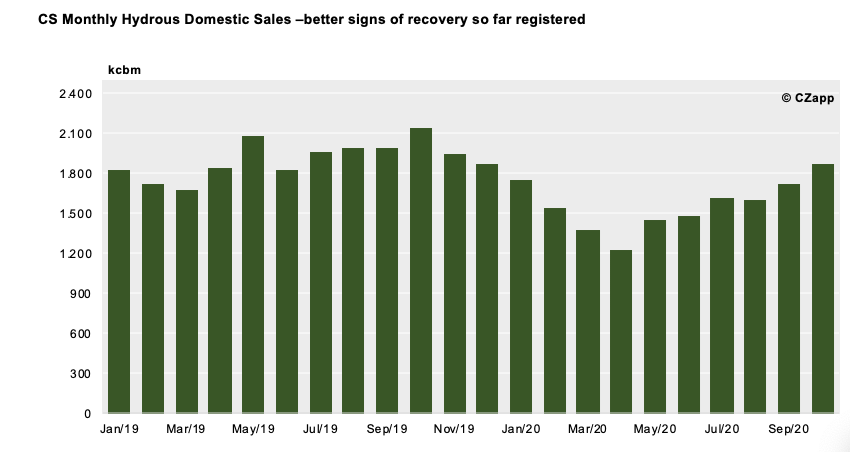

- Hydrous sales by the mills registered,1.87 bi litres in October, 13% decrease yoy.

- The retraction observed in October was below the values registered until now.

- This shows a better sign of recovery of the consumption of the biofuels.