- UNICA’s figures for the first half of March were in line with our perspectives.

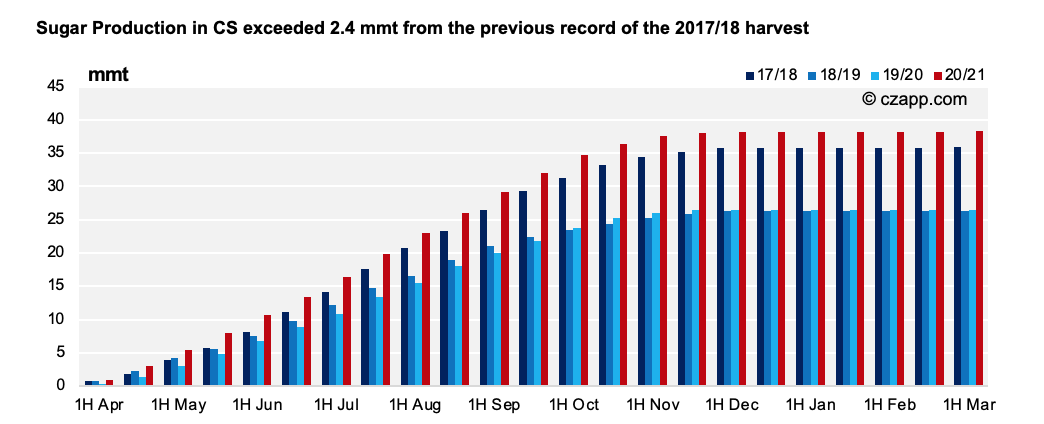

- So we still maintain our total cane harvested at 605mmt, which represents a total production of 38.4mmt

- Until March 16th, 30 mills started their harvest. Their numbers are officially accounted for the 2020/21 crop, but the mills in operation are starting the 21/22 crop.

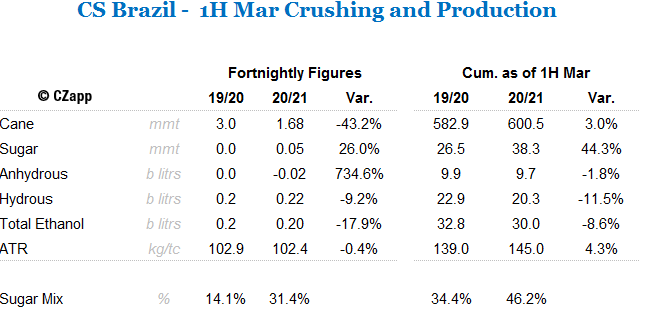

Summary Table 1H March

- Until the first half of March, CS processed 600 m tons of sugarcane – 17.6 mmt more than last year.

- From this cane 38.3 mt of sugar (record) and 30 bi liters of ethanol were produced.

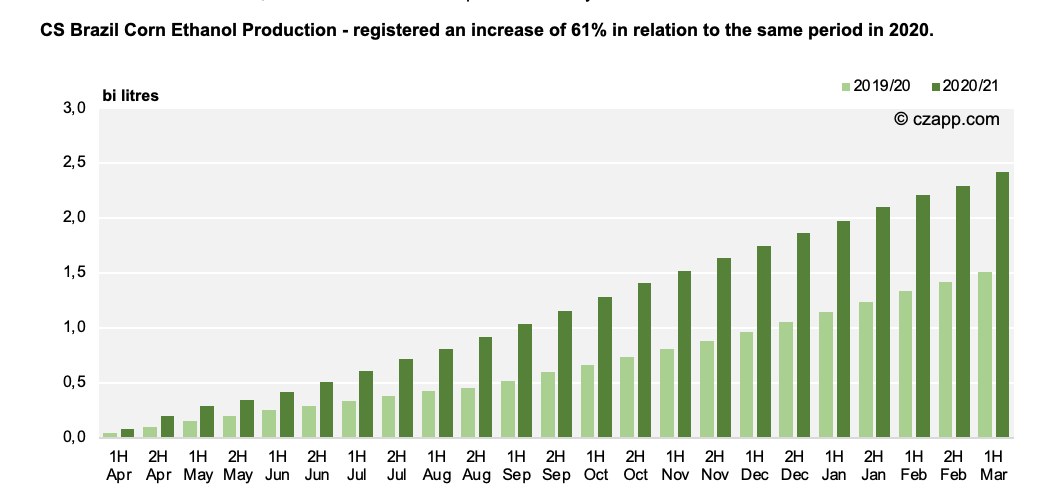

- Corn ethanol production also stood out this season, with 2.42 billion liters produced by the end of the first half of March – 61% yoy.

- Of these 2.42 billion, around 74% went to the production of hydrous ethanol.

Beginning the Operations

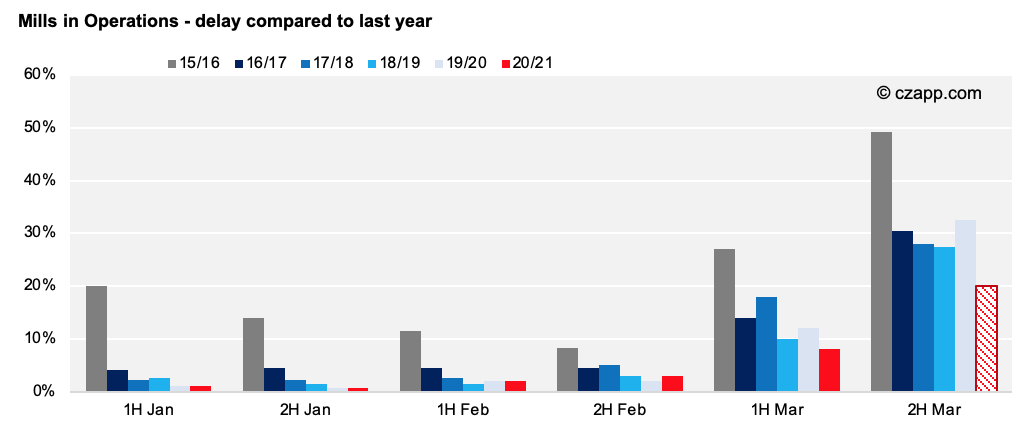

- In preparation for the 21/22 crop, so far 30 mills have started their harvest.

- According to UNICA, by the end of the month a total of 54 mills are expected to be operating – 33 less than last year;

- The slower start of the crop is due to the lower volume of biscane cane available and the development of the cane field, which is delayed.

- The below average rains in the last 3 months (in fact, for some regions since last year) impacted the growth of sugarcane in its critical phase, forcing some producers to postpone the beginning of the 21/22 crop.

Ethanol Market

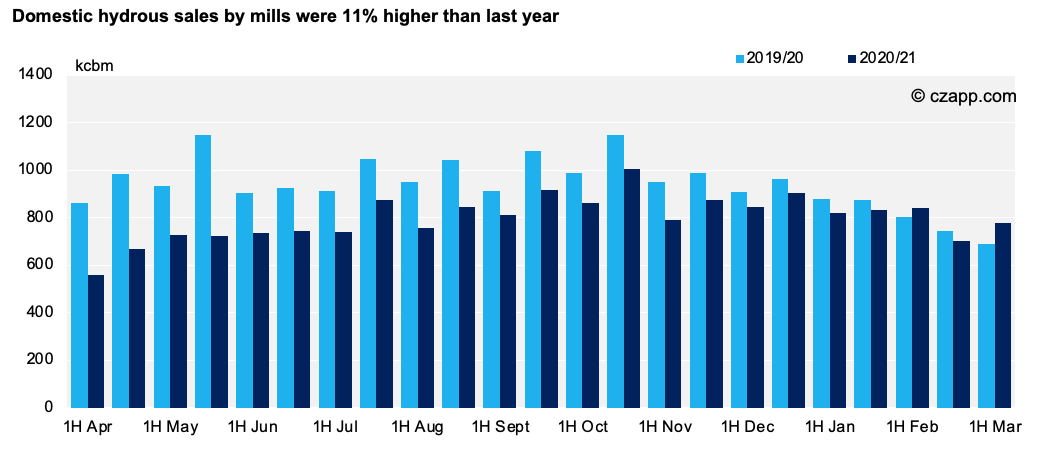

- Despite the restriction measures due to the pandemic, sales of the biofuel increased in the first half of March.

- 779m liters of hydrous were sold.

- However, the next two weeks are expected to show a drop in demand due to mobility restrictions.

- To better understand the hydrous price behavior, access The Brazilian Ethanol Market – Back to 2020?

Dashboard that you might like

Coming soon: Price and volume of CBIO Trades