Main Points

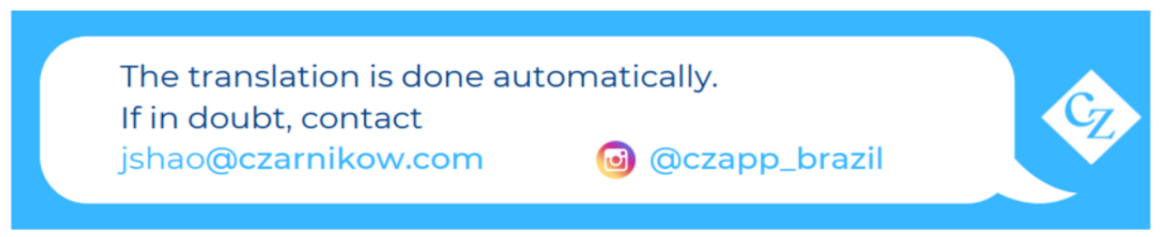

- Near the end of operations, CS reached 467 mmt of processed sugarcane by 2H of September.

- The region so far has a cumulative production of 29.19 mm of sugar and 22.79 billion of ethanol.

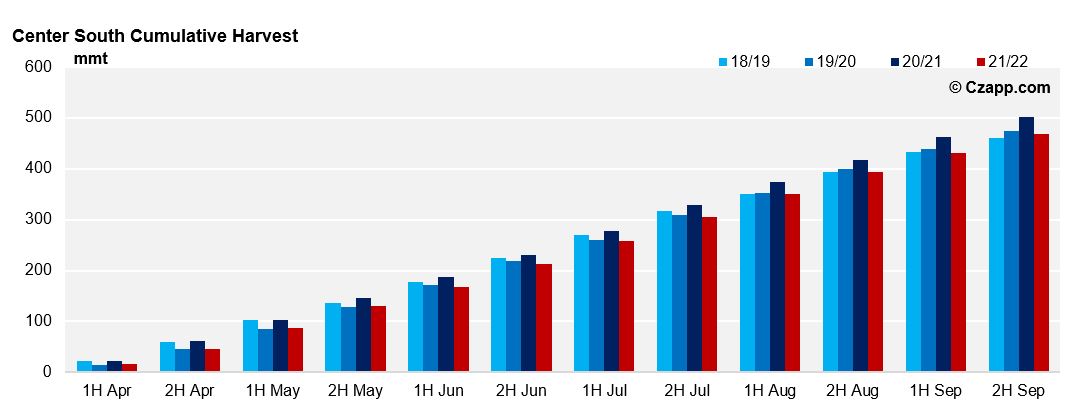

- So far 36 mills have completed their harvest, and another 52 units are expected to close in the next fortnight.

Crop 2021/22 – 2H September

Accelerated Harvest

- The amount of cane processed at the end of September was 35.8 mtc – 11% less than the same fortnight in 2020.

- With this, until the end of September, CS reached an accumulated crushing of 467.44 mtc against 501.88 mtc last year.

- The reduction in crushing is a direct result of the low availability of sugarcane in this cycle, a reflection of the drop in agricultural productivity:

- Preliminary data released by UNICA indicate that the drop in the first half of the month is 21% yoy:

- 58.2 mtc/ha against 74 mtc/ha.

- However, we still need to wait for the closed value for the month of September to compare recorded versus estimated.

- September sugarcane was one of the most affected by drought and frost, and we expect a drop of at least 20%.

Mills near closing

- With the lower availability of sugarcane, the mills are ending the harvest earlier.

- So far 36 mills have closed their harvest operations – versus 5 last year.

- Most of the mills that have ended the 21/22 cycle are in the state of São Paulo, which was the most impacted by the effects of drought, frost and lately fires.

- According to UNICA, another 52 mills are expected to end their operations in the next fortnight

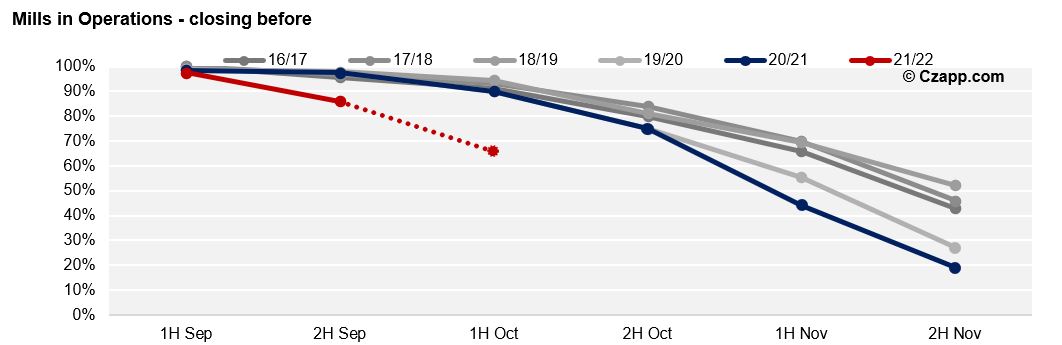

Ethanol market – anhydrous continues with the preference

- As in the previous fortnights, the mills continue to prioritize the production of anhydrous

- Despite the retraction in crushing, the production of anhydrous ethanol remains strong, reaching 8.8 billion liters in the accumulated – an increase of 24% compared to 2020.

- In September, 954 million liters were sold – almost 20% more compared to 20/21

- Direct reflection of the return of movements on the streets and with it increased demand for fuel.

- More specifically, recovery of gasoline, since hydrous is at a disadvantage with the parity at the pumps (average São Paulo) around 78%.

Dashboards that you might like: