Price Action

Market Commentary

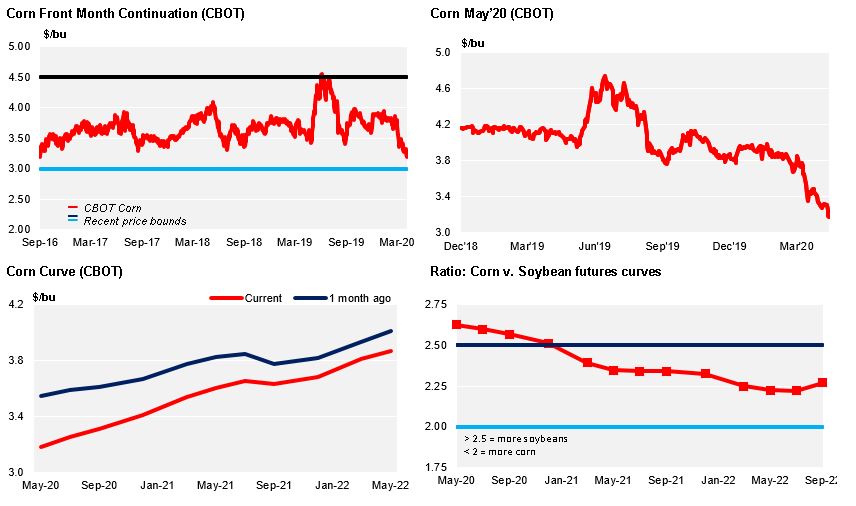

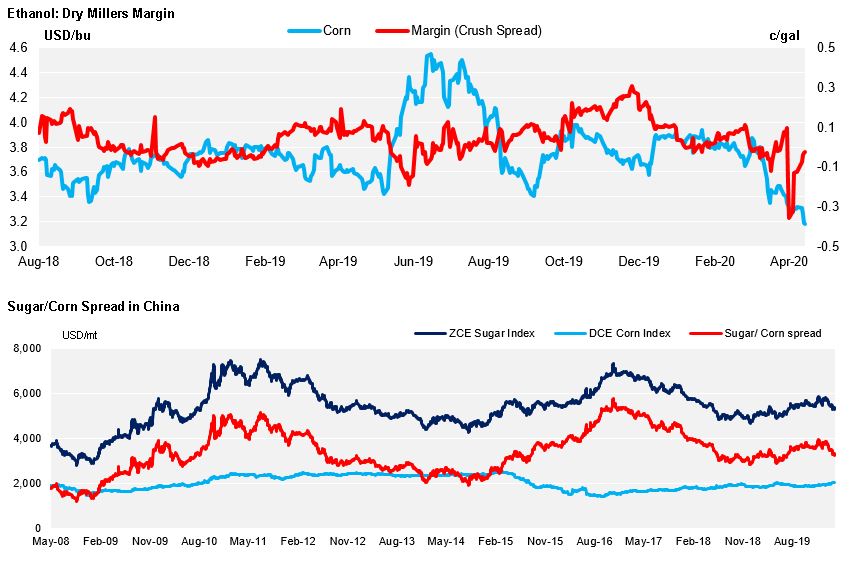

Losses across all geographies and all grains with Chicago Corn falling the most amid Ethanol demand destruction and lower Crude prices. Only May Wheat in Europe managed to close slightly positive.

European grains -specially Wheat- had been supported for some time as mobility restriction were impacting logistics, but once food logistics had been cleared up the market starts to feel the oversupply from COVID demand destruction, especially in Corn.

Wheat remains strong as exporting countries continue to try to control exports with the last example being Romania who after a week of having announced an export ban they backed up the decision. But also weather is giving additional support to Wheat with the best example being France as Wheat conditions fell again last week to 61% good to excellent which is the lowest level on record.

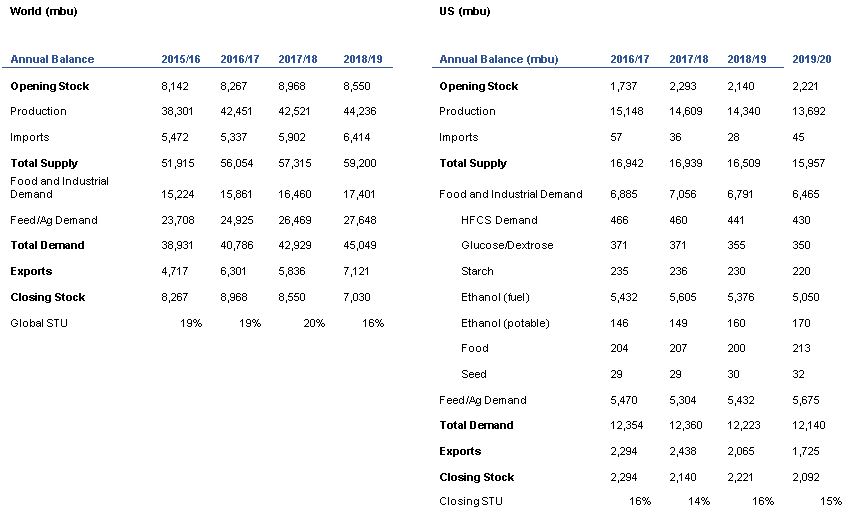

On the Corn side things are not looking good with Ethanol demand destruction being the main driver for lower prices. We have calculated 439 mill bu of demand loss from less US Ethanol production for this crop -Sep’19 to Aug’20- which is partially compensated with 147 mill bu of higher feed usage. This results in ending stocks at 2,3 bill bu and stock to use at 16,8% thus the reduction to our price forecast. These numbers are to be compared with the 375 mill bu of less demand from Ethanol the USDA is forecasting and 150 mill bu of higher feed usage.

In addition to the previous numbers which are for the actual crop Sep19 to Aug20, we are calculating additional 60 mill bu of demand loss for Ethanol usage from Sep20 to Dec20 vs. the same period last year.

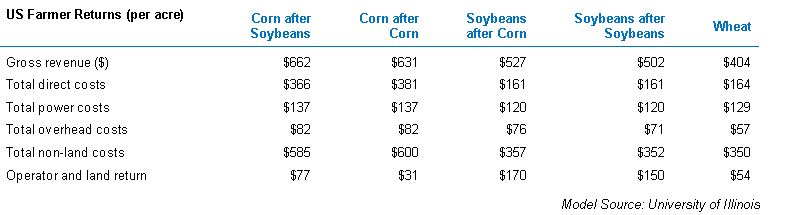

Besides the strategy of re-opening the economy impacting Ethanol consumption, the key will be the reaction of farmers to this demand loss as we don’t think they will plant 97 mill acres as the USDA published in their planting intention report. Farmers were polled right before COVID with no idea of what was coming right after in terms of the huge fall in fuel consumption. True is that with commitments for seeds and fertilizers done, is difficult to change their planting intention but those farmers still able to change will react and for sure acreage will be lower than 97 mill.

Brazil continued to trade lower on higher availability from Ethanol producers as Corn Ethanol crush margins continue to be negative.

Expect volatility in all grains with countries showing different exit strategies to confinement measures something it will be difficult. Wheat should remain supported while Corn will take the biggest hit from less usage for Ethanol.

Supply

WASDE Projections

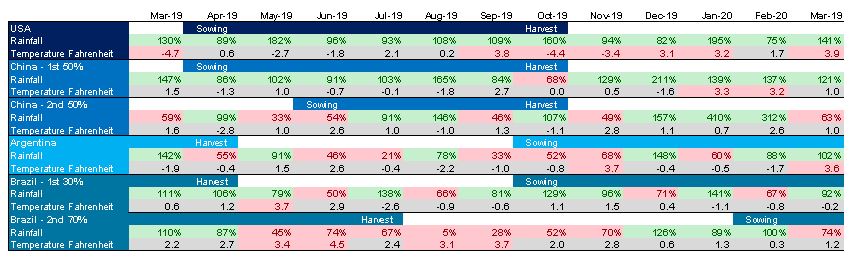

Weather in Main Corn Growing Regions

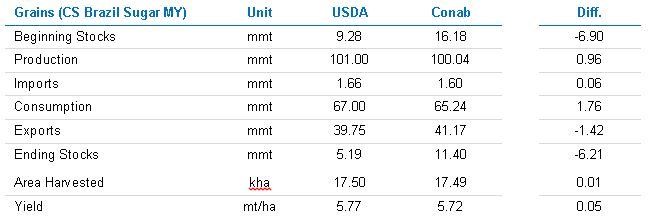

Brazil Balance

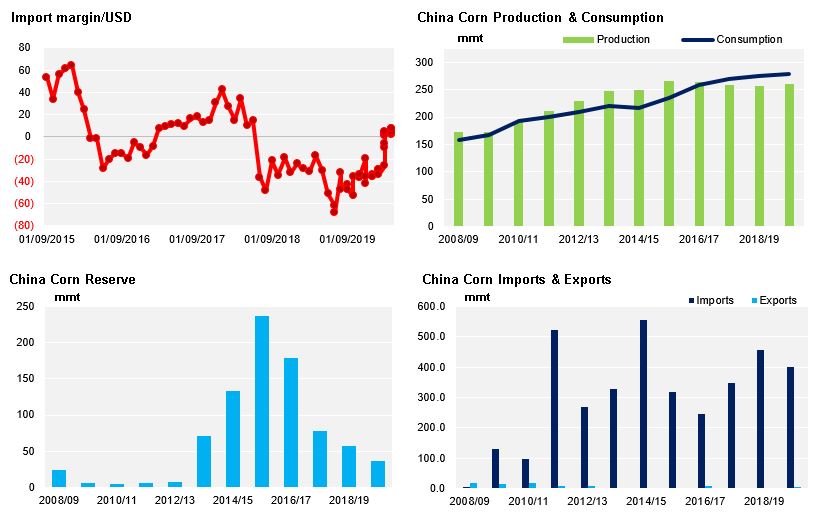

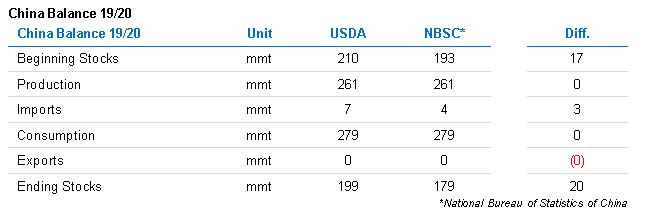

China

Demand

EU