Price Action

Market Commentary

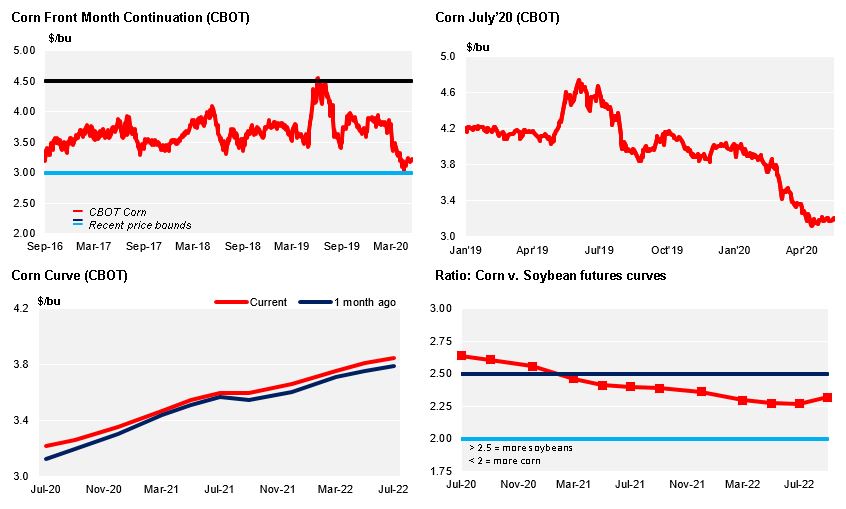

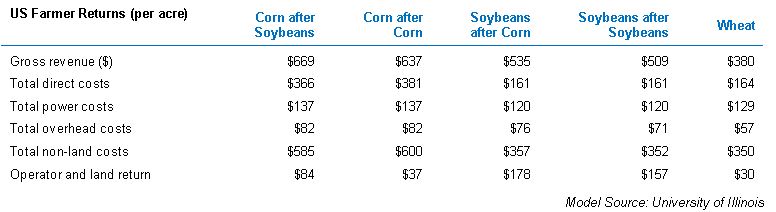

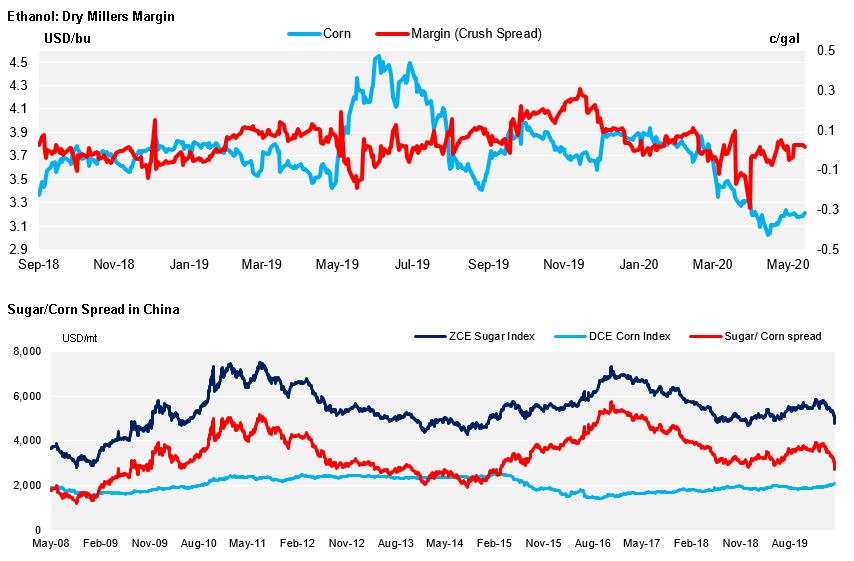

Corn rallied in Chicago boosted by higher demand for Ethanol together with a weaker dollar. Corn in Brazil was slightly negative for the opposite reason: the strength of the real. A stronger euro pressed as well EU Corn down. US Wheat rallied with lower production forecast but EU Wheat closed unchanged as the stronger euro capped the rally.

Not only demand for Ethanol and the dollar were the reason for the rally in Chicago Corn. A lower planting pace than expected and expectations of another downward revision to Corn production in Brazil helped as well.

US Corn planting reached 88% last week better than the 82% of the five year avg. but the market was expecting some 90% to 95%. The reference continues to be the 97 mill acres of the latest WASDE vs. a potential lower number of around 95 mill acres. The first measure for Corn condition showed is 70% good to excellent which is decent.

But the bulk of the rally was Thursday when the EIA weekly stats were published. The rise in Ethanol production made Corn to rally 2% due to spec buying triggering short covering from spec funds which continue to be net short.

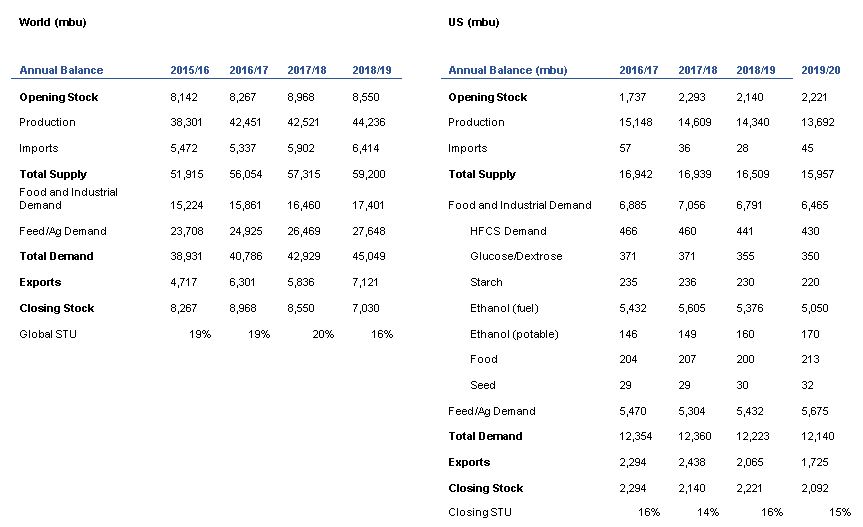

We are expecting higher Ethanol production this week again, which can give further strength to Corn in Chicago. But the reality is that the recovery in Ethanol production is already factored in the Corn S&D which continues to be awfully oversupplied with new crop ending stocks at 3,3 bill bu vs. the 2,1 we should have at the end of the actual

crop. Even a 95 mill acre crop instead of the 97 the USDA is projecting would set ending stocks at 3 bill bu.

The US-China tensions increasing is also negative Corn. Before Covid and the new Chinese law against Hong Kong we all knew that the Phase 1 agreement was extremely difficult to be fulfilled by China due to the large amounts of goods needed. After Covid with lower local demand in China, that large amount of agricultural goods to be bought is even more unlikely.

Now with tensions increasing due to the Chinese origin of the virus and the anti-democratic Chinese legislation against China this will all translate is less Corn exports thus higher ending stocks.

Demand for protein is also falling globally due to the closure of restaurants and cancelation of festivities across the world during Covid.

Hot and dry weather is forecasted for this week in the US which together with higher Ethanol production numbers can take the market higher. But the stock build we have around the corner will weigh in the market sooner or later.

The rally of the real vs. the dollar avoided any improvement to Corn values in Brazil even with further downward revisions to the safrinha crop due to dry weather.

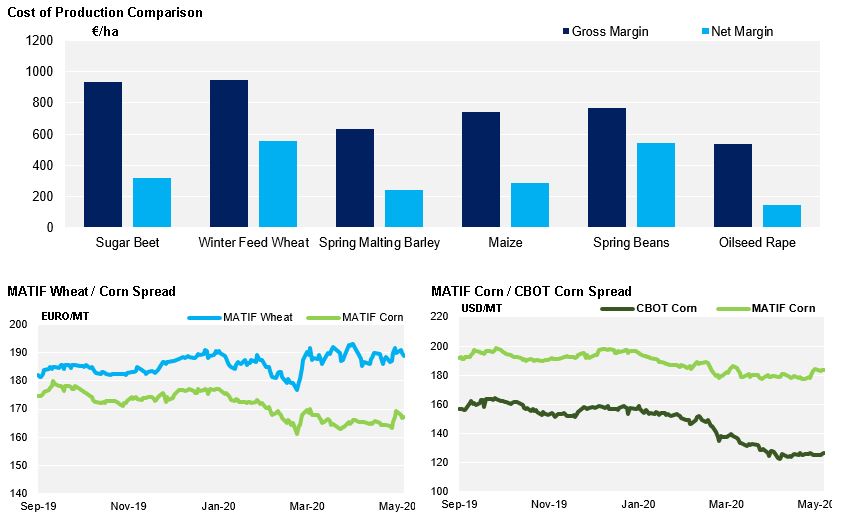

In Europe, we had some favorable weather including the Black Sea area which together with an increase in the production forecast by the EU pressed the market down.

The European Commission increased their Corn production forecast to 71.7 mill ton up 3% from their previous forecast of 69.5.

French Corn is 97% planted. Condition worsened to 83% good to excellent from 86% before.

Ukraine Corn planting has reached 98% and basically completed.

South Africa increased again their forecast for Corn production to 15.6 mill ton vs. 11.3 produced last year due to favorable weather.

The IGC increased global ending stock for Corn by 2.5% to 288 mill ton due higher production.

Corn is clearly well supplied globally.

On the Wheat front, the EU reducing their production forecast was fully offset by a stronger euro, favorable weather in the EU and Black Sea, and Ukraine allowing Wheat exports even though they had reached the export quota. EU Wheat prices were unchanged week on week.

The European Commission reduced their Wheat estimate by 3% to 122.5 mill ton. This is the lowest level since 2016.

French Wheat condition was lower again to 56% good to excellent down from 57% the previous week.

US Wheat condition was 54% good to excellent up two points from last week still far from the 61% last year.

The IGC increased global ending stock for Wheat by 2.5% to 288 mill ton due higher production.

Total grains production was forecasted at 2.23 bill ton an all-time high with record harvest of Wheat and Corn.

Corn is clearly in an oversupplied environment and any short term strength in Chicago should be a good selling opportunity.

Positive week for Corn in Chicago boosted by higher Ethanol production. BR was unchanged despite prospects of a lower safrinha crop due to the rally of the real vs. the dollar. EU Corn was negative due to ample supply and the strength of the euro. We could see further strength this week as we are expecting higher Ethanol production but

any rally should be short lived as the oversupply is secured. No changes to our forecast for Chicago Corn of 3.5 USD/bu in average for the actual crop (Sep/Oct) with year to date price running at 3,63 USD/bu.

Supply

WASDE Projections

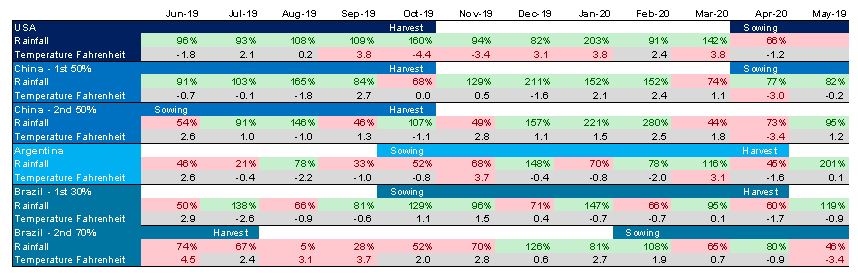

Weather in Main Corn Growing Regions

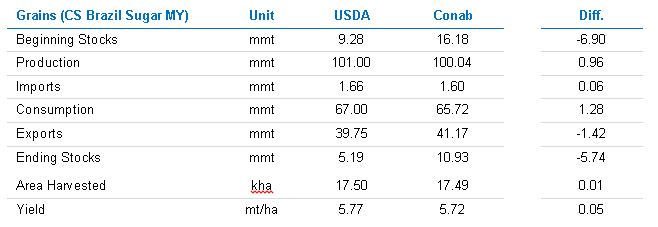

Brazil Balance

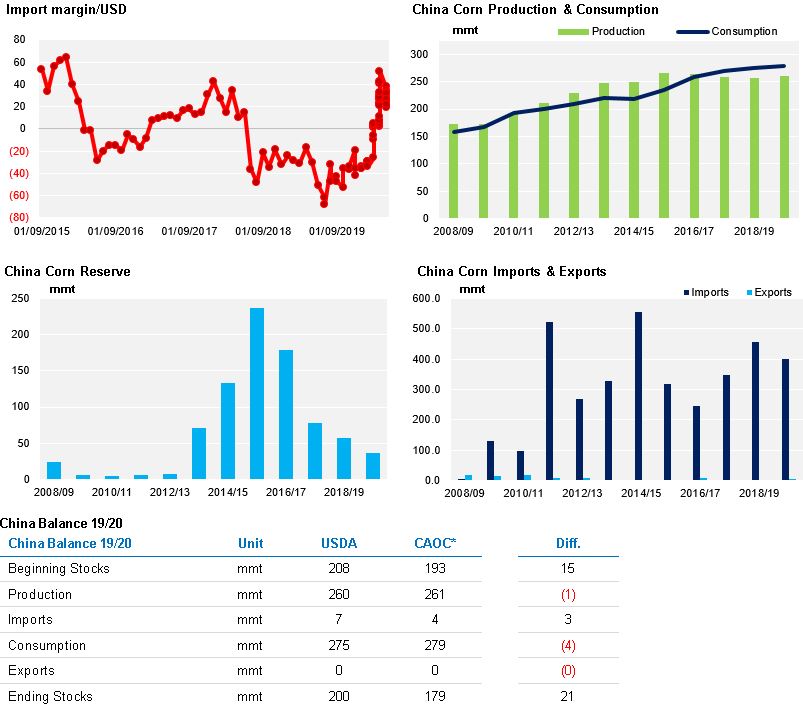

China

Demand

EU