Price Action

Comments

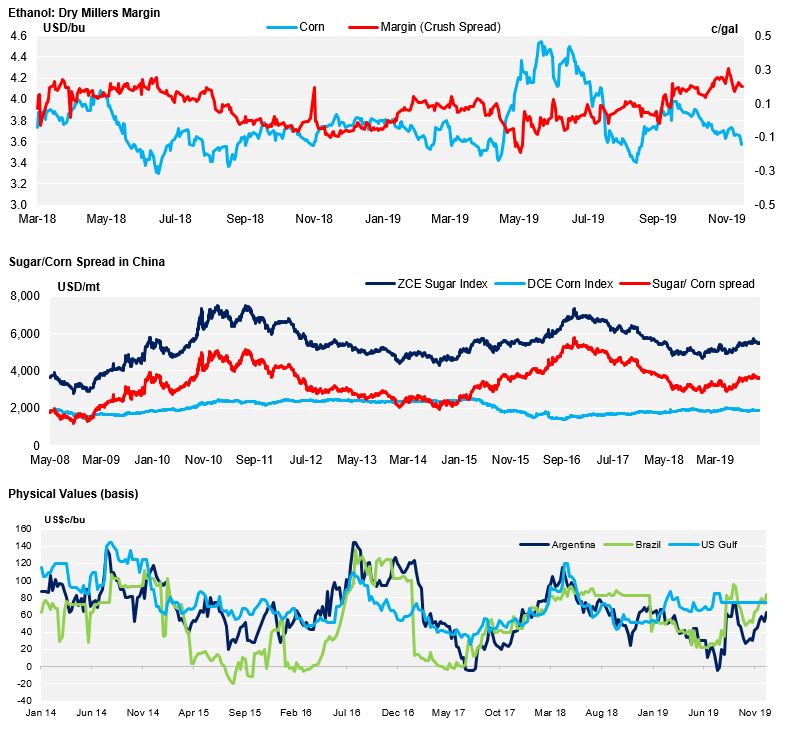

Corn

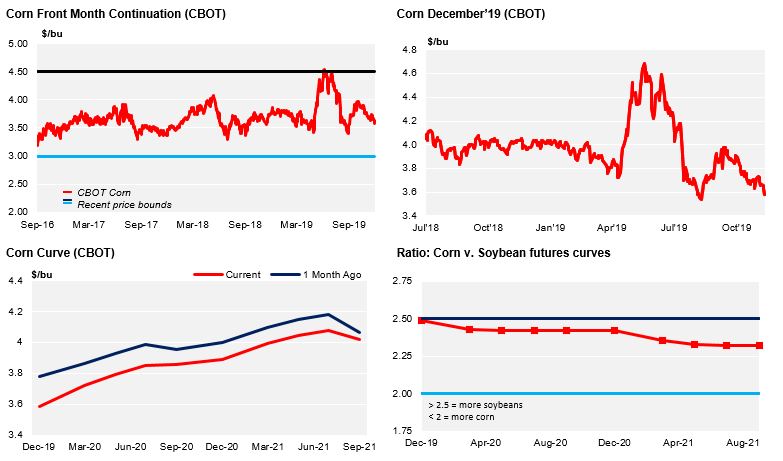

Chicago Corn was almost unchanged last week with the market down during the first half of the week following a fall in Soybeans and due to the lack of supportive data showed in the December WASDE,

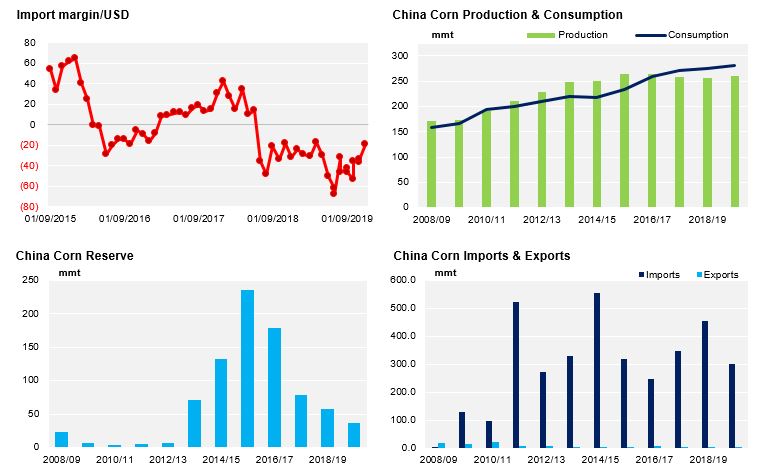

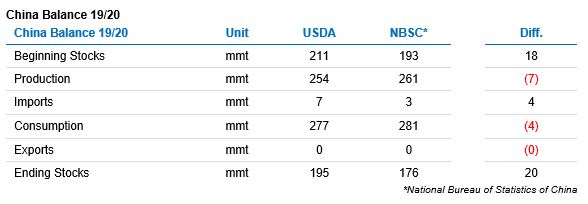

but then rallied later in the week on the back of the announcement of a US-China trade deal. However, the trade deal figure of US$50B a year seems unlikely to be fulfilled. In 2017 when there was no trade war, China imported farm goods for a value of $24B and the maximum they have imported was $29B. China does not need to import much more beans and the US will have to compete with Brazil and Argentina, making this an unlikely target to reach.

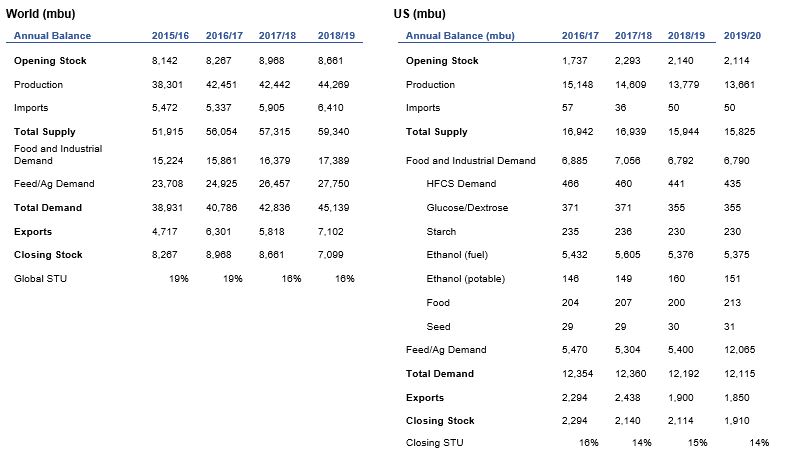

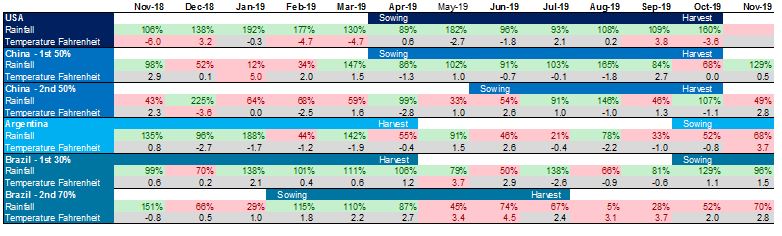

The December WASDE was a disappointment, with no changes made to the US Corn forecast or to other major production countries with the exception of China where production was increased by 6,8 m tons. Argentina and Brazil were left unchanged despite Argentina and Brazil suffering from dry weather and the concerns of a potential late planting in the safrinha in Brazil due to late planting of Soybeans. We are still early in the season but Soybean planting in Brazil has picked up very well and we think there will not be an issue with safrinha planting, particularly given the high price environment (in BRL) which will incentivize farmers to increase acreage for the new crop. The USDA is already surveying farmers focusing on the January report.

US Corn harvesting continues to be very delayed running at 92% vs. 100% last year and the four year average. Iowa and Illinois are running five and four points behind average, respectively, Minnesota seven and Wisconsin twenty one. Harvesting will have to continue in 2020 when the snow is off the fields, hence why we have been forecasting a lower number of harvested acres.

In the EU, Coceral lowered their forecast for EU Corn marginally to 61,2 mill ton vs. 61,6 before, and Strategie Grains went in the opposite direction and increased it to 67,1 mill ton from 63,6 before.

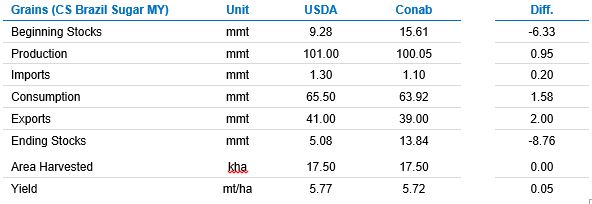

CONAB left unchanged their 19/20 Corn forecast for Brazil at 98,4 mill ton vs. 100 mil ton of the previous crop (vs. USDA forecasting 101 mill ton) The reality is that the price incentive is there for the farmers to increase area. We have seen in the market some 200k ton from Argentina being imported into Brazil which make sense as we haven even seen the arbitrage almost open from the US. Soybean planting is almost complete at 93% and is only 3 points behind last year. Soybean harvesting is expected to start very much in line with last year so Corn planting for the safrinha should not be impacted and all points to a 100+ mill ton crop.

Wheat

The Dec WASDE left US Wheat production unchanged but ending stocks were reduced by 40 mill bu due to a combination of 15 mill bu of less imports and 25 mill bu of higher exports. Outside the US they lowered Argentina from 20 to 19 mill ton (BAGE forecasting 18,5), reduced Australia from 17,2 to 16,1 mill ton, Canada from 33 to 32,3 mill ton, Europe up from 153 to 153,5 mill ton (vs. 147,9 mill ton of the EC) and finally Russia up from 74 to 74,5 mill ton. Wheat markets were up after the report but corrected part of the gains by the end of the week only to recover again when the US and China announced their deal.

Coceral increased their EU Wheat forecast to 145 mill ton vs. 143,7 before (vs. 153 of the USDA and 147,9 of the EC). In opposition we had Strategie Grans lowering their EU Wheat forecast to 140,5 mill ton from 144,5 before. But the UK farm office reported UK Wheat planting was only at 60% by the end of November when normally all is planted by this time of the year. 15% of the crop is poor to very poor and 36% is good to excellent. Wheat area is expected to fall by 10% which would be the lowest since 2013 all due to excess rains impeding the farmers to get into the fields and plant. For the same reason the French agriculture ministry forecasted French Wheat area to be at their lowest level since 2003 at 4,7 mill ha.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

Brazil Balance

China

Demand

EU