- The season in Brazil is 56% done, with 19.7mmt of sugar produced.

- Mills keep maximizing cane allocation to sugar – no surprise!

- However, ethanol production is pretty advanced as well, and stocks are 20% higher yoy.

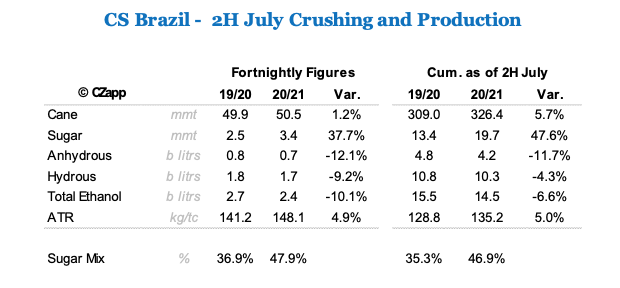

Summary Table 2H July

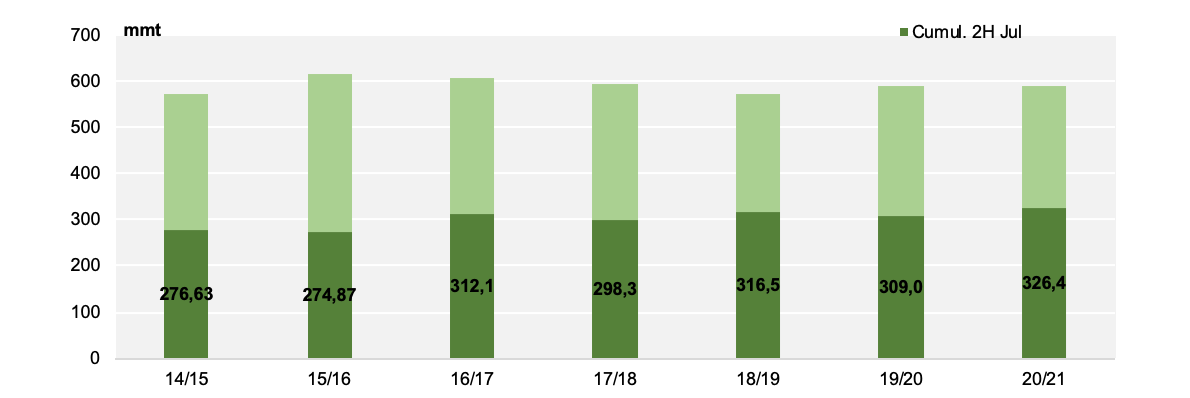

55% of the crush is done

- Cumulative cane crush has reached 326mmt – 5.7% ahead yoy.

- Crush pace has been excellent in CS due to dry weather, which limited days of stoppages.

- Efficiency has been so high that some mills are reporting that will end the season sooner than their initial projection.

CS Cane Crush – Until 2H of July 55% of the season done

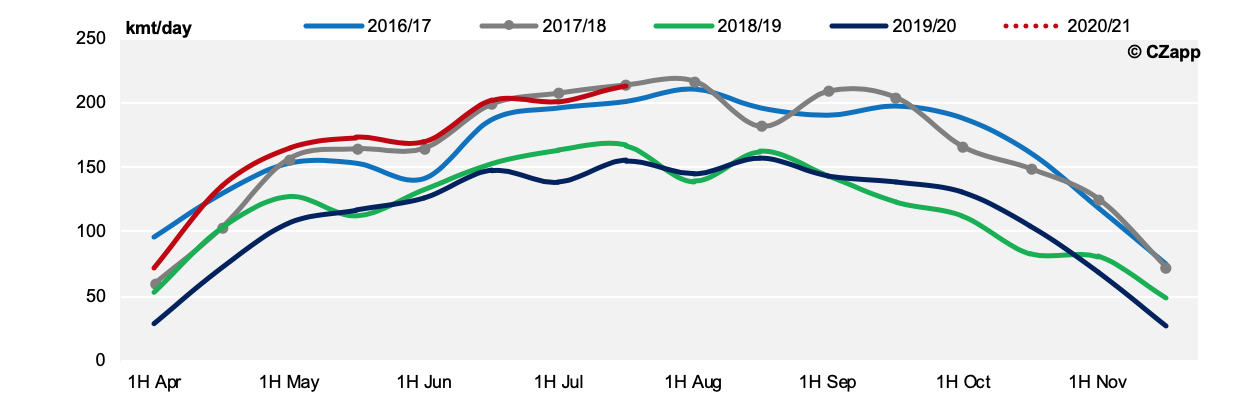

- As for product output, no surprise that mills keep maximizing cane allocation to sugar production.

- Cumulative sugar output stands at 19.7mmt – which is a record for the 2H of July.

- Daily sugar production has been somewhat similar to 2017/18 – the last time CS maximized sugar mix, reaching 46.5% sugar mix for the season.

CS Daily Sugar Production – Until 2H Jul CS sugar output has reached 19.7mmt

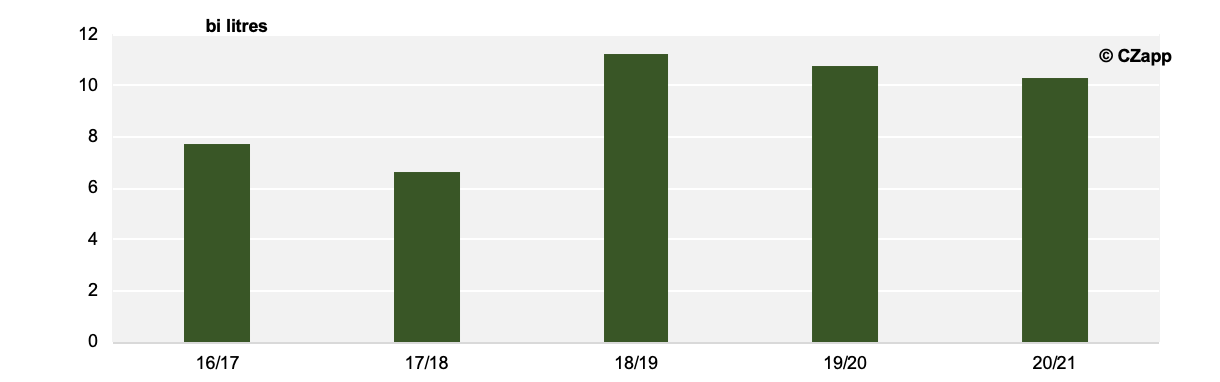

- Another interesting thing is that although CS is maximizing sugar output, ethanol production has been quite high.

- Up until the 2H of July, hydrous ethanol production had reached 10.3bi litres.

CS Cumulative Hydrous Production – Until 2H Jul CS hydrous output has reached 10.3bi litres

- With a lower demand due to the coronavirus pandemic and production quite strong, total ethanol stocks are over 20% above yoy.

- However, with the fuel demand expected to recover, the tendency is for stocks to fall below 2019 levels.

Ethanol Demand

- Hydrous sales by the mills totalled 857mi litres in 2H of July.

- Although it is 18% lower yoy, it is still an excellent volume and a 16% growth when compared to the previous fortnight.

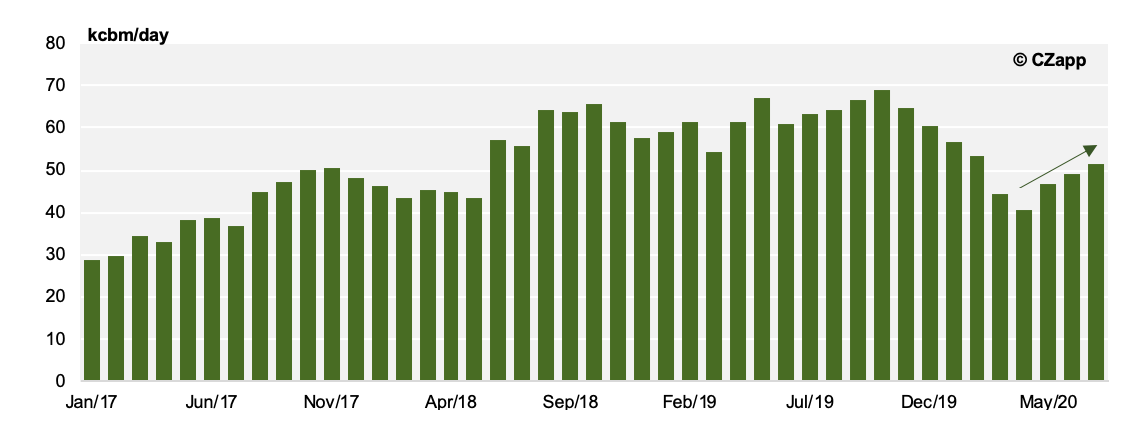

CS Monthly Hydrous Sales – slow and steady ethanol recovery of the domestic market

- Cumulatively, hydrous sales in CS stand at 5.7bi litres – 25% lower yoy.