Price Action

Market Commentary

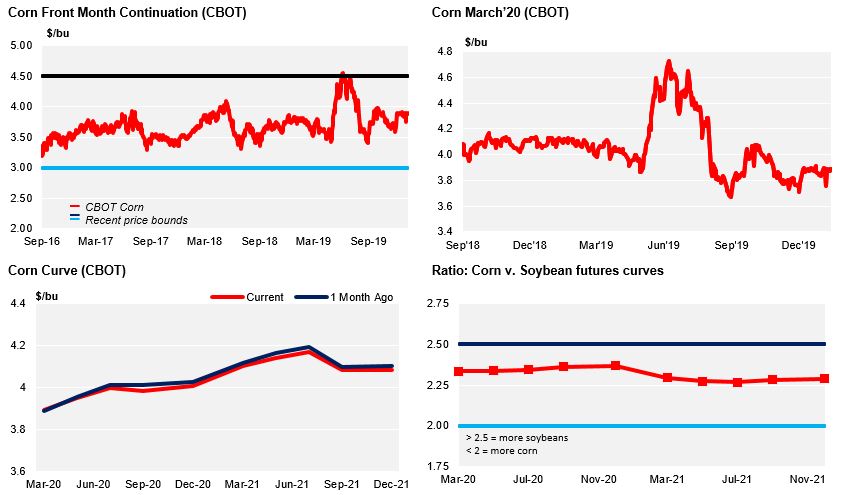

Chicago Corn was almost flat last week despite a rally last Thursday as it fell back on Friday dragged by lower Wheat and Soybeans closing the week slightly negative. EU and BR Corn had similar weekly closings but Matif was more volatile during the week.

No fundamental reason for the move apart from the coronavirus outbreak in China and reports that the virus may have originated from animal products. This pressed Soybeans down and Corn followed suit on Friday.

US Corn quality continues to be a concern and it can be seen in the trade flows with traditional importers of US Corn turning to Ukraine for some of their purchases. We will have to see how this situation develops but is potentially bearish.

Corn planting in Brazil could be delayed as Soybean harvesting is only at 1.8% complete vs. 6.1% last year due to wet weather. Is still early but if finally delayed it will have an impact to the new crop tightening stocks even more. By now prices have stabilized as Brazil continues to buy from Argentina.

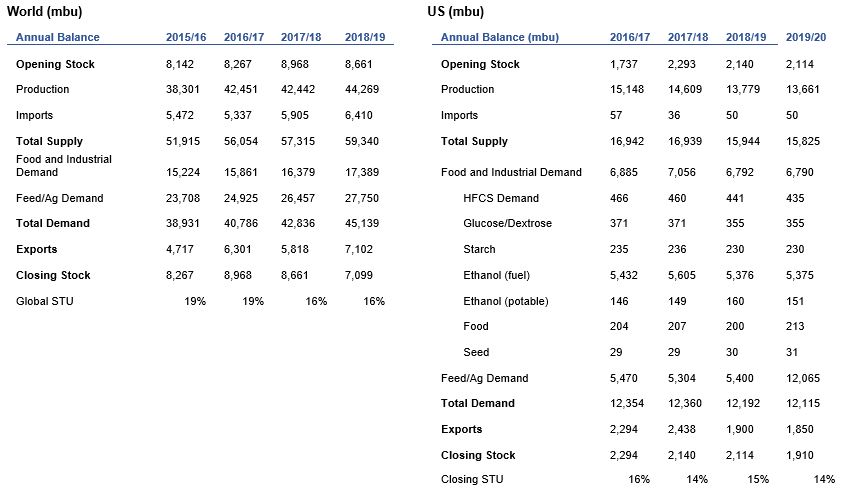

The IGC increased their 19/20 Corn production forecast by 8 mill ton to 1,111 mill ton below the 1,129 mill ton of the 18/19 crop. The upward revision was based on higher production in the US and China.

European Corn continued to be very volatile during last week due to the logistical difficulties caused by the strikes in France.

The fundamental picture has not changed and the key info to look at will be the USDA final number for the size of the Corn crop later in March.

Wheat made another positive week despite heavy selling by mid-week on profit taking. The market continues sustained by good demand with fresh tenders from Algeria and Pakistan. By the end of the

week, China surprised the market buying some 500k ton of Australian Wheat instead of looking to the US as part of the recently signed trade agreement. Logistics in France continue to be a nightmare which is also behind the strong Matif prices. The IGC reduced their world 19/20 Wheat production by 1 mill ton to 761 mill ton vs. 733 mill ton of the previous crop. Canada’s Wheat output for the 20/21 season is expected to grow by 600k ton to 28 mill ton due to higher acreage.

Supply

WASDE Projections

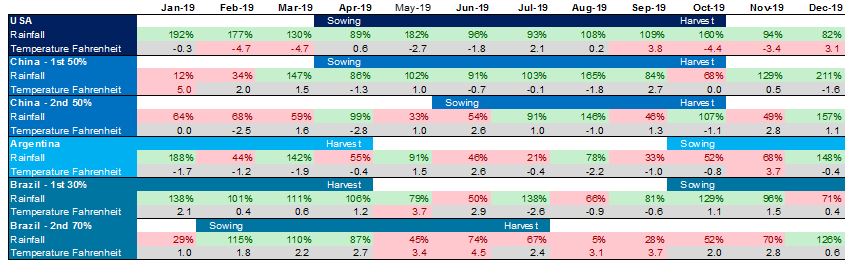

Weather in Main Corn Growing Regions

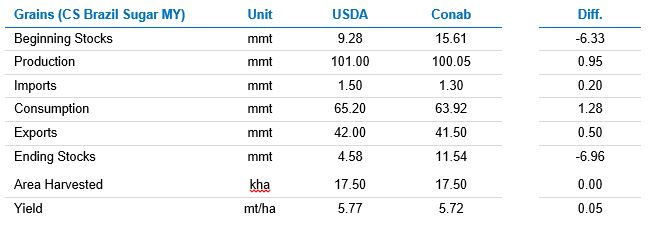

Brazil Balance

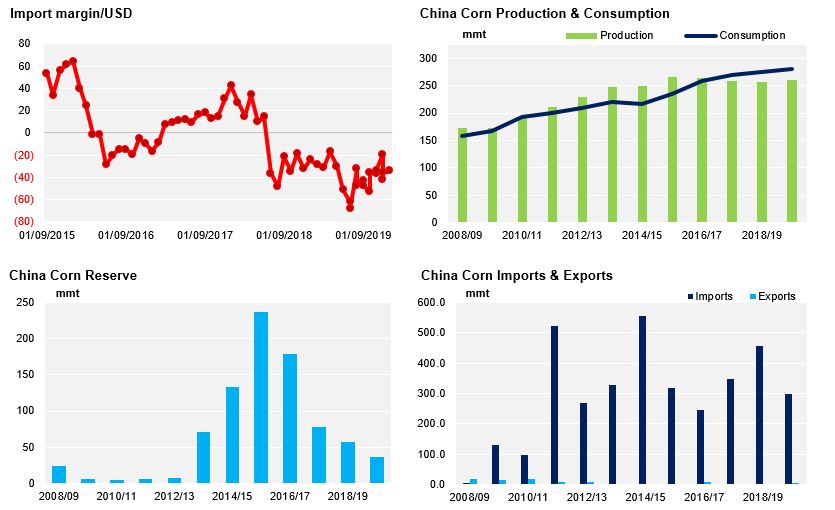

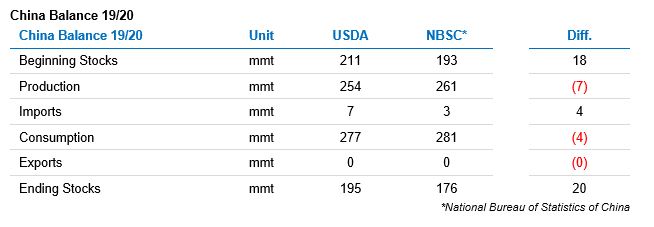

China

Demand

EU