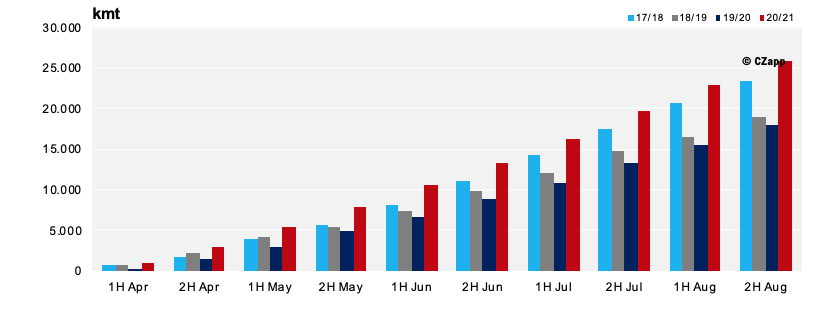

- Despite rains disrupting crushing pace this fortnight, cumulative sugar production is 7.9 ahead yoy.

- If dry weather continues, there is a risk of ag. yield decrease for the coming months.

- This could result in a sooner than expected end of the crop.

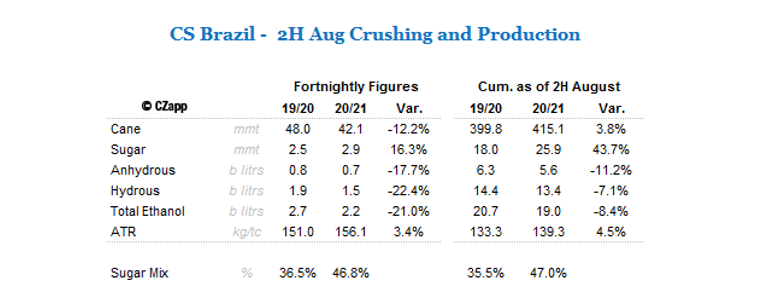

Summary Table 2H August

Slowdown in Operations

- In this fortnight, 12% less cane was crushed if compared to the 1H of August.

- The crushing pace reduction is a result of rains, especially in the state of Paraná and Mato Grosso.

- However, it didn’t affect São Paulo, especially in Ribeirão Preto and São José to Rio Preto.

- So the mills in the region were able to crush without interruptions.

- So far CS has already processed 70% of the estimated cane for the season.

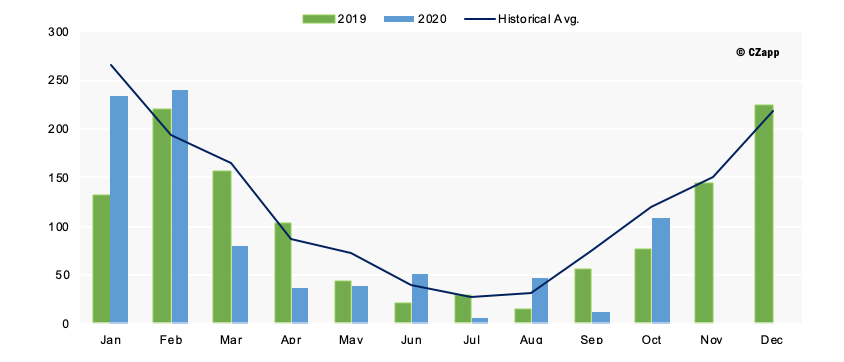

Historical Average of Rains in CS Brazil vs 2019 & 2020e – Low levels of Rain Reported on the past 5 months

- However, it is important to notice that the lack of rains could be negative for cane development.

- So far no mill has registered significant agricultural cane loss (TCH), but concerns are raising.

- If the dry spell continues and TCH falls significantly, the crop could end a few weeks sooner than expected.

Dry weather, Higher Sugar Content

- The dry weather allows a higher sugar concentration in cane (ATR) – in this fortnight ATR reached 156.1kg/ton, an increase of 3.4% yoy.

- Attractive returns in BRL/mt of sugar made mills allocate more ATR towards sugar output, mix of 46.8%.

- So far, the cumulative sugar production this season has reached 25.9 mmt, – 7.8mmt ahead yoy (or 43.8% more).

CS Cumulative Sugar Production – Until August CS sugar output has reached 25.9mmt

- Out of the additional 7.9mmt, it is estimated that 6.0mmt is due to sugar mix increase and the remainder 1.9mmt due to higher ATR and strong crushing pace.

Ethanol Market

- Hydrous sales by the mills registered 1.59 bi litres in August, 21% decrease yoy.

- The sales retraction was already expected due to the recession provoked by the pandemic.

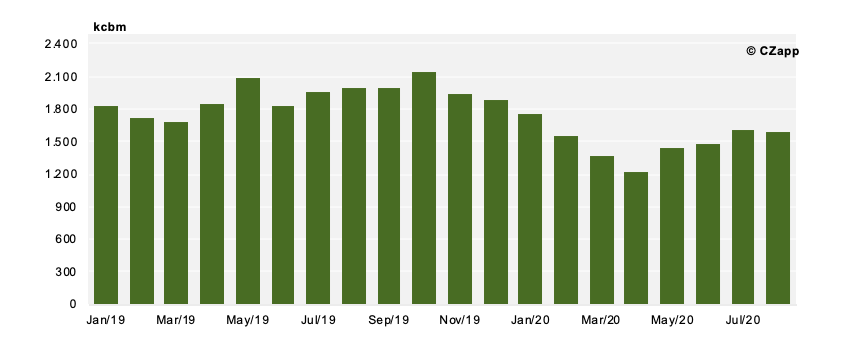

CS Monthly Hydrous Domestic Sales – slow recovery