Global Overview

Since entering commercial production back in the 1980s, PET bottle-grade resin has rapidly grown to become the dominant packaging for beverages. The move away from traditional glass bottles was driven by a need to reduce both transportation and production costs, whilst improving the durability and safety of packaging. Improvements in production and compounding technologies over this time also enabled for a rapid expansion in PET resin usage across the food and beverage space.

Between 1990 and 2010, global PET resin production capacity grew quickly, averaging 15.4% CAGR. And whilst North America and Europe were the first regions to develop PET resin industries, fast-growing emerging markets with access to their own raw materials quickly caught up. With a relatively low barrier to entry, new producers were quick to emerge, and production expanded rapidly across South Korea, Taiwan, India, and China.

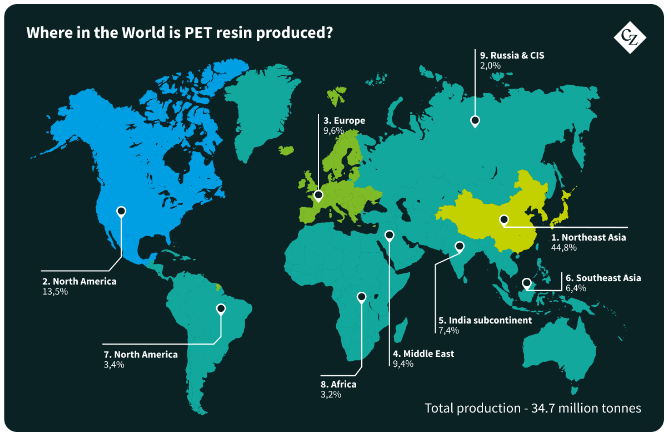

Where in the World is PET Resin Produced?

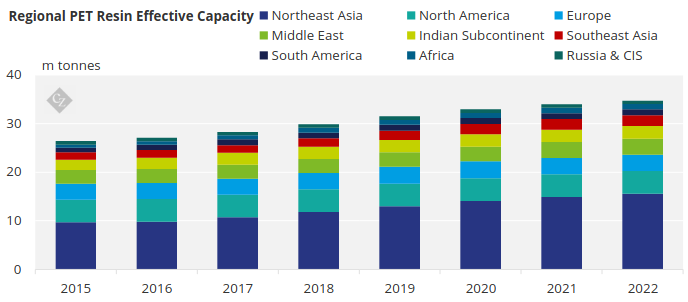

Since 2010, global PET resin capacity has slowed averaging 6.4% CAGR over the last 12-years. The substitution away from glass has plateaued, whilst new challenges to demand have arisen, including the emergence of the war against plastics, the global pandemic, and economic fallout from Russia’s war in Ukraine. In 2022, global effective capacity for bottle-grade PET resin was around 34.7m tonnes, up from approximately 16m tonnes in 2010.

Northeast Asia dominates the PET resin market, not only is the region the largest consumer of PET resin but it has also long surpassed North America as the largest global production centre for virgin PET resin. In 2022, Northeast Asia accounted for around 45% of total global PET resin production capacity, with over 15.6m tonnes. Within Northeast Asia, China alone has around 13.2m tonnes, representing around 38% of the world’s total PET resin capacity.

In contrast, North America’s share of global production has shrunk from 63% in 1990 to just 14% in 2022, due to a lack of competitiveness with lower-cost Asian production. Europe’s share of total global capacity has also fallen over the same period to only 10% in 2022.

Other regions, such as the Middle East, South and Southeast Asia, have also seen their own PET resin industries develop. Although these regions hold great potential for future growth, they currently represent a much lower share of total global capacity.

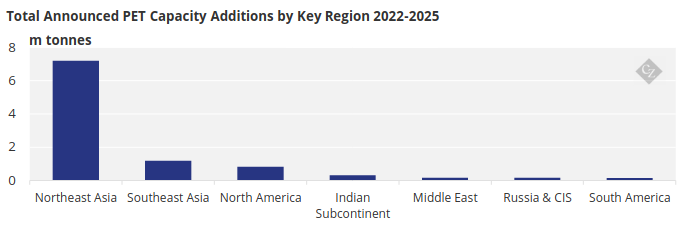

Where are Future PET Resin Projects Planned?

With many new capacity projects postponed or paused during the global pandemic, 2022 has seen a flurry of announcements and updates as planners begin to think beyond COVID.

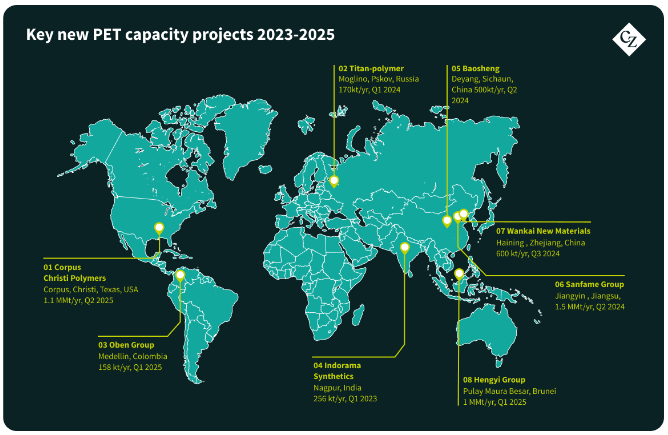

Between 2022-2025, over 10m tonnes of new virgin PET resin capacity have been announced, 6.5m tonnes of which is being planned within the Northeast Asia region, all of which is in China.

Major Chinese PET resin producers, including Sanfame, Wankai, Yisheng, and Dragon are all planning near-term expansions.

Outside of China, several other major projects of over 1m tonnes capacity are also being planned, including in the US, India, and Brunei. Restarts at JBF Rak, expected in late 2023, and at CRC/Chengao in Q4 2022 will also add pressure on existing trade flows.

Future demand uncertainty, created by the risk of global recession and China’s zero-COVID policy, combined with greater rPET demand will undoubtable impact some virgin resin project timeframes.

Europe and Africa are the only regions that are currently lacking any announcement on future capacity expansion. Europe is even at risk of capacity rationalisation. Alpek UK has already closed one 150k tonne production line in 2020, and several other producers have switched production lines to incorporate between 15-25% rPET content into single-pellet solutions, a de-facto reduction in virgin resin capacity.

Who are the Largest Producers Globally?

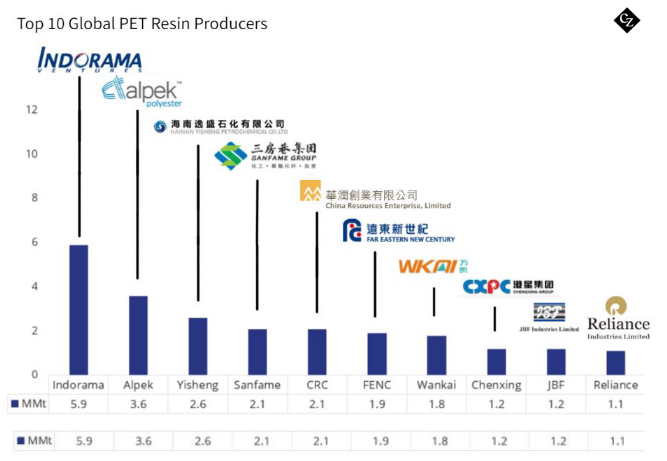

In 2022, the top 10 largest producers of bottle-grade PET resin accounted for about 68% of total global production capacity. Many of the leading PET resin producers also benefit from downstream integration into key raw material supply, including PX, PTA, and MEG, as well as owning and developing novel production technologies.

Indorama Ventures is the world’s largest PET resin producer with a total combined capacity of around 5.9m tonnes across the globe. The second largest global producer is Alpek, with around 3.6m tonnes capacity. The Alpek group is also the largest PET resin producer in Americas, and in 2019 acquired its first plant outside of the region, gaining a foothold in Europe, in the UK.

Chinese PET resin producers then occupy the next 6 positions in the global rankings. Even with the potential addition of CCPC, Texas in 2025, the continued expansion of PET resin production in China looks set to challenge the dominance of the leading pair. Sanfame has already announced further additions of 1.5m tonnes in 2023, whilst Yisheng and Wankai have 1.1m tonnes and 600k tonnes of new capacity planned in the next couple of years respectively.

For information on PET Resin and Plastic Packaging, please contact GLamb@czarnikow.com.

For any data and consulting enquiries, please contact AChase@czarnikow.com.