Price Action

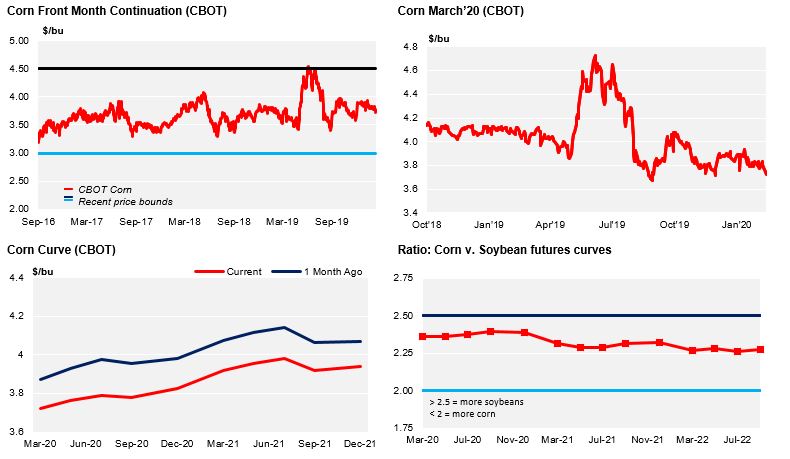

China has not given signs of starting to buy US farm goods and the USDA publishing their first projection for the 20/21 Corn crop leaves Corn in Chicago trading sideways for another week, closing with small losses but basically unchanged. Brazil and EU Corn posted weekly gains as well as Wheat both in the US and EU.

After China having eliminated import tariffs on US agricultural goods the expectation in the market was they would start buying, but they haven’t. It is true the Chinese authorities had informed they would fulfill their commitments but they would start slow due to the crisis with the coronavirus. But the market was expecting to see some intentions at least. Not positive.

The USDA published their first outlook for the 20/21 crop projecting ending stocks at 2,7 bi bu which is a sizable jump vs. the 1,9 bill bu they are forecasting for the actual 19/20 crop. The key is in the recovery of yield which they forecast at 178,5 bushels per acre vs 168 this crop, and in a recovery of acres at 95 mill vs. 90 of this crop. It is still very early and we have a lot of weather ahead of us but is a good indication of what the US farmer will do and with these initial numbers is hard to be constructive looking forward.

Quality problems for US Corn continue to be in the market as South Korea tendered volume excluding offers from north east ports in the US due to low quality.

The harvest in Argentina has formally started with 0,4% progress and yields above average. BAGE maintained their forecast at 49 mill ton.

Coceral forecasted EU Corn production at 65 mill ton up 4 mill ton year on year.

The unknowns we have in the market remain: Phase one going slow, coronavirus and swine fever, the final size of the US crop, and planting season in the northern hemisphere around the corner. The dollar continues strong which negative for Chicago values and beneficial for South American crops.

European Wheat had a positive week on the back of strong demand with several countries buying and Saudi Arabia in the market last Friday for a sizable volume.

Coceral forecasted Wheat production in the EU (27 + UK) will fall to 137,9 mill ton 8 mill ton down year on year. This is to compare with SG forecasting 139 mill ton. Less acreage across Europe due to excess rains during planting season is behind the lower forecast with the biggest losses coming from France and the UK.

French Wheat condition was 65% good to excellent vs. 85% last year.

Logistical constraints in Canada supported Wheat prices as well as exports fell 37% week on week with protests in the country disrupting logistics.

Chicago has opened negative this morning as new cases and deaths of coronavirus have been reported in Europe and South Korea. China needs to start buying and fulfill their Phase One agreement in order to give some support to the market.

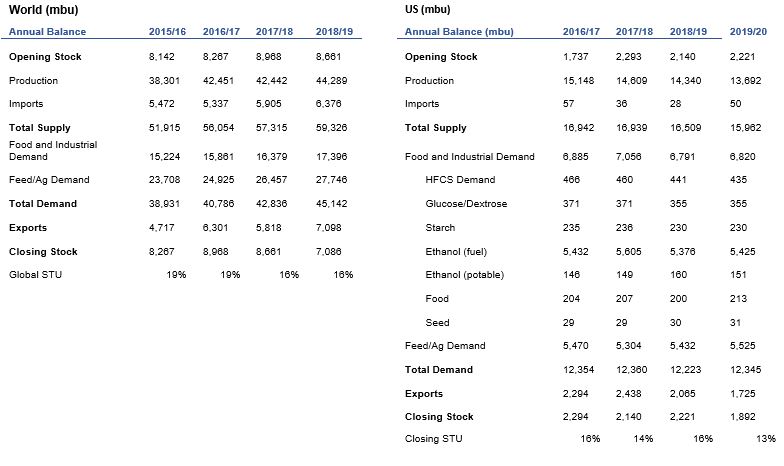

Supply

WASDE Projections

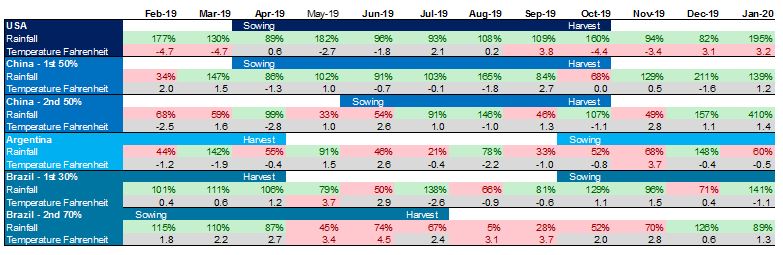

Weather in Main Corn Growing Regions

Brazil Balance

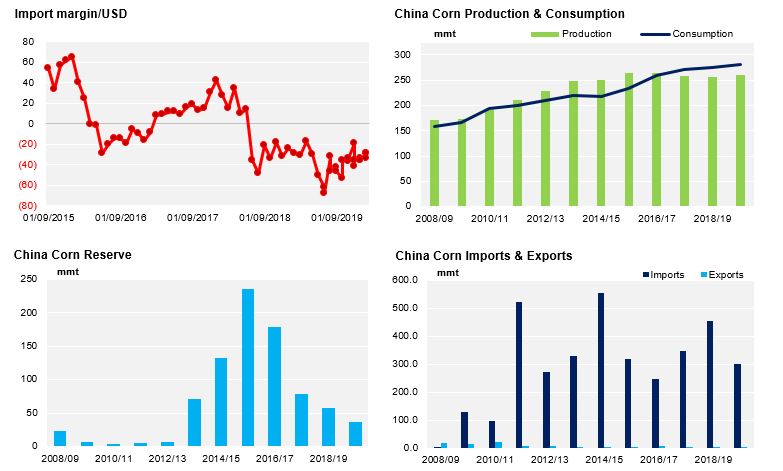

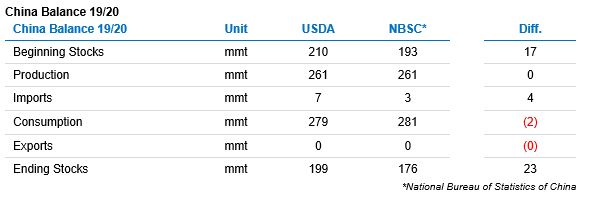

China

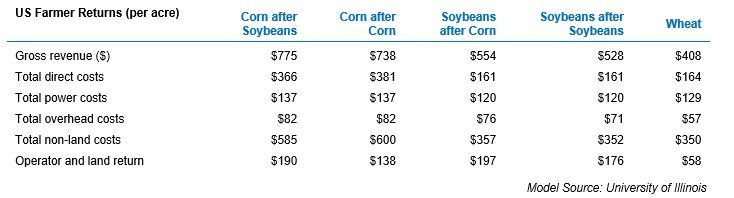

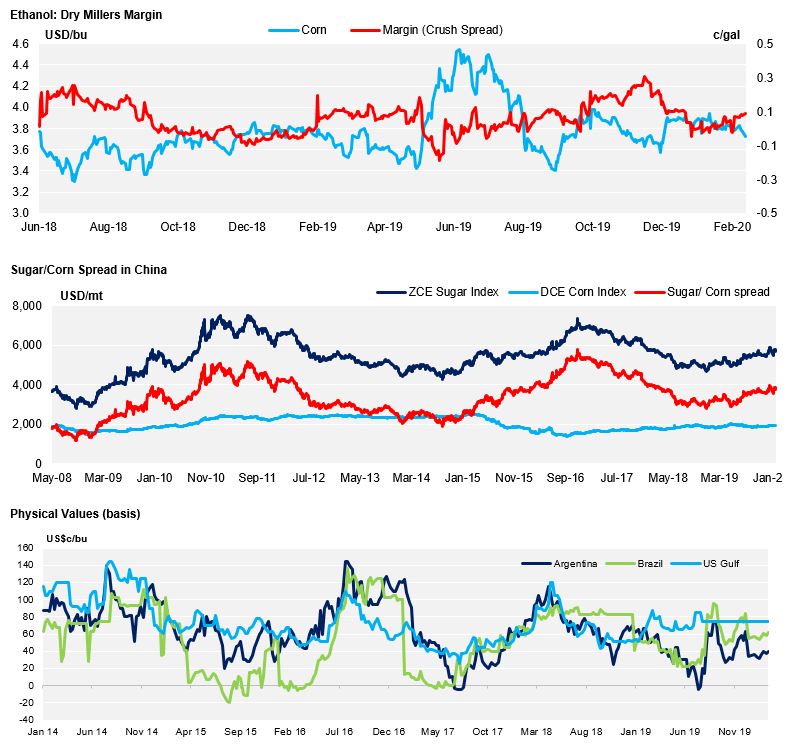

Demand

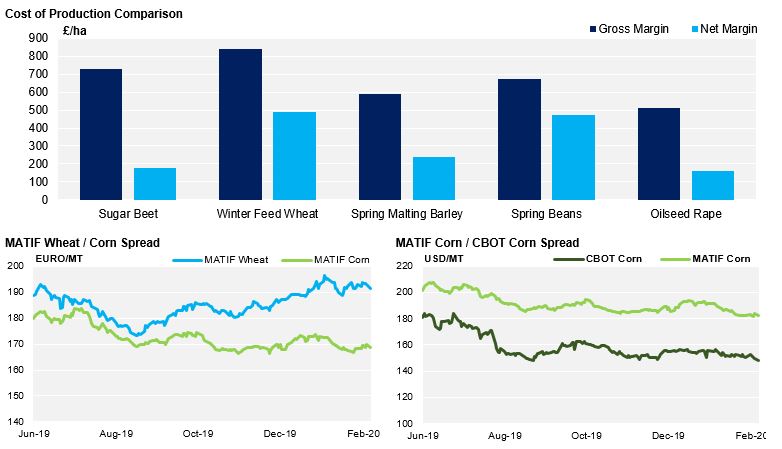

EU