Price Action

Market Commentary

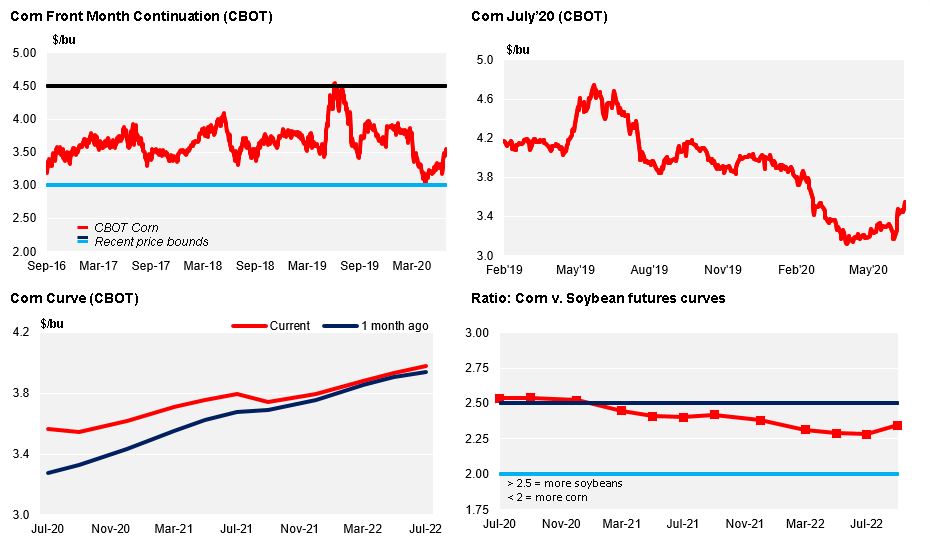

Higher ending stocks than expected in the July WASDE made Corn to plummet last Friday in Chicago erasing the gains of the week and closing almost 2% down (September future). BR and EU Corn were higher with the EU Aug future rallying 5%. Wheat had also big gains both in the US and EU as it benefited the most from the July WASDE.

The July WASDE was published last Friday. Corn plummeted after the report.

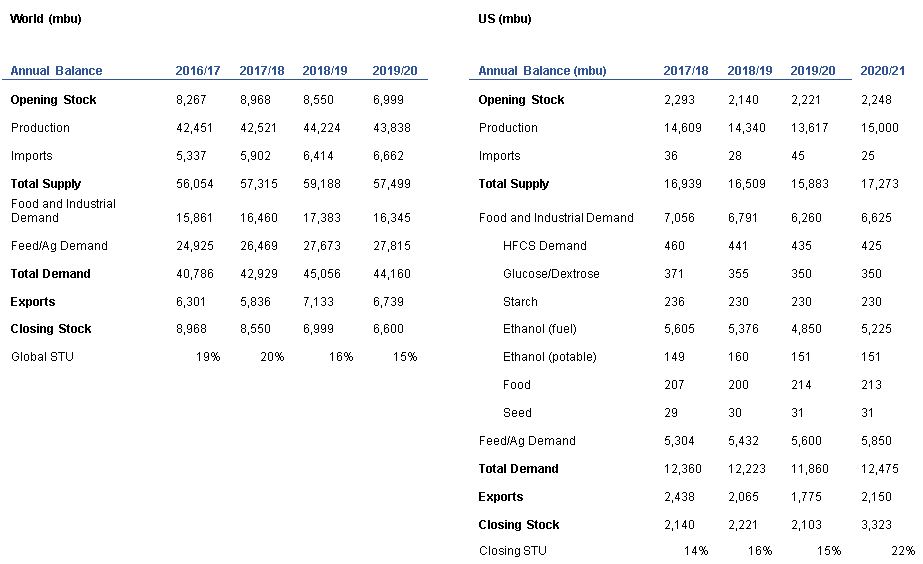

The USDA updated Corn acreage for 20/21 as per the planting report from the previous week with 92 mill acres and 84 mill harvested acres. Yield was left unchanged thus production was lowered to 15 bill bu vs. 16 of the June WASDE.

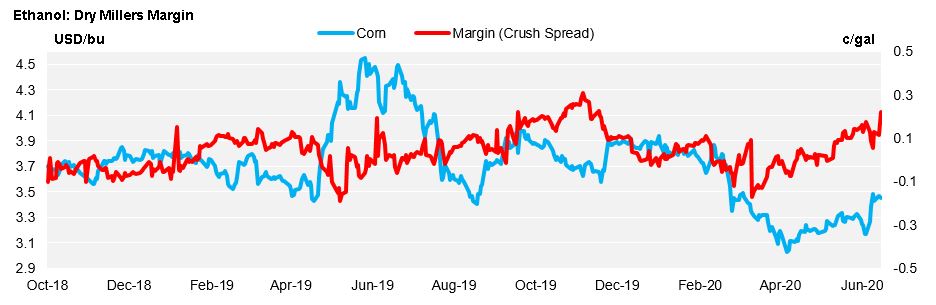

On the consumption side The USDA lowered 19/20 Feed and Ethanol consumption in total by 150 mill bu with the consequent increase in ending stocks. Feed usage was reduced by 200 mill bu and food usage was increased by 25 mill bu, Ethanol use and exports were left unchanged with a negative impact of 175 mill bu of less demand.

Ending stocks were forecasted at 2,6 bill bu vs. 3,3 of the June WASDE.

The lower acreage was expected but the market was also expecting lower yields which didn’t come and certainly the lower 19/20 consumption was a surprise.

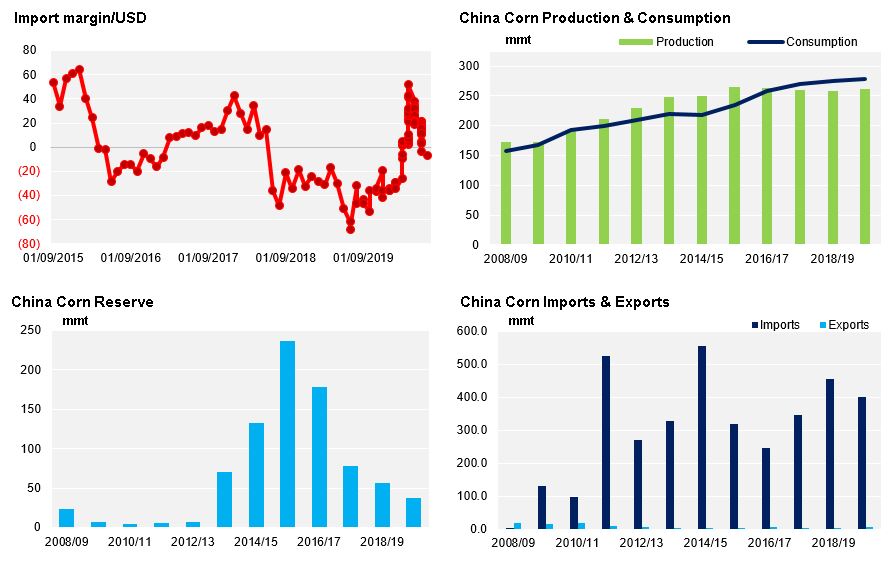

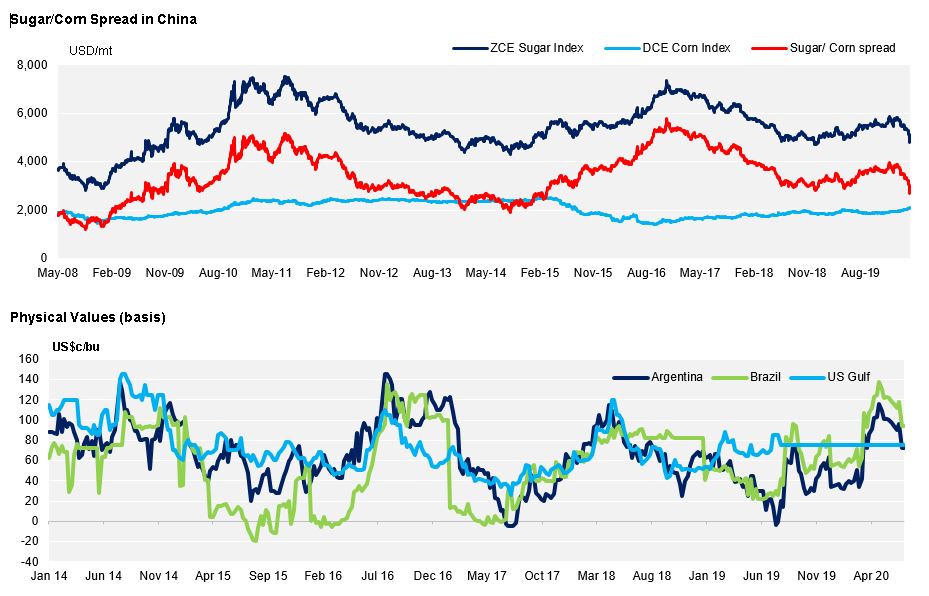

China buying 1,4 mill ton -the second largest volume on record- was not able to avoid the 3% Friday fall. China said the Phase One agreement was on course and they will accelerate purchases forecasting 6 mill ton of imports vs. 3 mill ton of the previous estimate. This is despite Trump saying there is no interest in a Phase Two agreement and relationships between both countries worsening.

Looking forward we are still in a weather market as Corn has an important development phase ahead of us and if heat and dry weather persists much longer we may have lower yields than forecasted. We have some relief as there are some rains forecasted for this first part of the week which is beneficial, but then we have again heat and dry weather.

US Corn condition worsened to 71% good to excellent vs. 73% the previous week vs. 57% last year.

EU Corn (Aug) rallied 5% week on week while the Nov future rallied 1,8%.

The USDA left EU production unchanged at 68,3 mill ton vs. 66,8 of the average of European forecasters. Russian production was increased by 800k ton to 15,3 mill ton. The rest main players were left unchanged from the June WASDE.

French Corn condition was 83% good to excellent unchanged from the previous week vs. 78% last year.

Brazil Corn was 1% higher.

Argentinian Corn is 87% harvested.

The July WASDE was bullish for Wheat with US and World stocks, despite higher vs. the previous WASDE, they were lower than expected. US and EU Wheat both rallied.

US Wheat harvested acreage was reduced by 1 mill acres with a result of some 30 mill bu of lower production but the impact in ending stocks was of just 10 mill bu of lower stocks due to higher ending stocks of the actual 19/20 crop which were increased by 61 mill bu.

China bought US Wheat as well supporting last week’s rally.

Global Wheat production was reduced by 4 mill ton to 769,3 mill ton. EU Wheat production was reduced by 1,5 mill ton to 139,5 mill ton although this number is still well above the 120 mill ton of average EU forecasters (EU, SG and Coceral) Russian production was reduced by 500k ton to 76,5 mill ton and the rest of major players were left unchanged.

French Wheat condition worsened last week by one percentual point 55% good to excellent vs. 73% last year. Wheat is 10% harvested.

As we anticipated last week the big cut to Corn acreage was simply less bearish as supply continues to be ample. Weather will dictate market behavior but don’t expect impact to yields just yet.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

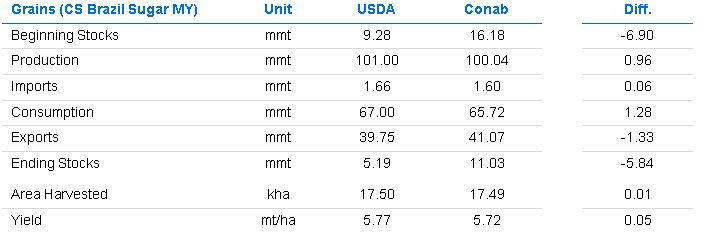

Brazil Balance

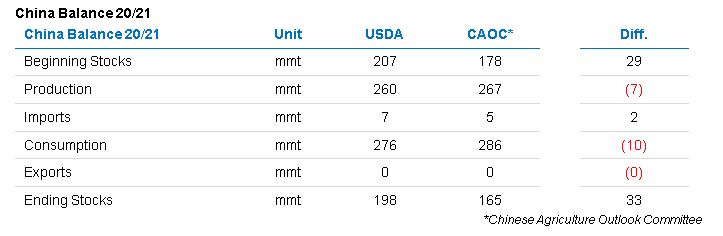

China

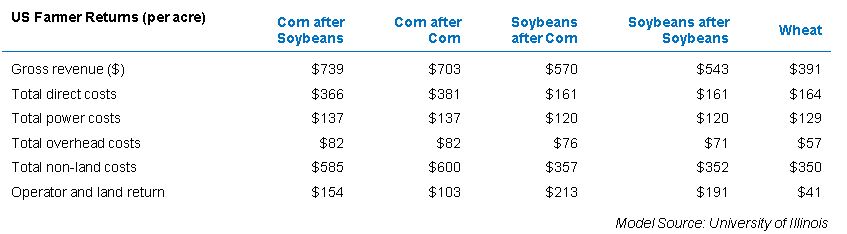

Demand

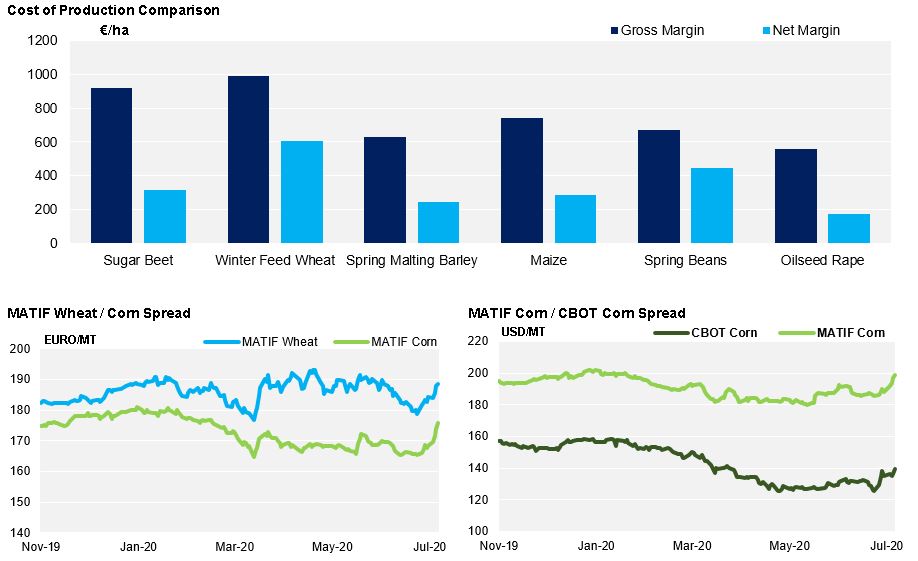

EU