Price Action

Market Commentary

Except for the 2% rally in Brazilian Corn, all grains were negative last week in the rest of geographies.

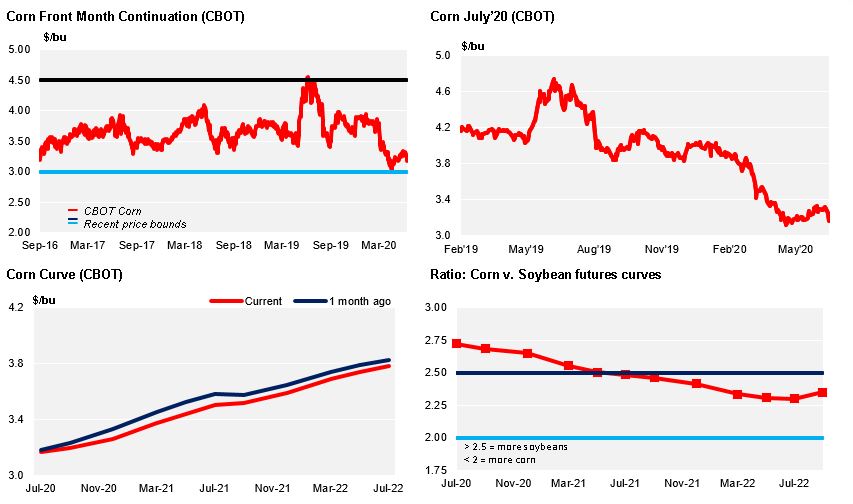

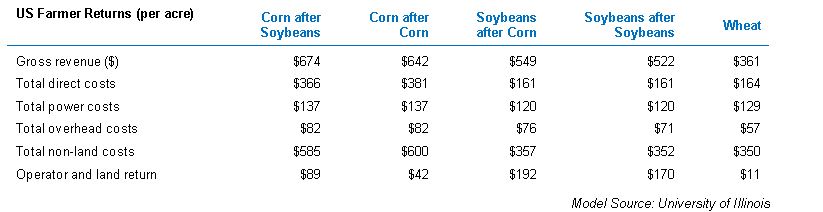

There was no single positive piece of news last week for Corn: US conditions were better than expected, the market is expecting higher yields than the USDA, Soybeans plummeted due to less purchased from China and lower Crude Oil, and Wheat fell as well on good harvest progress in the US and weather stabilizing in EU and Black Sea.

Besides the lower than expected Soybean purchases from China, the concerns from new Covid cases has made them request Covid free soybeans from the US and Brazil something that should be difficult to fulfill.

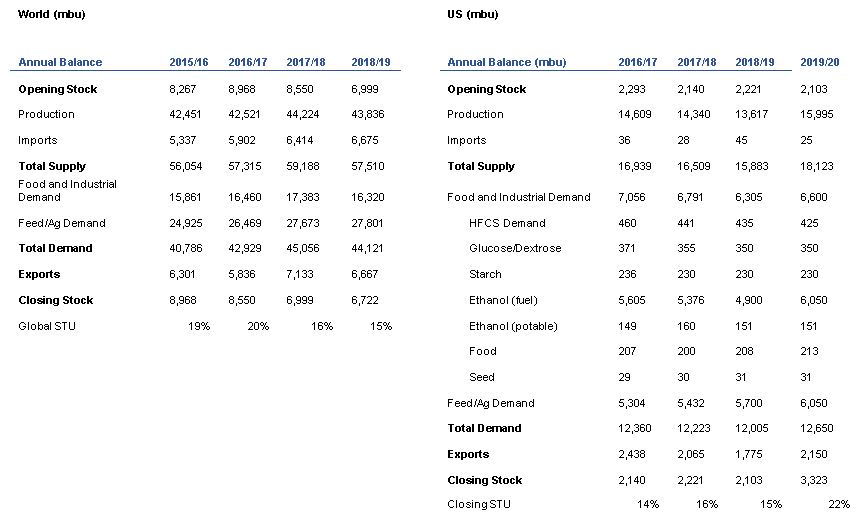

Corn fundamentals are also bearish with perfect weather in the US Midwest and a Reuters poll showing an yield expectation of 180 bpa vs. the 178,5 of the June WASDE. This would take ending stock to a massive 3,5 bill bu vs. the 2,1 bill expected by the end of this crop that finishes on Aug 31.

Tomorrow we have the USDA acreage report with the average guess being 95,2 mill acres vs. 97 of the March report.

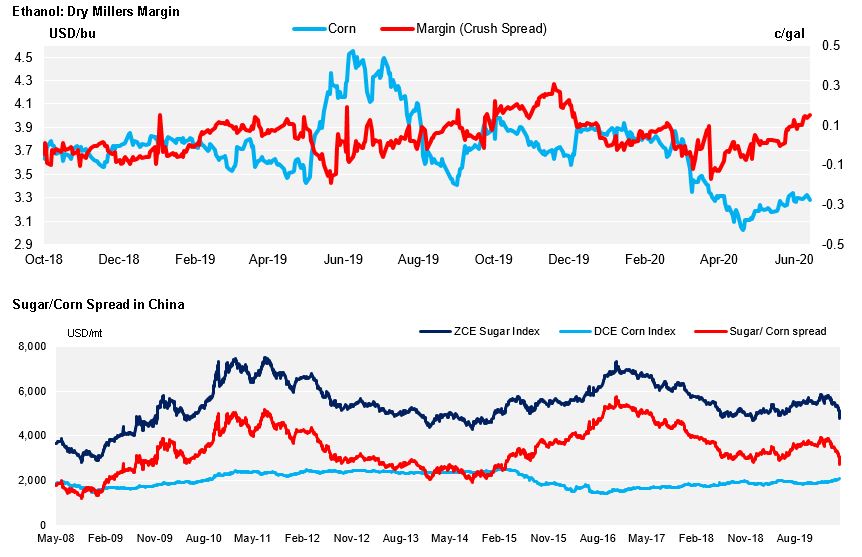

There were rumors of Chinese buying US and Ukraine Corn which gave some support by the middle of last week but it was not enough to offset the negative environment. US Ethanol production increasing again was positive as well but this should be already priced in.

US Corn condition improved just one point last week at 72% good to excellent when the market was expecting conditions to worsen.

US Corn net sales were 28% higher week on week moving again on track to make the 45 mill ton forecasted by the USDA.

The IGC raised its global Corn production forecast by 3 mill ton to 1,172 bill ton for the 20/21 crop.

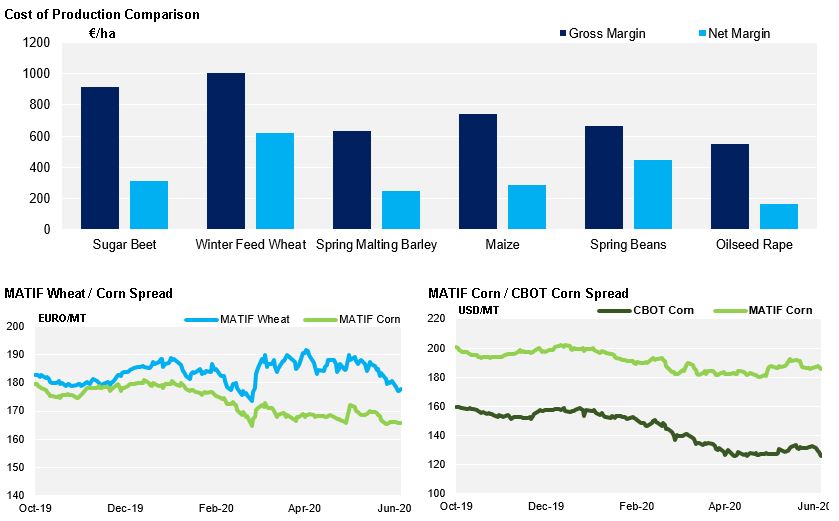

The EU reduced the import levy on US Corn to 4,65 Eur/ton down from 10,4 Eur/ton. They also increased their Corn production forecast by 500k ton to 71,9 mill ton.

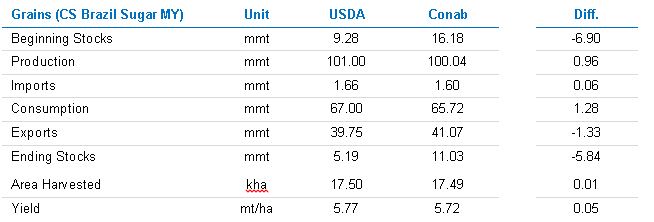

In Brazil, Safras & Mercado increased their Corn production forecast to 108,4 mill ton vs. 101,5 before. All estimates had been reducing the size of the crop due to dry weather so this is a new outlook for Brazilian Corn. Argentinian Corn is 78% harvested and BAGE maintained its forecast at 50 mill ton.

On the Wheat front, strong harvest progress in US Wheat pressed Chicago prices down. Conditions are also stabilizing in the EU and Back Sea area acting as a cap to the market.

The IGC raised its global Wheat production forecast by 2 mill ton to 768 mill ton for the 20/21 crop.

The EU lowered their Wheat production forecast by 4,3 mill ton to 117,2 mill ton which is 10% lower than last year’s production. This is the lowest forecast vs. Coceral and Strategie Grains at 119,7 and 121,1 respectively.

EU Wheat was a bit supported but the lower crop is already priced in and it finally made weekly losses.

Ukraine increased their Wheat export projection by 2,3 mill ton to 17,2 vs. 14,9 they had before thank to improving yields.

The outlook remains unchanged: Corn and Wheat supply should be ample globally, with the only exception of lower Wheat crops in the EU and Black Sea which is fully offset by higher production elsewhere. China should continue to give support but is unlikely they will be able to buy the volumes of the Phase One agreement. And finally, Corn demand for Ethanol will be lower this year due to Covid.

We are still in a weather market which will bring some volatility as we still have a some three months before the Corn harvest in the northern hemisphere. But if we don’t have a serious weather issue, Corn is very much oversupplied thus expect a low price environment.

Supply

WASDE Projections

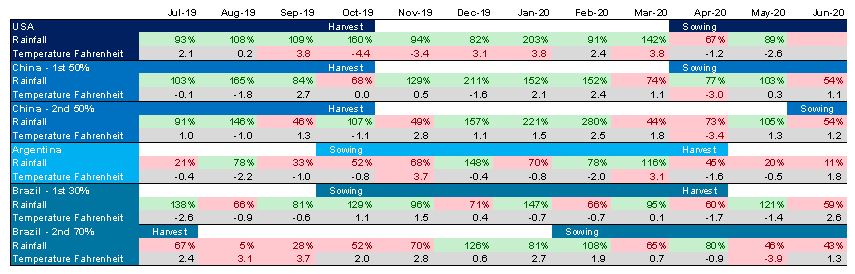

Weather in Main Corn Growing Regions

Brazil Balance

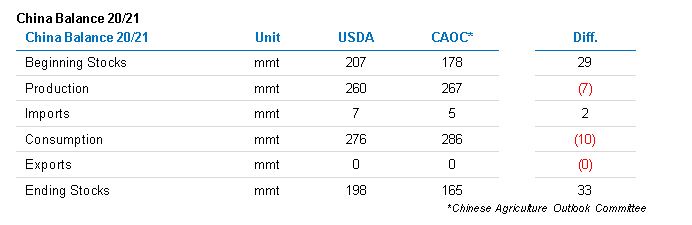

China

Demand

EU