Price Action

Market Commentary

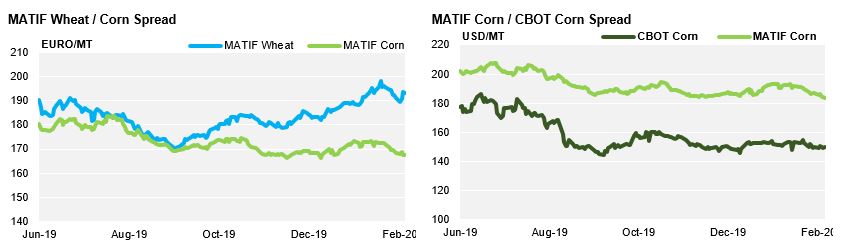

Corn in Chicago was positive week-on-week helped by a recovery in Soybeans and Wheat. Brazil Corn was slightly down as ell as Matif Corn while EU Wheat made a 1,2% gain week on week pushed by China buying two vessels from France and rumors of up to eight cargoes being booked.

China announced the reduction of tariffs on USD 75b of US imports as of Feb 14th as part of the Phase One agreement. Tariffs on US Soybeans will be reduced by 2,5 percentage points while Corn and Wheat tariffs will be reduced by 5 percentage points. This shy cut should not really make a difference to the actual trade flows thus to higher US exports of those products.

This week we have the February WASDE and the key is how much of the Phase One agreement will be taken into account by the USDA meaning a potential increase in exports. Soybeans should see their exports increased but with the timid reduction in import tariffs announced by China it seems unlikely that will happen. The USDA already said they will not include predictions from the trade agreement. Besides the potential impact of the US-China deal we still have unresolved the area and yield for Corn. We still think we will have lower harvested acres but this may not necessarily be reflected in this week’s report.

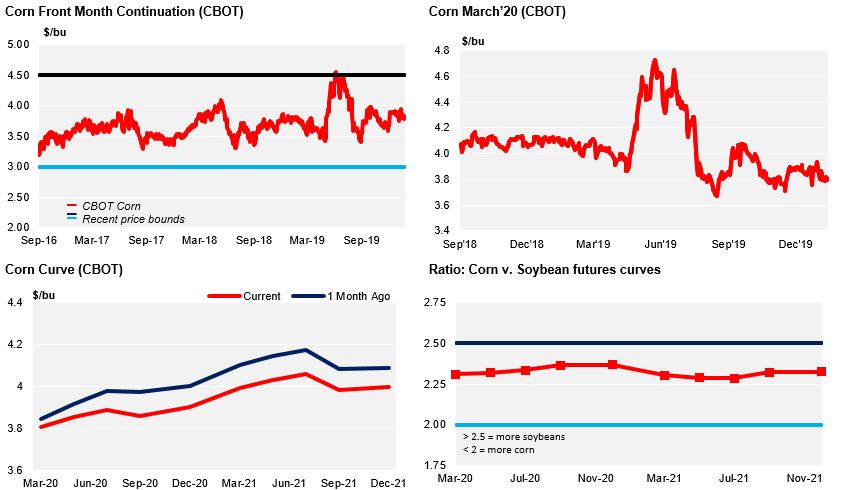

Corn in Chicago has been resisting very well through the Coronavirus crisis trading in a small trading range of just 10 cents per bushel between 3,76 and 3,86 USD/bu. The WASDE and the evolution of the virus will dictate the behavior of the market.

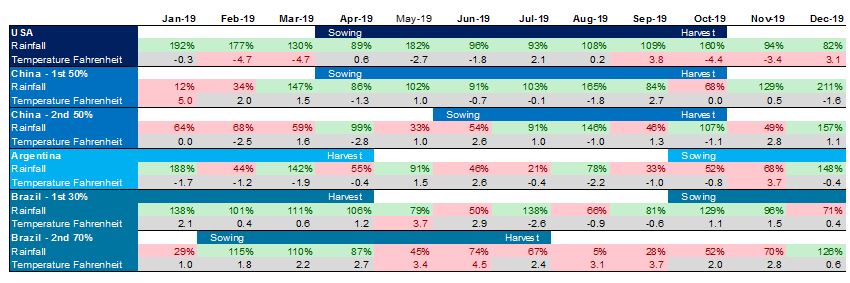

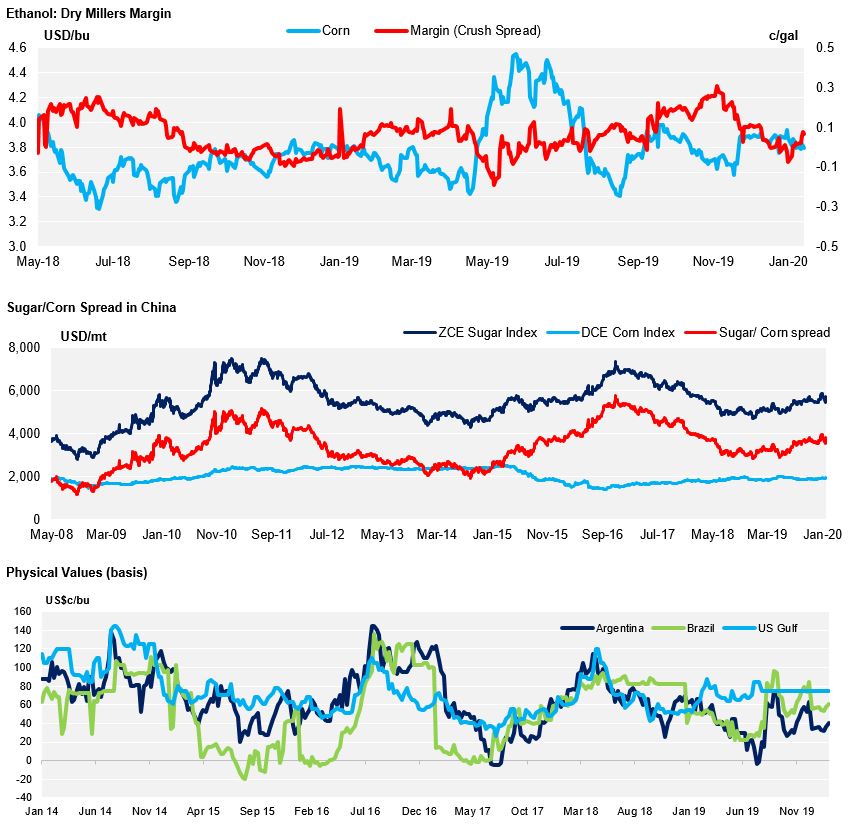

Brazilian Corn continues to trade sideways while the country is sourcing Argentinian Corn. The Soybean harvest is 9% completed vs. 19% last year with most of the delay coming from Mato Grosso which at the same time is the biggest Corn state. Corn planting in Mato Grosso is 22% complete vs. 30% last year so we continue to have high risk that Corn planting will be delayed. But despite this late planting risk, IMEA said last week they forecast Corn area to increase 5% this year when compared with the 18/19 crop. The reason is clear: high prices and increasing demand forecasted for Corn Ethanol is incentivizing higher acreage.

Corn planting in Argentina is virtually completed with 99% planted. Rainfall has been generous leaving good moisture in the soil and expectation of good yields.

We expect another volatile week with the February WASDE adding to the uncertain evolution of the coronavirus.

Mixed week for Corn, up in the US while down in Europe and Brazil. This week’s WASDE adds additional volatility to the market although the USDA said they will not include predictions from the Phase One agreement. We expect lower harvested acres in US Corn but it might not appear in this week’s WASDE yet.

Supply

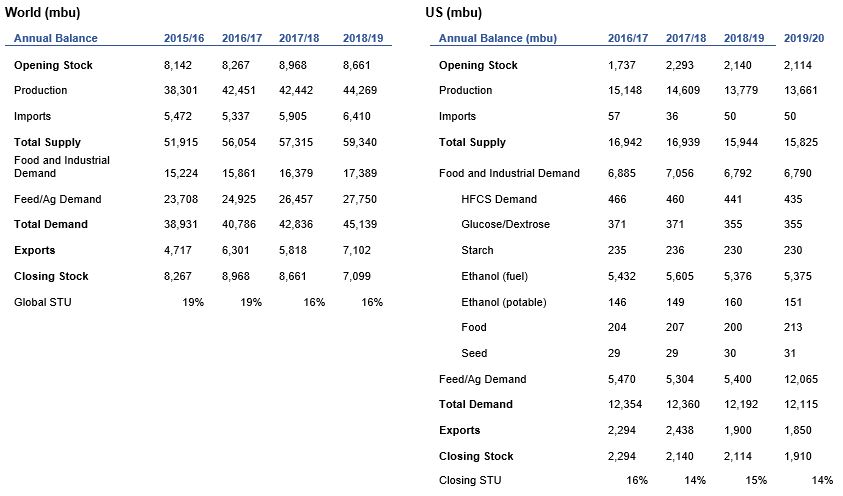

WASDE Projections

Weather in Main Corn Growing Regions

Brazil Balance

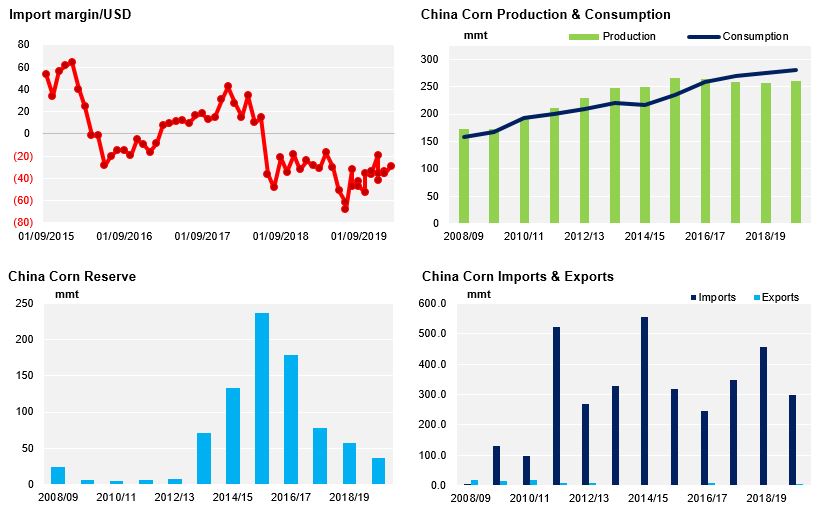

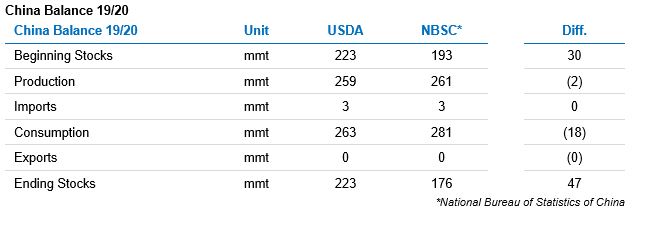

China

Demand

EU