Price Action

Market Commentary

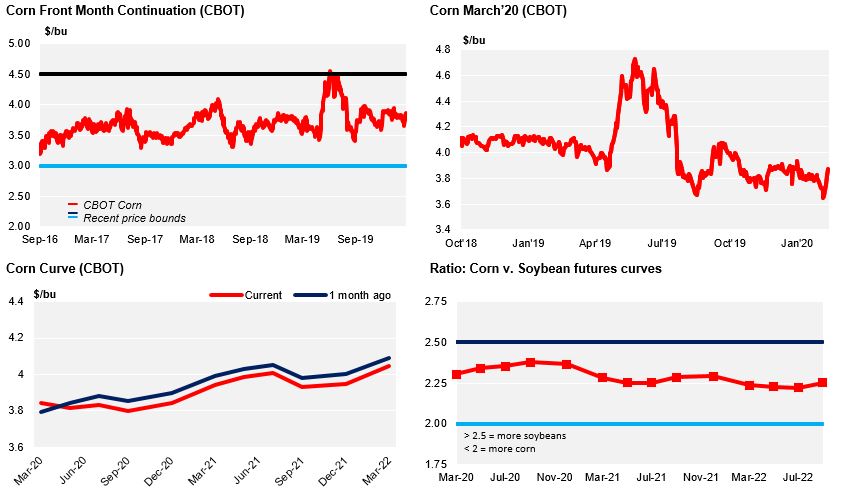

Corn rallied last week following the rally Soybeans at the beginning of the week on the back of a potential vaccine for African swine fever. Brazilian Corn rallied as well on the back of local strong fundamentals while European Corn and Wheat fell week on week.

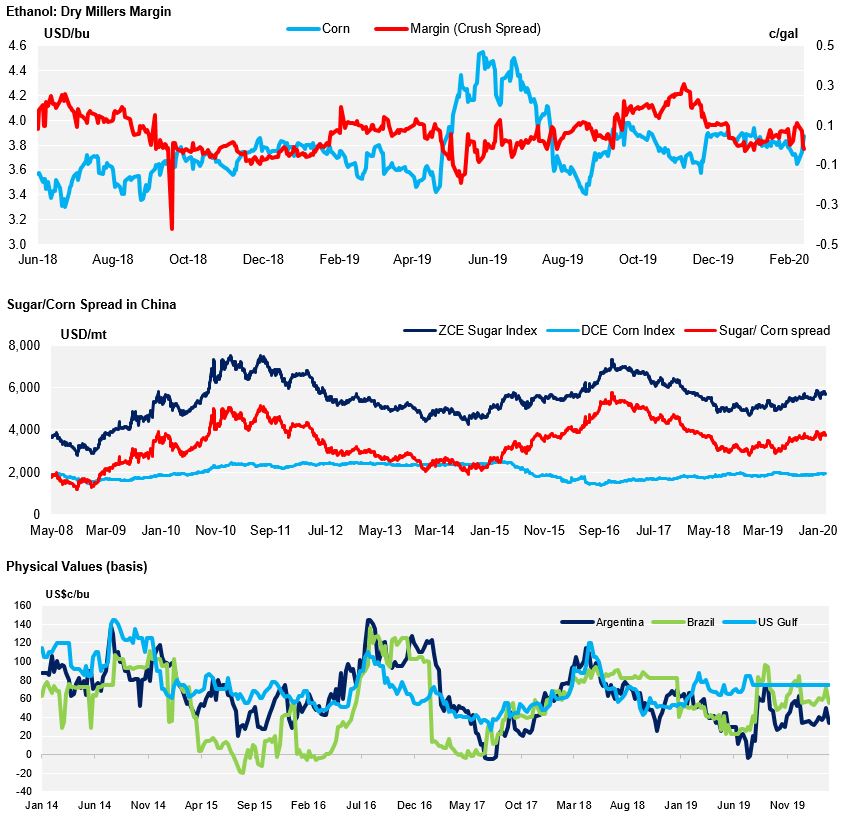

But the party is over with the new bearish Crude Oil environment as it will drag the soybean complex down and Corn will follow suit.

A potential vaccine for African swine fever was published in an academic report last week. The virus has killed a sizable amount of pigs in China and neighboring countries and it has reached Europe as well hurting demand for protein. This should be supportive mid-term but not before Crude Oil settles down.

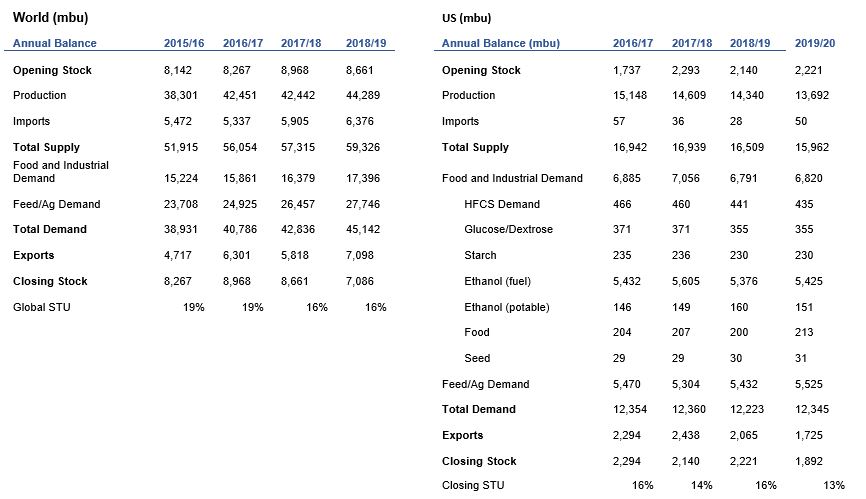

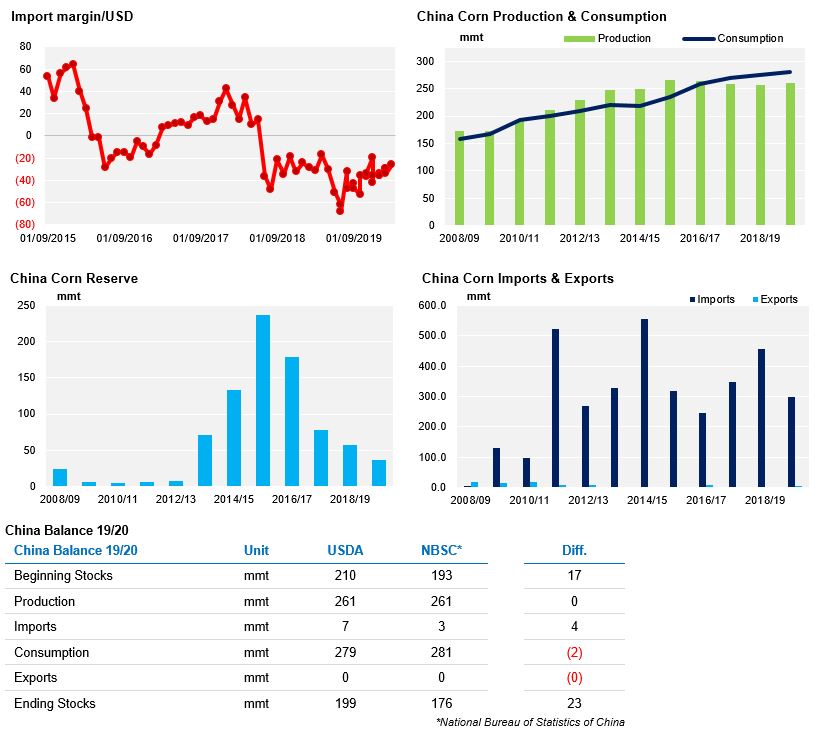

In addition to the turmoil in Crude, demand from China continues to be absent and the fulfillment of the Phase One agreement is not happening. There is really no reason to see higher prices unless this week’s WASDE surprises the market. In this bearish environment is certainly the right moment to publish lower harvested acres for Corn which we think is the major supportive factor for Corn.

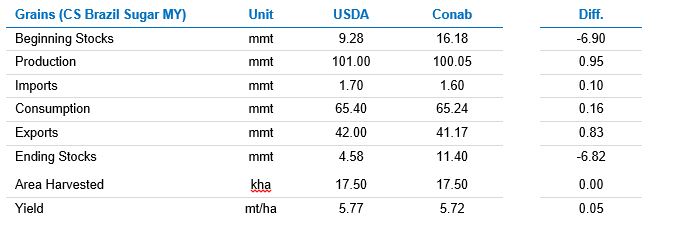

Brazil Corn rallied again last week on strong local consumption. The tightness in the market could be seen by the low volume exported in Feb with only 346k ton exported which is down 75% vs. Feb last year. Planting in Mato Grosso reached 92% at the end of Feb ahead of last year and of the five year average, and finally erasing all fears of delays due to rain and late Soybean planting. FC Stone increased their forecast for the 19/20 Brazil crop to 101,1 mill ton due to higher acreage for the second crop being planted now.

Argentina’s president confirmed they will increase taxes on Soybean exports from 30% to 33%. Corn or Wheat will not be impacted by additional export taxes.

The Ukrainian Grain Association lowered their 20/21 forecast for all grains due to a warm winter and expectations of lower planting area. Corn was lowered by 900k ton to 34,3 mill ton vs. 35,6 of the previous crop.

French Wheat condition remained at 64% good to excellent vs. 86% last year.

The Ukrainian Grain Association lowered their 20/21 Wheat forecast to 25,8 mill ton or 8,5% down from last year.

Abares forecasted the Australian Wheat crop at 21,4 mill ton or up 41% vs. last year’s crop of 15,2 mill ton which was the worst of the last decade.

Chicago is down 1% in today’s opening pressed by Crude Oil. Expect a negative week with the WASDE potentially adding some volatility.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

Brazil Balance

China

Demand

EU