This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Raw sugar future prices tumbled this week and deliveries slowed. However, this 2222market weakness can only be seen as temporary in the context of lethargic plantings and reduced availability of sugar imports from Mexico.

Beet Price Weakness Fleeting

Cash sugar sales for 2025 remained slow during the week ended April 19, while prices exhibited some weakness, in part as raw sugar futures prices tumbled.

One beet processor stepped away from the 2025 market until at least September, having reached a comfortable internal sales threshold. Another processor was selling only on a selective basis. Others remained in the market, indicating sales progress lagged a year ago and were below the levels that prompt firmer prices or a pullback from the market.

Bulk refined beet sugar for 2024-25 was said to be trading in the low 50¢/lb FOB area in the Midwest with indications of some activity slightly below 50¢/lb FOB to secure volume. Bulk refined cane sugar for 2025 was offered at 60¢/lb FOB Northeast and West Coast and 56¢/lb to 58¢/lb FOB Southeast and Gulf.

Even as price weakness for next year surfaced, some traders saw it as short term, in part because most expect supplies from Mexico next year will remain below average as the Mexican cane crop will not be fully recovered from two years of drought, and due to the tendency of US beet processors to raise prices to slow sales once internal thresholds are met. PULSE AQUÍ

Plantings, Deliveries Slow

Sugar beets in the four largest-producing states were an aggregate 6% planted as of April 14, behind 9% at the same time last year and 11% as the 2019-23 average for the date, the USDA said. There remains ample time for beet planting.

Beet sugar was offered for 2024 steady at 55¢/lb to 58¢/lb FOB Midwest. Refined cane sugar for 2024 was offered steady at 62¢/lb FOB Northeast and West Coast and at 58¢/lb to 60¢/lb FOB Southeast and Gulf. One beet processor remained withdrawn from the 2024 market, and another was selling only spot supply. Others remained in the market.

Deliveries of contracted sugar for the current year continued at a mixed pace depending on sector. The USDA in its April 11 Sweetener Market Data report said deliveries of sugar for human consumption in February (most recent data available) were down 5.7% from a year earlier with October-February deliveries down 3.4%. Trade sources and the USDA indicated deliveries have improved since February.

Production Issues Remain

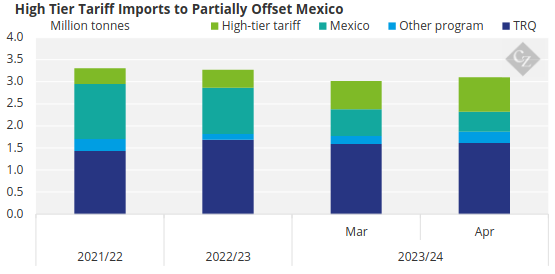

The USDA in its April 11 World Agricultural Supply and Demand Estimates lowered from March forecast US imports of sugar from Mexico by 25% but raised tariff-rate quota, re-export imports and high-tier imports, the latter to a record 855,000 short tons (775,642 tonnes), equal to 25% of US sugar imports and 6% of total supply.

Note: short tons converted to metric tonnes

Source: USDA

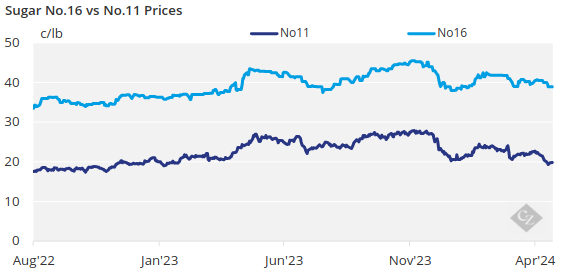

No. 11 world raw sugar futures plunged the past couple weeks as global sugar supplies have increased. No. 16 domestic raw sugar futures followed suit due to the increased influence of the world market on domestic futures because of the high use of high-tier imports in the US market. The pressure in futures was beginning to spill into the cash market.

Corn sweetener markets were quiet.