- Figures regarding 2H of December production have been published today;

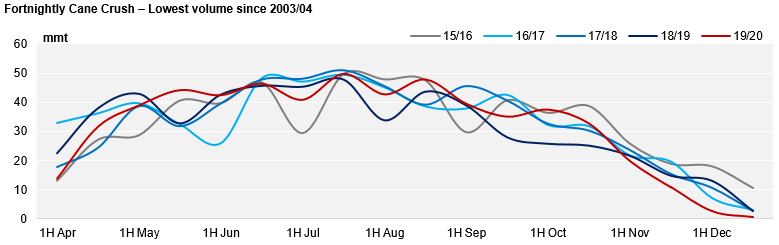

- As expected, only marginal output with the lowest crush since 2003/04 – for the period;

- Ethanol sales 5% higher yoy;

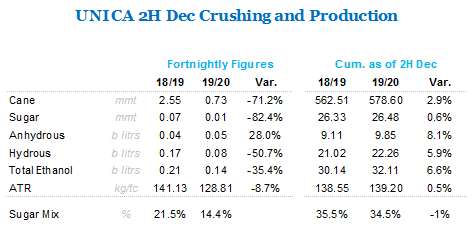

Summary Table

Marginal Volumes

- As mentioned in our previous report, crush in CS is basically done;

- During the 2H of December, crush was the lowest of the past 15 years with less than 1mmt of cane processed;

- And with currently only 5 mills in operation, crush for the next fortnights should be minimal;

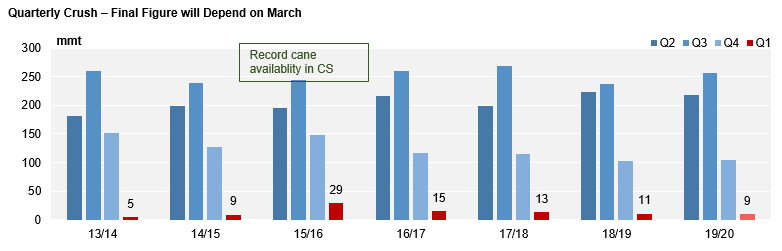

- The CS region has crushed 578.6mmt until the end of December;

- Our estimate is that it should crush another 9mmt over this 1st quarter, ending 2019/20 with a total of 588mmt of cane processed;

- Of course this will depend on the willingness of mills to begin the season earlier;

- We explain: mills re-starting in March will have their output officially accounted as 2019/20;

- Due to the cane availability, we don’t see a strong pace of operations in March – meaning that fresh output is not expected to weight on the market;

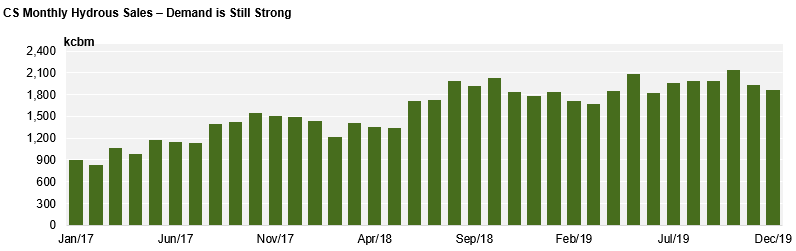

Hydrous Sales

- Price parity at the pumps averaged around 68% (SP basis) in December;

- And still, consumers remained favouring hydrous fuel – between 65% and 70% price parity a shift back to gasohol is usually registered;

- In December, 1.87bi litres of hydrous were sold in CS – a 5% increase yoy – and only a small reduction when compared to November;

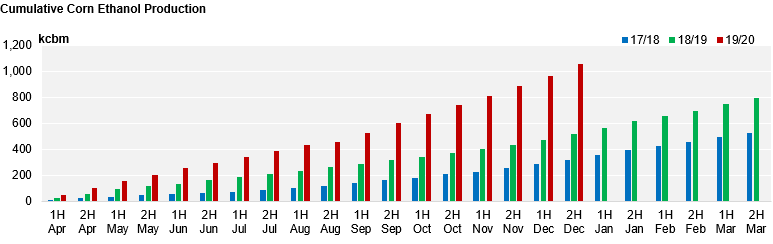

Corn Ethanol Production

- Total corn ethanol production surpassed 1bi litres last fortnight – a 104% increase yoy;

- The output remains focused on hydrous, with 737mi litres produced so far this season;

- Initial estimates are expected to be surpassed and total corn ethanol production should reach 1.6bi litres;