Price Action

Market Commentary

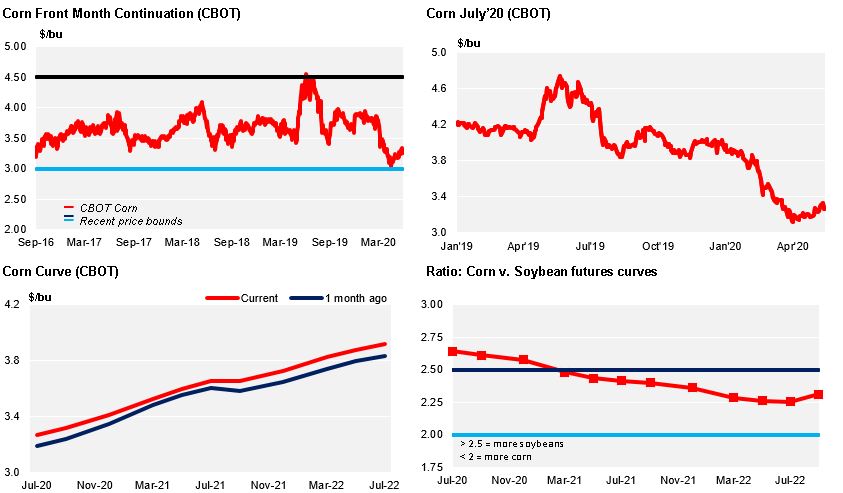

Despite an 8% fall in Crude Oil, Corn in Chicago had a flat week after a neutral WASDE which was bearish for Wheat. EU and BR Corn were down.

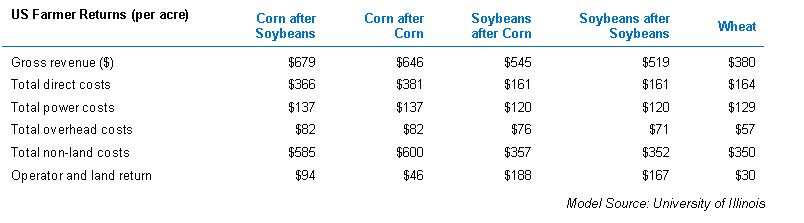

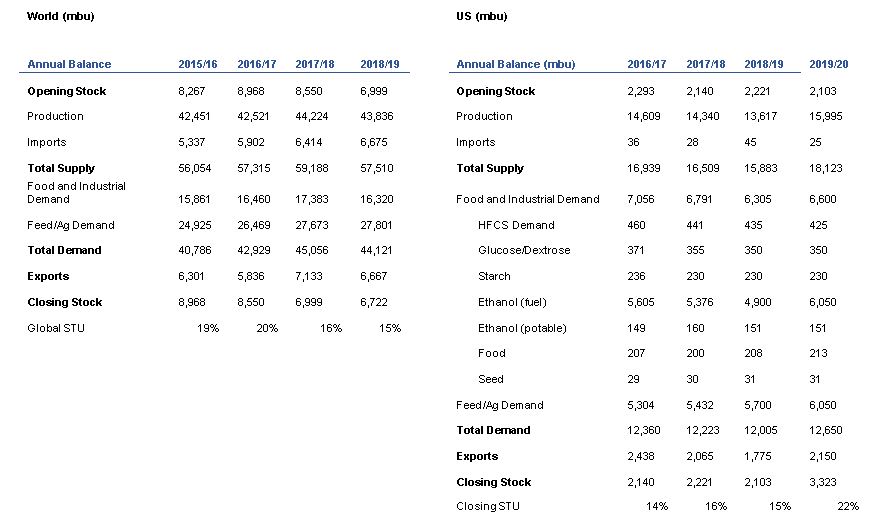

The June WASDE reduced a bit old crop production by 46 mill bu (lower harvested area and lower yield) but they also reduced demand for Ethanol usage by 50 mill bu the whole resulting in 4 mill bu of higher ending stocks for the old crop about to finish. They made no changes to their 20/21 forecast thus ending stocks for the new crop remained at 3,3 bill bu or a whopping increase of 1,2 bill bu vs. 19/20.

The small reduction in 19/20 stocks triggered a rally as the expectation was for a slightly increase in ending stocks. But the rally was short lived as the oversupply in the new crop continues to be huge and the macro environment was negative with fears of a second wave of Covid.

World Corn stocks were reduced by 2 mill ton. Brazil production was forecasted at 107 mill ton, EU at 68,3, Ukraine at 39 and Argentina at 50.

US Corn planting reached 97% last week better than the 94% of the five year avg which makes planting virtually finished. Corn condition was at 75% good to excellent vs. 59 last year. The market fell following the reports as the USDA forecast for 97 mill acres is closer to reality.

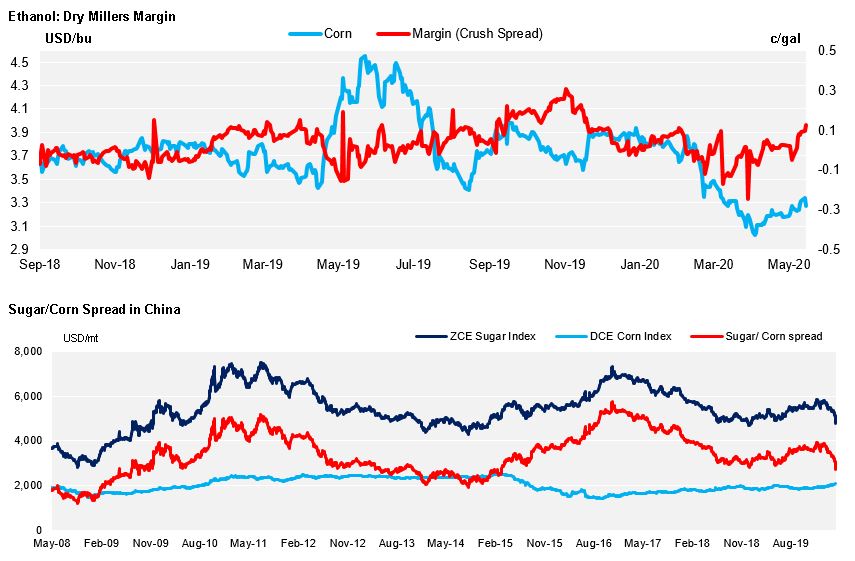

US Ethanol production increased by 9% last week but this time it had no impact to the market as it is already factored in the WASDE projection thus already priced.

The biggest problem we see are Chinese purchases as they are way off their commitments with the Phase One deal. The USDA is expecting China to increase their purchases in Q4 but here lies the difficulty: the total commitment for 2020 is 37 bill USD of agricultural goods while year to April is running at 6,3 bill USD. They will probably fail to

fulfill the agreement with the consequent impact to US exports and a potential come back to a trade war.

In Brazil and Europe, Corn made weekly losses pressed by a weaker dollar and ample supply.

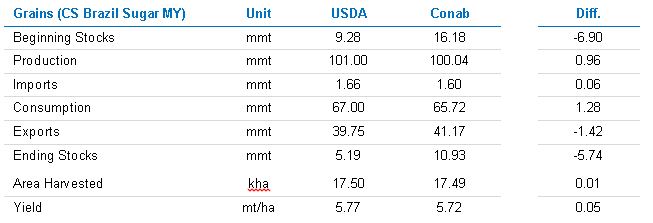

In Brazil Agrural reduced their BR Corn production forecast to 96,4 mill ton vs. 100 last year. Conab is forecasting 101 mill ton.

Coceral increased their EU Corn production forecast to 66,8 mill ton.

French Corn condition worsened 2 percentual points to 83% good to excellent vs. 82% last year.

Wheat made losses both in the US and Europe.

The June WASDE was bearish for Wheat as they increased US 20/21 ending stocks by 16 mill bu with part of it coming from the actual old crop and the rest from higher new crop production (higher yields).

World Wheat stocks were increased by 6 mill ton with a record production figure of 773,4 mill ton coming from higher stocks in the US, China and India while lower stocks in the EU and Russia.

EU production was pegged at 141 mill ton and Russia at 77 mill ton which has a big disparity with local forecasters: see Stragtegie Grains, Coceral and SovEcon below.

Strategie Grains lowered by 2 mill ton their EU Wheat production forecast to 130,9 mill ton. Coceral lowered their EU Wheat production forecast to 129,7 mill ton vs. 135,4 they had before. Last year’s production was 146 mill ton. The cuts was on the back of dry weather.

France Agrimer cut their Wheat acreage by 1% from last month and is already 8,3% down year on year. French Wheat condition was unchanged week on week at a poor 56% good to excellent vs. 80% last year.

Russias SovEcon increased their Wheat production forecast to 82,7 mill ton vs. 81,2 before thanks to the latest rains.

Australia is expecting to increase their Wheat production by 25% year on year to 26,1 mill ton.

Wheat prices are starting to feel pressure from the global oversupply, despite a smaller EU and Black Sea crop, but also the pressure from low Corn prices which is heading to a record production year, weather permitting. We are still in a weather market, especially in Corn as the Wheat harvest has already started.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

Brazil Balance

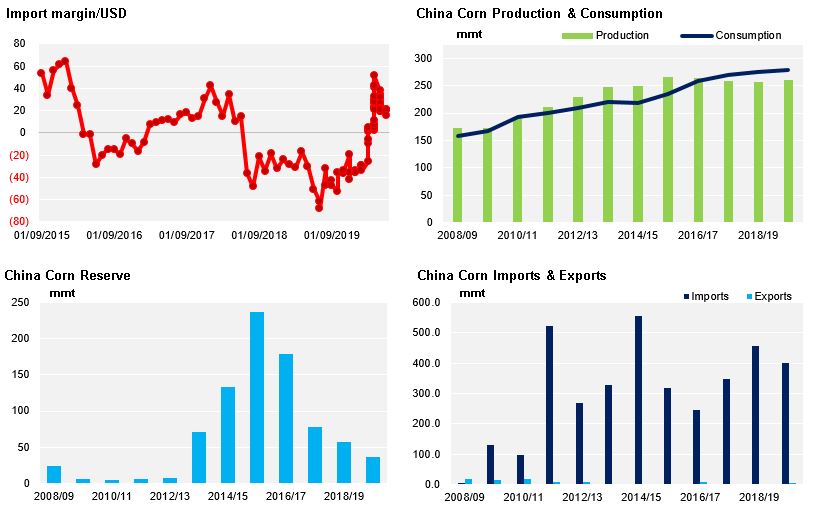

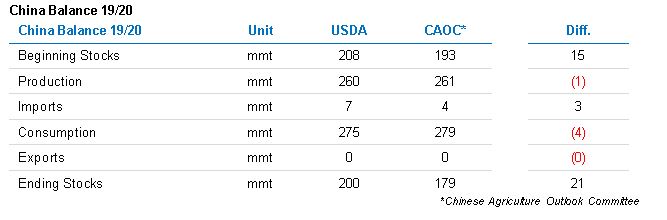

China

Demand

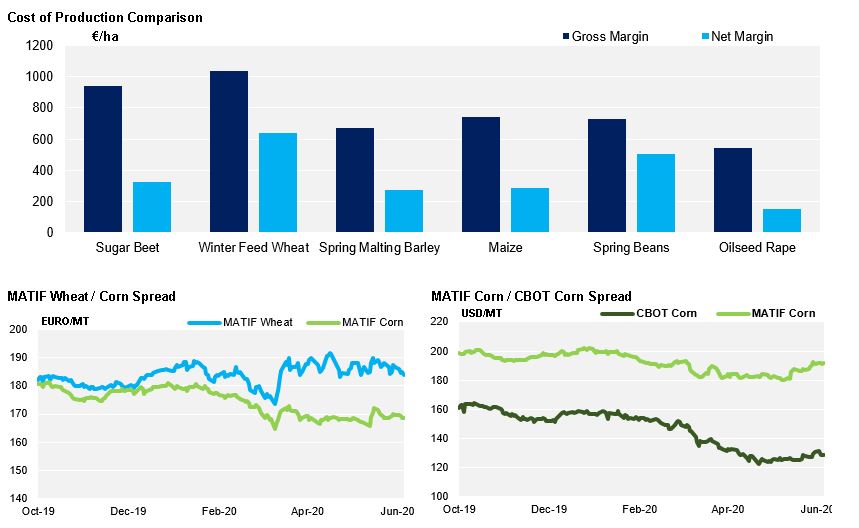

EU