Opinion Focus

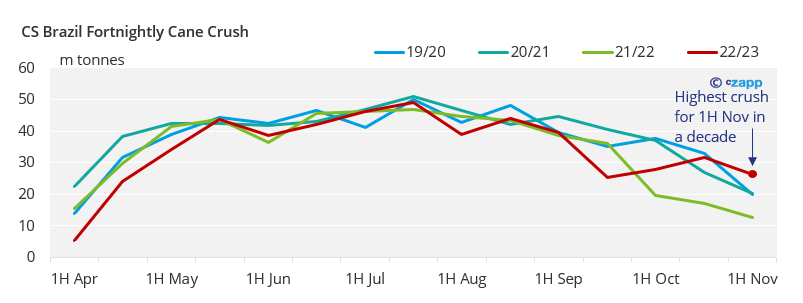

- The gap between this season and 2021 is now closed.

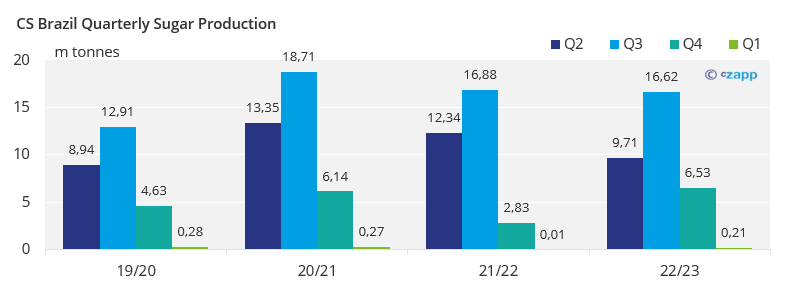

- Up until H1 of November, Centre South (CS) Brazil produced 32mmt of sugar.

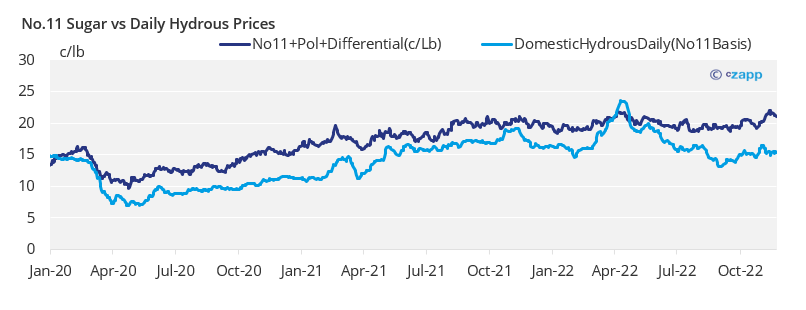

- Mills are willing to crush until December to avoid missing out on high prices.

Centre South (CS) Brazil’s cane crush in H1 November was the highest in a decade. The cumulative crush has reached 517m tonnes, finally closing the gap with last season. Sugar output also recovered, reaching 32m tonnes.

The 2022/23 season is now at the same level as last year. However, unlike 2021/22 the season is not done and, depending on weather, sugar output could reach 33m tonnes. This would be an increase of 1m tonnes on last year’s production.

This is valuable extra sugar from the world’s largest cane region and sugar exporter.

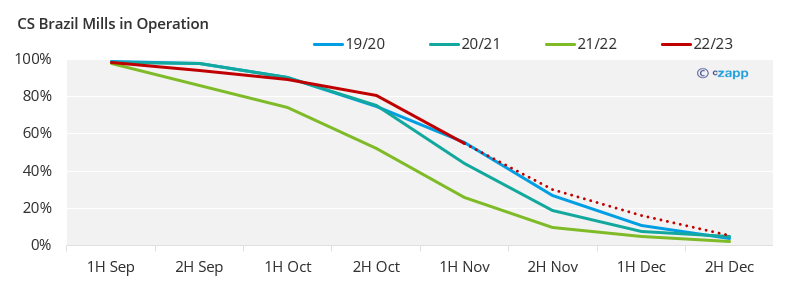

How Does the End of the Cane Crush Look?

Last season, due to lower cane availability, mills were forced to end the season sooner. During H1 November, only 26% of mills were operating versus 55% this year.

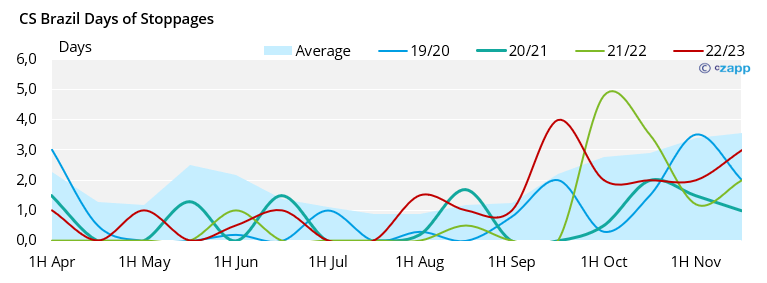

This year heavy rains in September and October disrupted the pace of operations but mills more than compensated in the past couple of fortnights. Weather has been favourable, with lower than average precipitation limiting stoppages. If daily rains are above 10mm then mills are forced to interrupt harvesting so that machinery doesn’t compact the soil.

To reach 33m tonnes sugar, CS Brazil will need to produce 1m tonnes from now until March. However, we believe the bulk of the volume will be made by the end of December, meaning Q4 production will be the highest since 2018. This is not an impossible task and one that mills are keen to take given high sugar prices.

Leaving stood over cane means leaving money in the fields.