Opinion Focus

- Mills take sugar mix to new highs.

- The upside for sugar output will depend on weather conditions.

- More sugar does not necessarily mean lower FOB physical differentials.

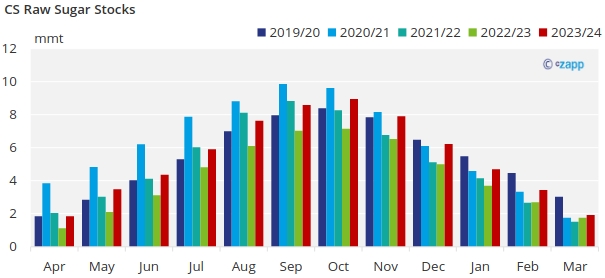

Centre South (CS) Brazil is the world’s largest cane region, will be the world’s main supplier of sugar for the upcoming months. 2 months into the current cane season, there’s a lot of noise around sugar availability.

Pushing the to the Limit

Mills are maximizing cane allocation to sugar production as much as possible; this is not news to anyone comparing sugar and ethanol parity.

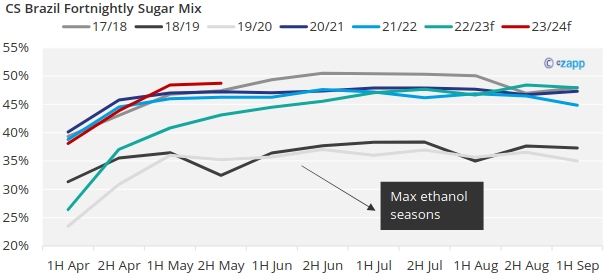

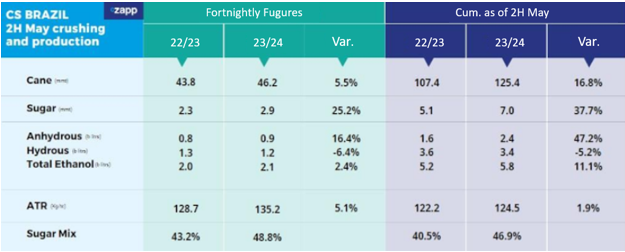

However, what’s impressive is how much mills have been able to push the sugar mix so early into the season. The cumulative sugar mix until the end of May had reached 46.9%, the highest level since 2006!

This brings cumulative sugar production up to the end of May to 7m tonnes.

So far, production updates are in line with our estimates thus our sugar production forecast remains unchanged at 37.7m tonnes.

Since the sugar mix has surpassed our initial estimates, we wonder if max sugar is higher than our projected 47.5%. It might be, however the upside will depend on favourable weather conditions. The impact of the El Niño in CS Brazil is not straightforward but could bring more rains.

Impacting Physical Differentials

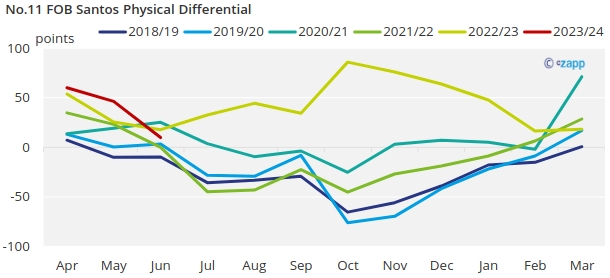

In the past month, physical differentials have come down significantly – going from an average 46pts in May down to flat this week. This is the usual dynamic for the sugar market. As the season progresses, more sugar availability resulted in discounted sugar against the board.

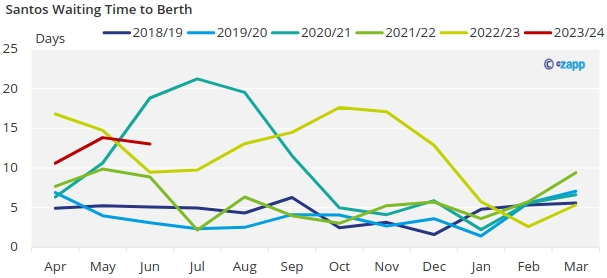

However, this is not what we would expect in a season of fierce logistical competition. Like we explained in our report last week, this month things seems calm ahead of the flow of corn exports.

Despite the long line of vessels, with waiting time to berth averaging 13 days in Santos, demand has waned due to high prices. This lack of liquidity in the physical market has impacted physical values over the past weeks.

However, we believe FOB physical values should begin to rise once the flow of sugar to the ports becomes harder. Imagine, the seller has a vessel to load and not enough sugar to fill the ship. The choice is: pay demurrage bill or buy spot FOB sugar. Players with sugar available and ready at the port can benefit and sell sugar at a higher price.

FCA (Free Carrier) physical differentials on the other hand are expected to take a dive. Normally, FCA is cheaper than FOB because it does not have the logistic costs included. However, we expect FCA values to be even lower this season. If sugar production is indeed higher than expected, this additional sugar would not have logistics contracted.

This season barely begun and is showing some interesting dynamics…