Main Topics

- The numbers for the 1H of June came even lower than market expectations

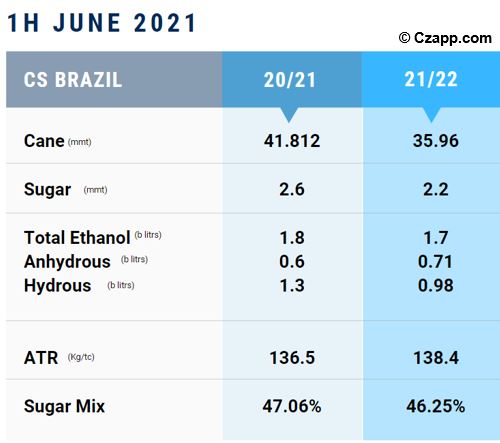

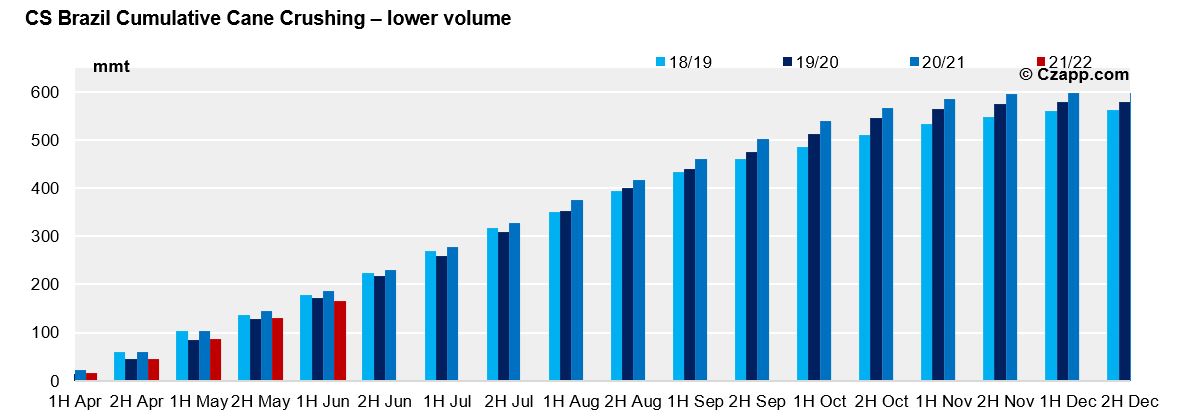

- 35.96 mm of cane were crushed in this fortnight – this represents a cumulative crush of 165.6 mmt

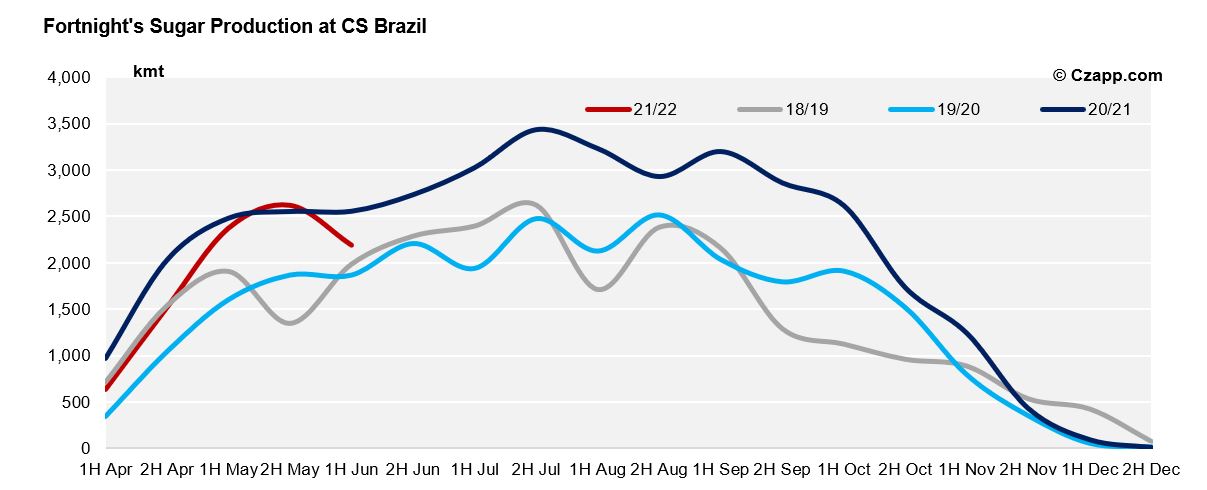

- As a result, 2.2 mmt of sugar and 1.7 billion liters of ethanol were produced.

Safra 2021/22 – 1H June

Cane Crushing Even Smaller

- The numbers for the 1H of June were lower than expected:

- Crushing dropped 14% yoy – 35.96 mm cane were processed in CS.

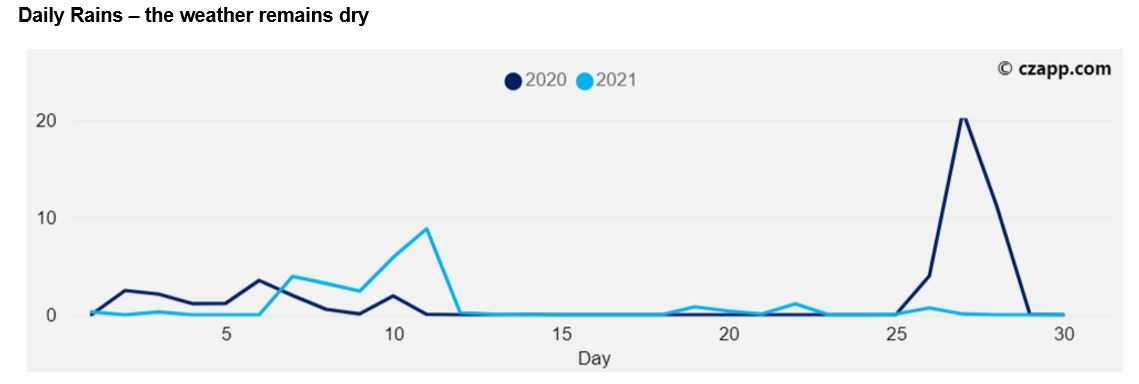

- Although rains were recorded in some regions, this was not the reason for the retraction of the crushing volume

- after all, there were few days of rain and concentrated in specific regions of the state of São Paulo, Paraná and Mato Grosso.

Acess the Weather Dashboard to know the forecast in your region

- We believe that the deceleration in the crushing pace may be related to mills under maintenance, after two months of uninterrupted crushing.

- And another important factor to take into account is the reduced availability of cane in this crop, as a result of the constant drought in the CS Brazil.

- Agricultural productivity has been greatly impacted, with the latest data showing:

- The month of May presented the TCH (ton of sugarcane per hectare) of 77 ton/ha against 85.9 ton/ha

- For 1H of June, preliminary numbers from Unica point to an even greater drop in TCH (15%)

- On the other hand, the dry weather contributes to a higher concentration of sucrose in the plant.

- The ATR came in strong with 138.4kg/tc – the highest value in the last 14 years

- This has partially offset the lower crushing and although sugar production was 14% lower in the fortnight, it is still the second largest recorded – 2.2 mmt

Ethanol Market

- The average parity in São Paulo remains above 70% – a level at which hydrous ethanol is no longer considered attractive to drivers

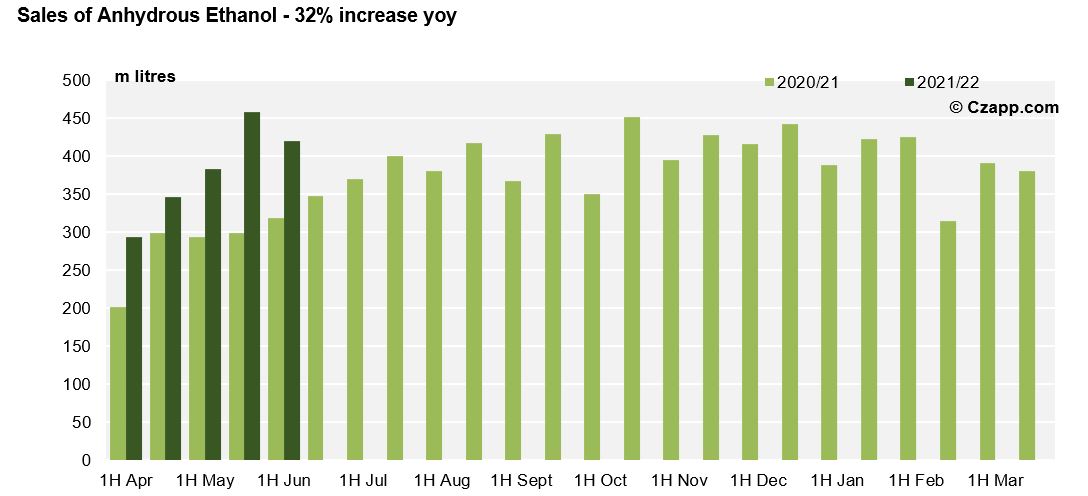

- As a result, the demand for anhydrous (which is blended with gasoline) remains high compared to last year.

- This is due both to the recovery in fuel demand in relation to 2020, and to the reduction in the hydrous market share:

- In this fortnight, 420 m liters of anhydrous were sold (32% higher than last season)

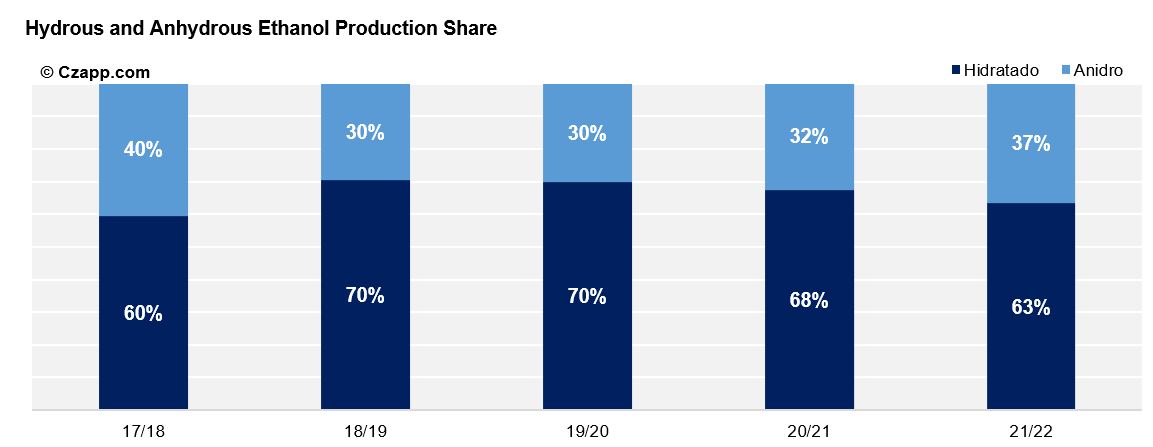

- With the demand for anhydrous growing, we saw a change in the production profile of this crop.

- Until now, the cumulative anhydrous production had an increase of 15% yoy.

- We believe that the split between anhydrous and hydrous this season should be 37% vs the 32% recorded in the last cycle.

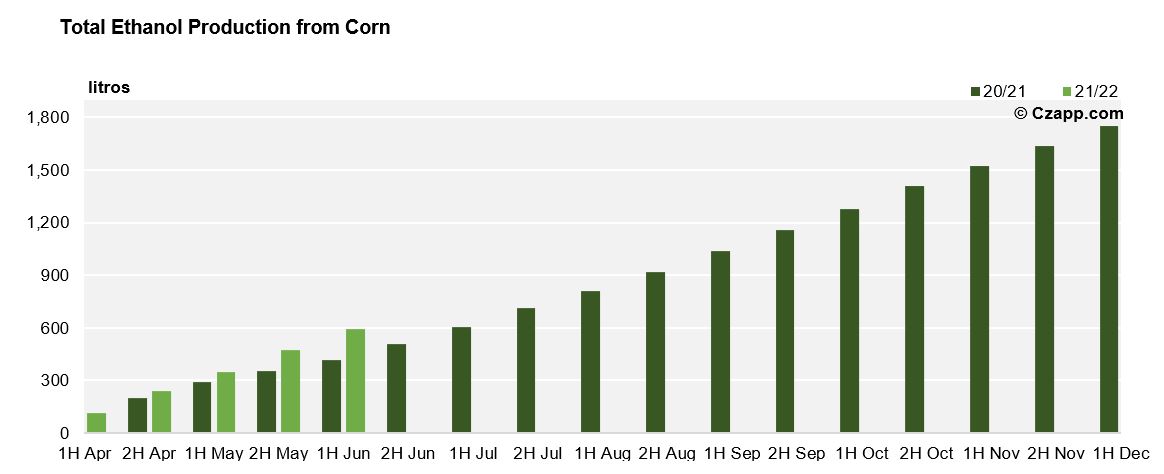

- The production of ethanol from corn also expanded.

- Despite the drop in the corn crop also due to the drought, the cumulative production reached 592.51 m liters, an increase of 41.65% compared to 2020/21.