Price Action

Market Commentary

All grains finally fell last week after a few weeks of strength in Wheat and Soybeans which were the support for Corn. Even Brazil fell almost 2% week on week.

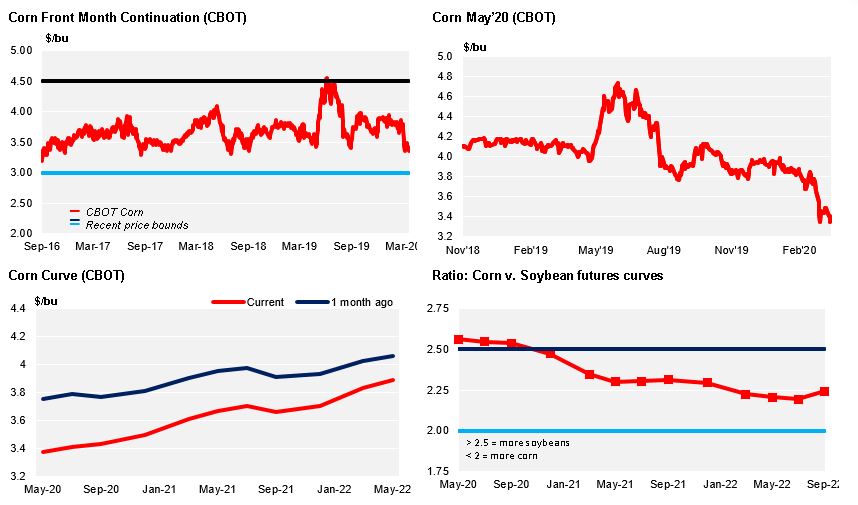

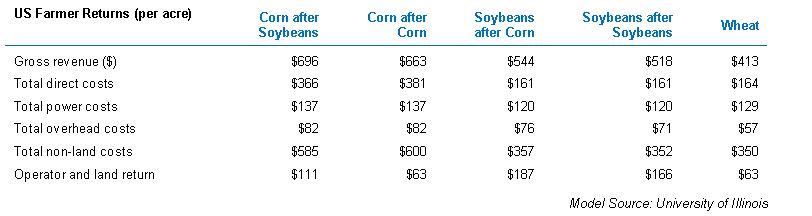

Corn in Chicago lost 4,5% with a bearish planting intention report last week and a poor demand outlook for Ethanol. Corn acreage came in at a whopping 97 mill acres vs. 94 expected and vs. 90 of this crop, but the market was a bit supported by lower quarterly stocks which came in at 7,95 mill bu vs. 8,1 expected.

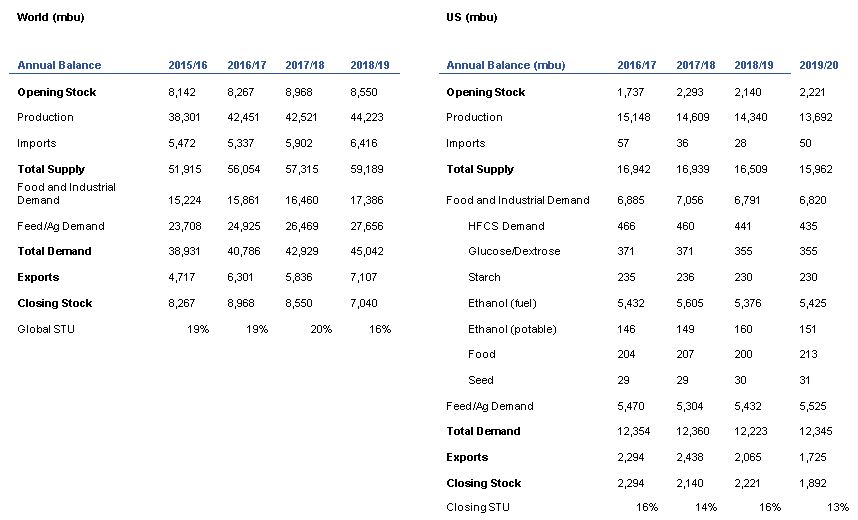

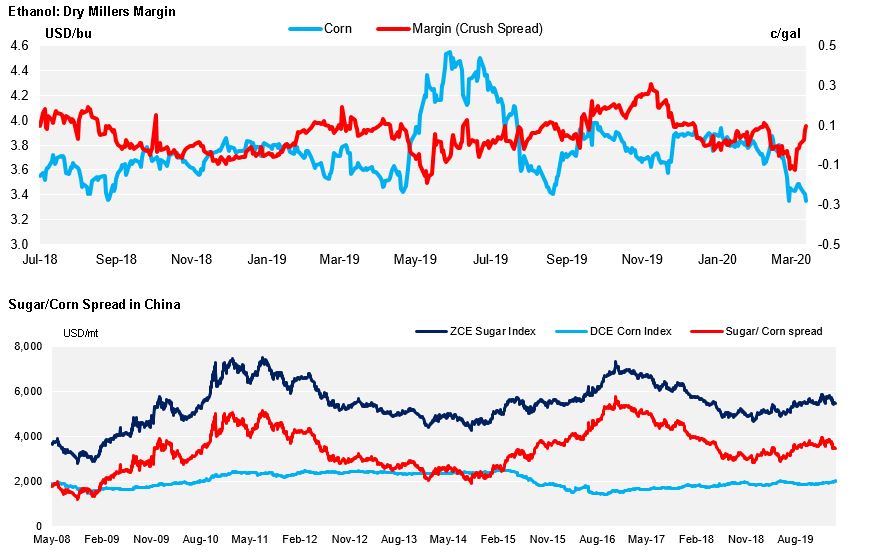

But the reality in Corn is that we could lose around 401 mil bu of lower demand for Ethanol in the actual 19/20 crop. If we combine that lower demand for the actual crop, even with Ethanol production coming back to normal for the new crop, with 97 mill acres to be planted and a normal yield of 175 bpa, the 20/21 ending stocks would surpass 3 bill bu. We don’t think farmers will plant that much area as the situation now is very different from when farmers were asked at the end of February and beginning of March thus we think the report does not have much value.

We are simply in a fully different world today than a month ago. We have now stock build in Corn due to less demand for Ethanol and a big unknown of when are we coming back to normal. On the other hand at this moment in time with planting season started, is difficult to change plans with seeds and fertilizers already purchased. Also the soy/corn ratio continues to favor Corn.

USDA stocks and planting intentions last week were: Corn acreage came in at 97 mill acres vs. 94 expected, Wheat came in at 44,7 mill acres vs. 45 expected and Soybeans at 83,5 mill acres vs. 85 expected. Q1 Corn stocks came in at 7,95 mill bu vs. 8,1 expected, Soybeans at 2,25 vs. 2,23 and Wheat at 1,4 mill bu within expectations.

Corn was lower in Brazil and some Ethanol plants have stopped buying Corn and are instead selling their stocks as Corn Ethanol crush margin is trading negative like in any other geography except for Europe. Corn demand for Ethanol was 3,75 mill ton during the last Sugarcane crop (Apr to Mar) and we were forecasting demand for Ethanol use to grow to 6,75 mill ton, something that will not happen anymore. Corn demand for Ethanol will probably fall below the level of the last crop. Safrinha Corn planting is

now 99% complete and the concern is now the lack of rain.

Argentina extended quarantine until April 12 but food transportation and exports activities are not impacted and the activity should continue without problems. Grain flows to Argentinian ports are now normalizing.

EU Corn had also a negative week following Chicago and with the EU issuing new guidelines to ease transportation within EU27 after some countries had reported delays in food deliveries due to mobility restrictions and lack of seasonal workers. That also weighted in Wheat prices which lost 2% week on week despite French Wheat condition down again with only 62% rated good to excellent vs. 84% last year which is the lowest value on record.

Supply

WASDE Projections

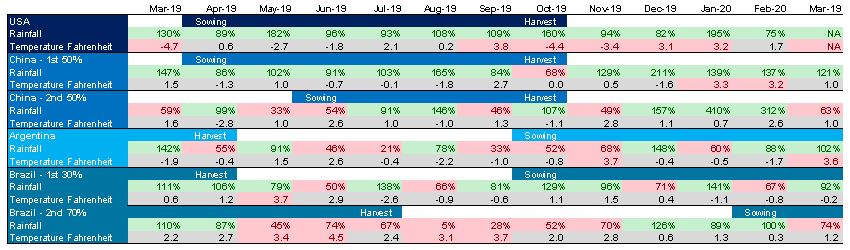

Weather in Main Corn Growing Regions

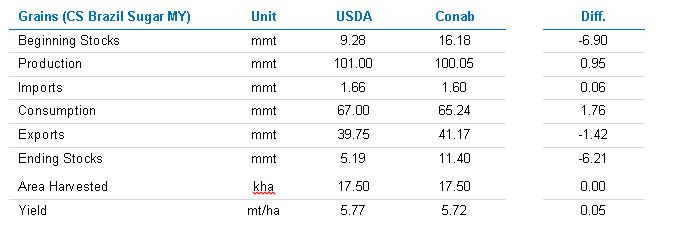

Brazil Balance

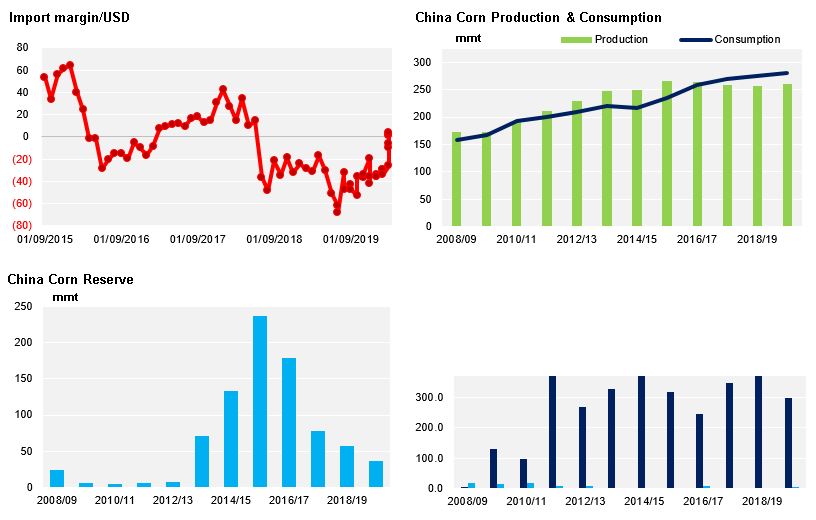

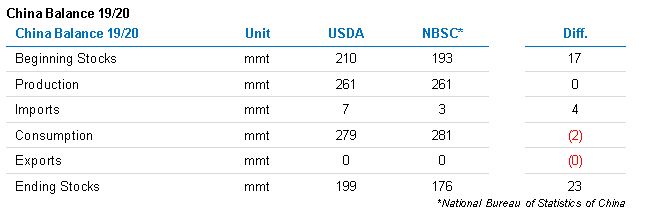

China

Demand

EU