Price Action

Forecast

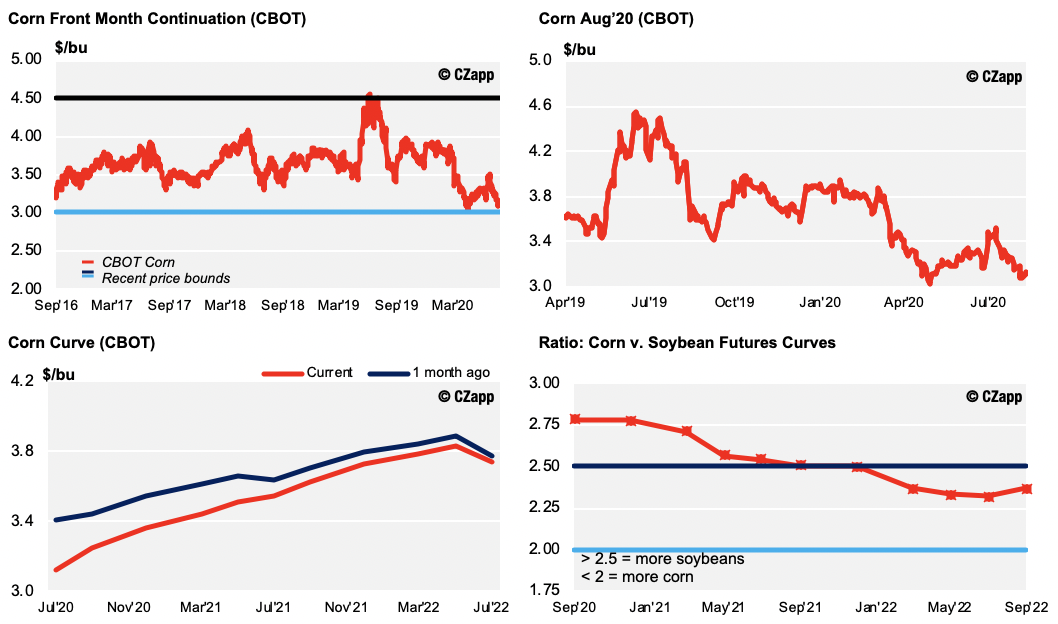

- There are no changes to our forecast of 3,5 USD/bu for Chicago Corn on average for the 19/20 crop (Sep/Aug).

- The year-to-date average is running at 3,56 USD/bu.

Market Commentary

It was a negative week last week for US grains. The main producers revised their production estimates upwards and tensions between the US and China heightened.

European and Brazilian corn made weekly gains, but it fell by 2,5% in Chicago. Wheat also plummeted 7% in Chicago and 3% in Europe.

COFCO bought more than 10 cargos of US soybeans last week, but this did not stop the fall. The large purchase happened amidst the ongoing tensions between the US and China ahead of this week’s meeting regarding the Phase One Trade Agreement.

Despite the fall, much of the information we received last week pointed to ample global supply.

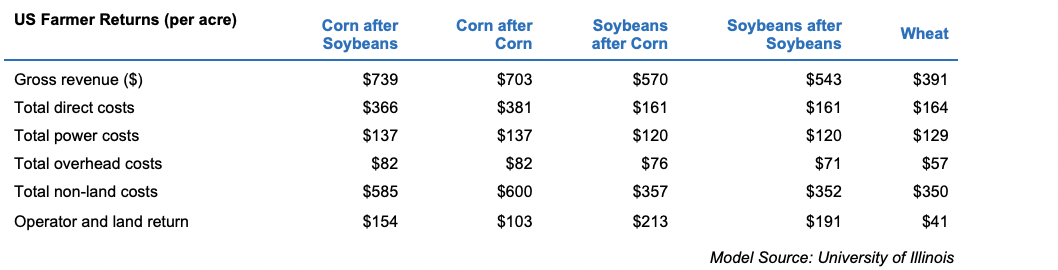

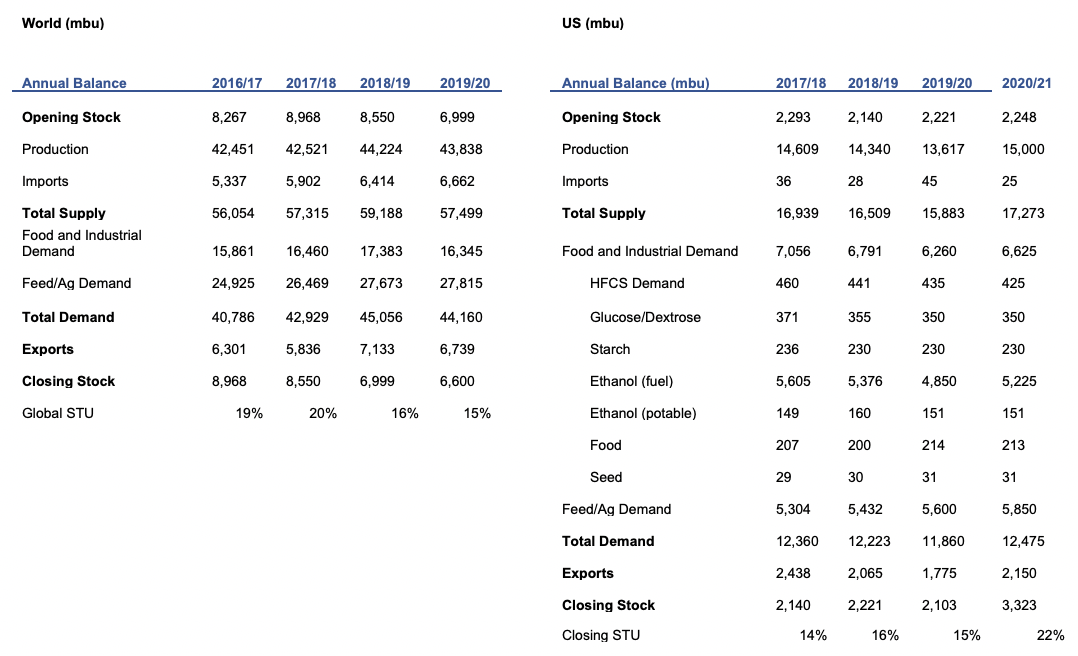

The US corn condition was unchanged at 72% good to excellent; this is a good level. Predictions for this week’s WASDE also show that the market is expecting a bigger corn crop with yields of 180,5 bpa, compared to 178,5 stated in the last WASDE. This comes as most regions have enjoyed favorable weather for corn. StoneX have also forecasted a large increase with a yield of 182,4 bpa and production of 15,3 bill bu, compared to the latest WASDE’s 178,5 bpa and 15 bill bu respectively.

Outside of the US, there were upward revisions in the EU, Brazil and Ukraine.

The Ukraine Grain Association increased its 2020/21 corn forecast to an all-time high of 38,9m tonnes, up 10,5% last year’s 35,9m tonnes.

Agroconsult forecasted that Brazil’s 2020/21 corn crop could reach 110,3m tonnes compared last year’s 101m tonnes.

The French corn is still up from 64% last year, despite dropping 3% last week to 74% good to excellent. The Agricultural Ministry forecasted that the corn crop could total 14,4m tonnes, up 11% year-on-year.

The French wheat harvest is virtually finished now, at 99% completion. The French Agricultural Ministry cut their wheat crop to 29,7m tonnes from 31,3m tonnes; a multiyear low. This is 25% below last year’s crop and 16% below the five-year average.

The German Statistical Office said their wheat harvest will total 20,2m tonnes, down 12% year-on-year due to dry weather.

IKAR increased their Russian wheat production forecast to 79,5m tonnes from 78m tonnes previously.

After the big losses seen in Chicago last week, the August WASDE this Wednesday will dictate the behavior of the market. The consensus around a big corn crop should limit any upside and we don’t expect any big surprise from the USDA. Also, the US-China trade talks next weekend on 15th Aug should bring some volatility as tensions between both countries increase and the outcome of the meeting is uncertain.

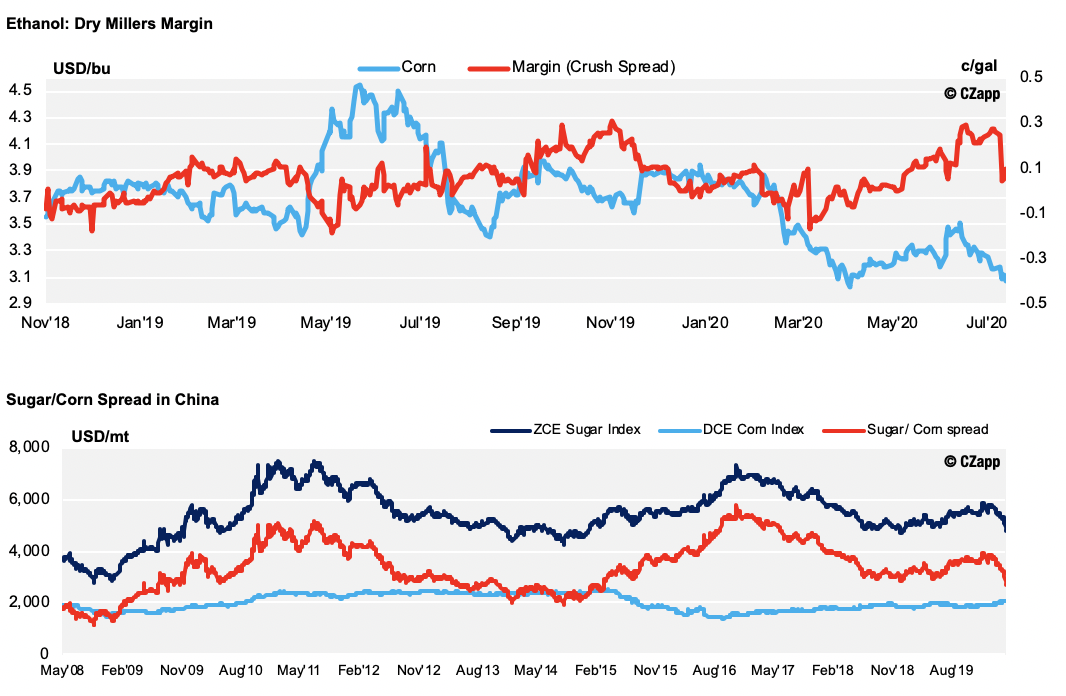

Supply

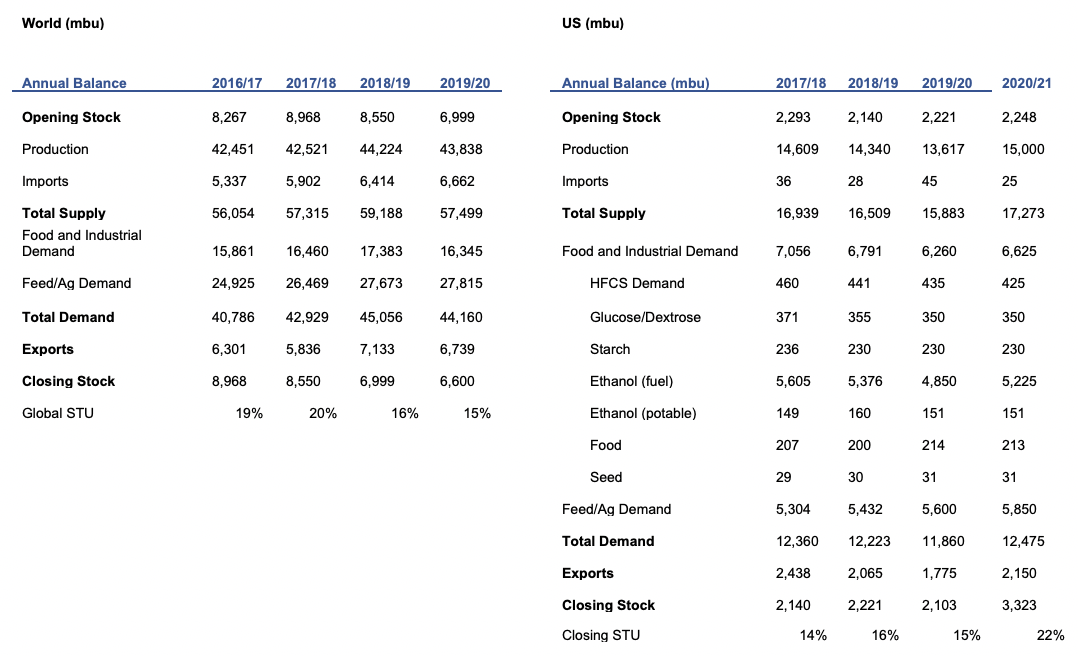

WASDE Projections

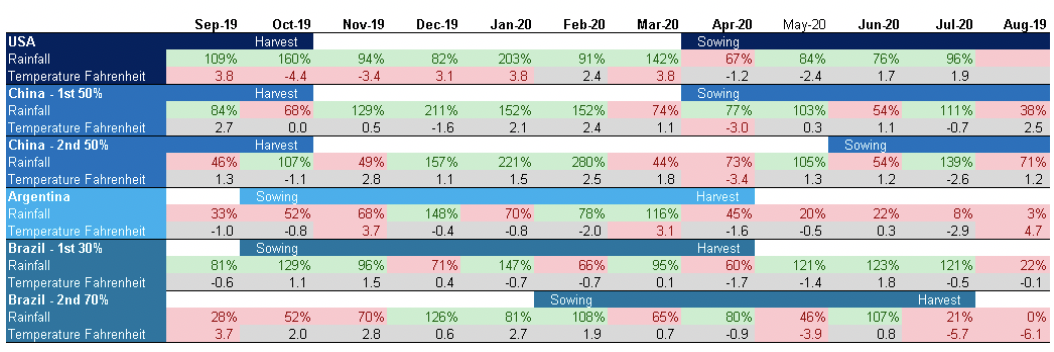

Weather in Main Corn Growing Regions

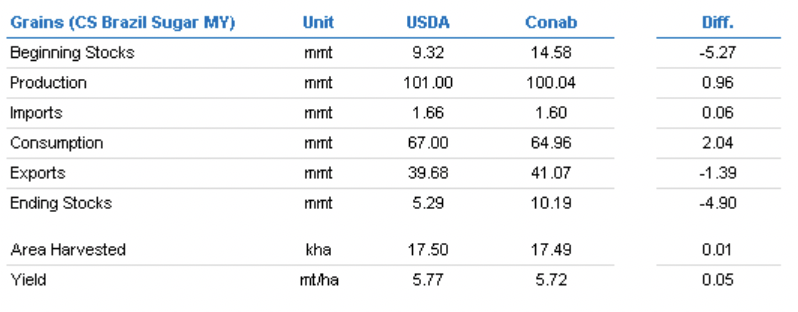

Brazil Balance

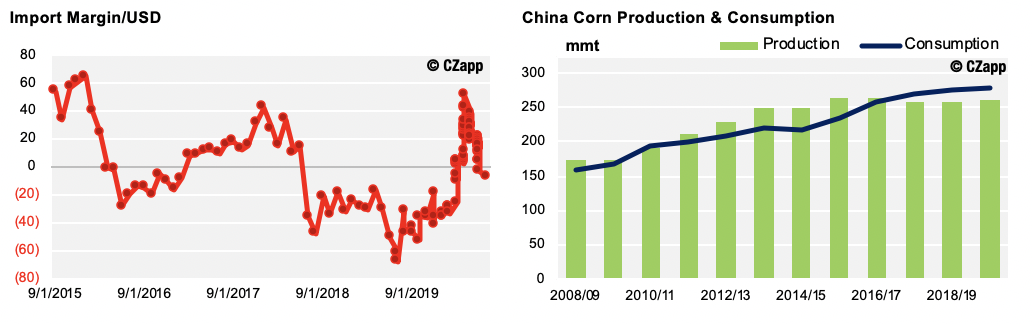

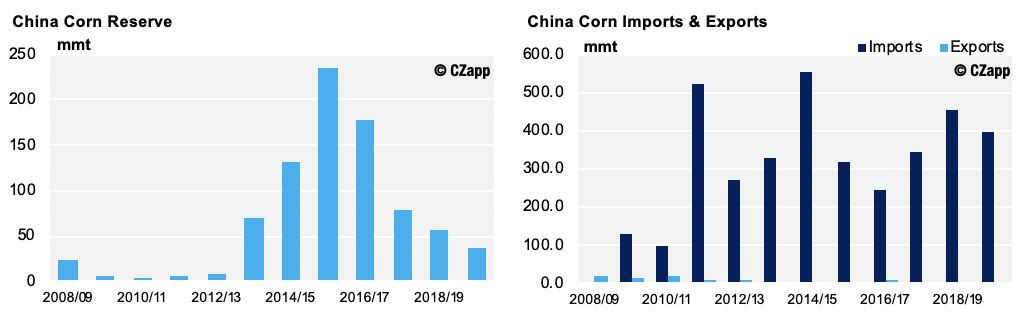

China

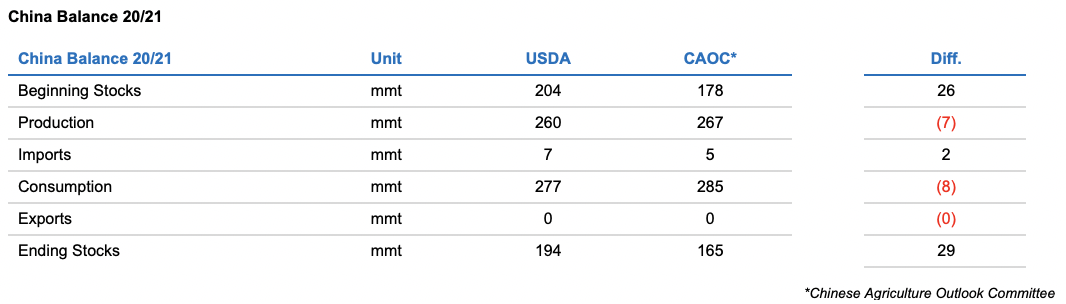

Demand

EU