Price Action

Market Commentary

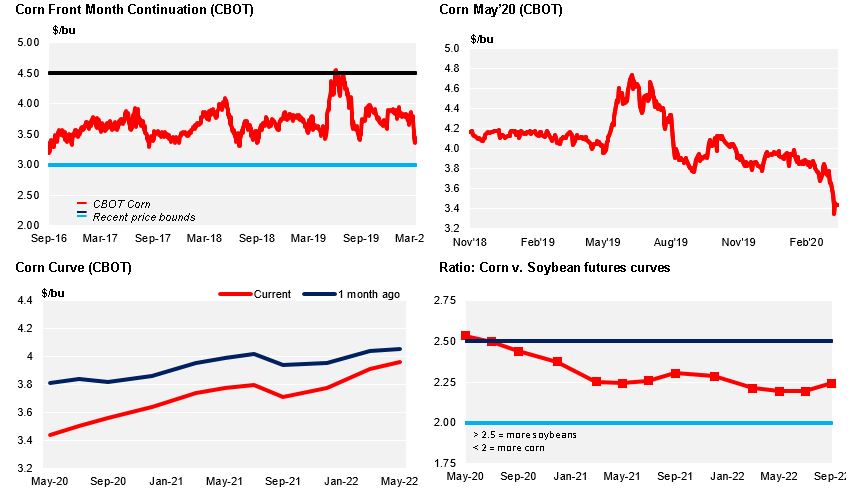

Chicago Corn plummeted on demand concerns of lower use for Ethanol. EU Corn as well as Wheat both in EU and Chicago rallied last week fueled by bargain buying and COVID19 disrupting logistics in Europe. Brazilian Corn continues immune to international markets and it rallied 2,5% week on week for a sixth week in a row due to strong local demand.

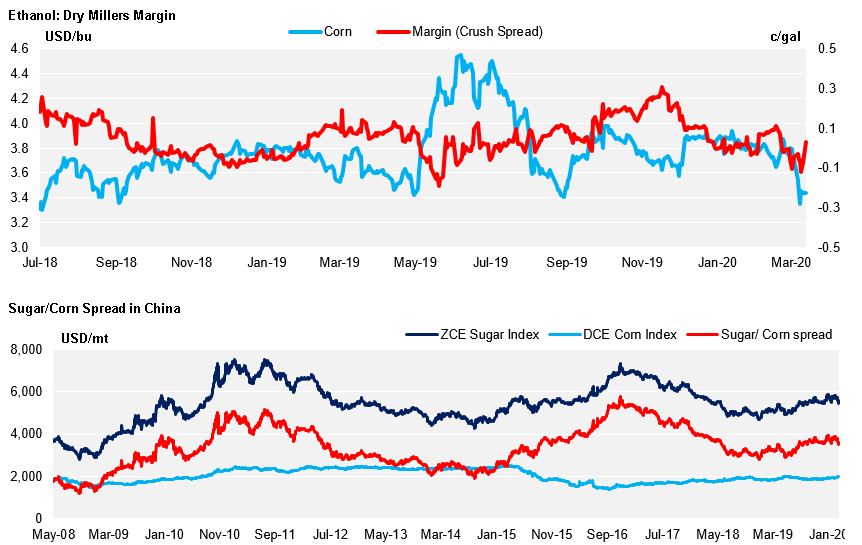

Chicago Corn plummeted as demand for Ethanol use will be significantly reduced (see US Ethanol section). A perfect storm has formed around US Ethanol: big demand loss from COVID19, Ethanol exports and E15 are at risk with RBOB at a discount to Ethanol, and then the structural oversupply of the market. This situation has taken Ethanol margins below cost of production and plant closures will happen very soon, as the industry has been destroying cash since late Q4’19.

China gave some support last week buying US Corn at the by the end of the week but the expected huge new crop and loss of demand for Ethanol weighed more in the market than the Chinese buying.

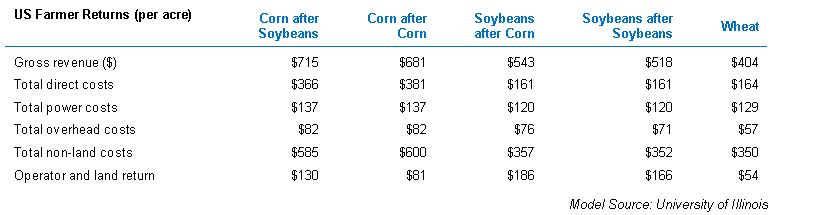

But actual prices are still attractive for farmers to plant Corn and also the Soy/Corn ratio is in favor of Corn. An additional incentive comes from cheap diesel thanks to plummeting Crude Oil just when planting season is about to begin, something that lowers the break even for farmers. The USDA is predicting 94 mill acres to be planted vs. 89,7 of the actual crop. With the Soy/Corn ratio at the lowest level of the last five years and the breakeven moving lower, the number of acres predicted by the USDA is secured as nothing is more important than this ratio during planting season.

Corn prices in Brazil continued to rally and they should remain firm. We have three major boost from the demand side: demand for feed as livestock demand from Chinas has rallied since they had the swine fever, Corn Ethanol production growing at rates of 100% year on year, and a big export program. The new crop is expected to be similar to the last one thus the supply side remains unchanged and prices will therefore remain strong. But looking forward, demand for Ethanol will probably not grow, as Corn Ethanol margins are negative now and the outlook is bearish. Planting in Mato Grosso is 99,6% complete.

Brazilian and Argentinian port workers have threaten with strikes worried of contagion of COVID19 and both countries have already announced measures similar to those in Europe.

Canada is also worried that closing border will leave their farming sector without foreign temporary workers something that could delay planting thus potentially impacting their grain production. German farmer’s unions have warned of the same situation.

Ukraine and Russia said they could consider closing borders to exports if they see a threat to domestic supply.

Wheat rallied both in Chicago and in Europe. Chicago was influenced by reports of China buying US Wheat for the first time since 2017. European Wheat was influenced by still poor condition across Europe, the lockdown in France due to COVID19 disrupting logistics coupled with strong local demand, buying interest around the world, and a seven year low in Ukrainian Wheat stocks as of Mar 1 given the record export pace.

French Wheat condition was unchanged at 63% good to excellent vs. 85% last year. It has been the wettest first half of March of the last 60 years.

Logistic disruptions from COVID19 measures could have an impact to prices. Prices in export markets like the US and South America could suffer while prices in import markets could be supported. The risk is to the downside for Chicago Corn as 4 bill gal of Ethanol installed capacity needs to shut down during the next three months.

Chicago Corn down due to demand loss from Ethanol use which European and Brazilian prices rallied on local fundamentals. The risk is to the downside in Chicago as at least 4 bill gall of Ethanol installed capacity must close down.

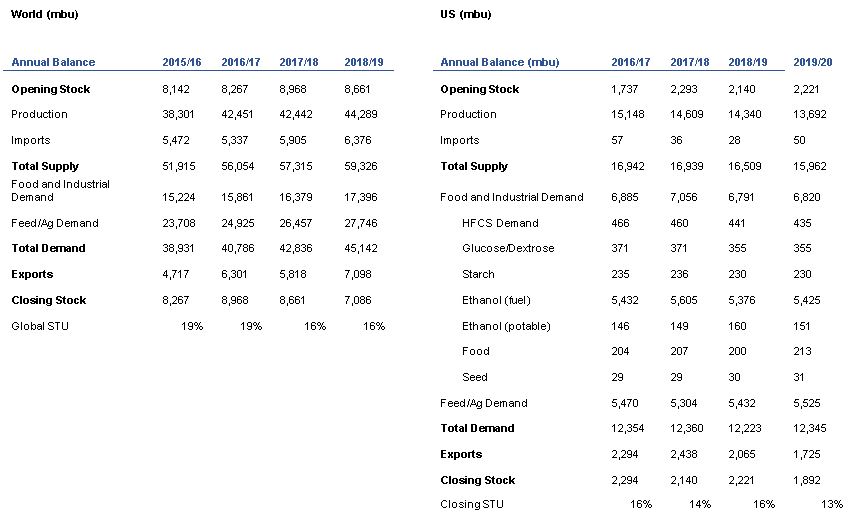

Supply

WASDE Projections

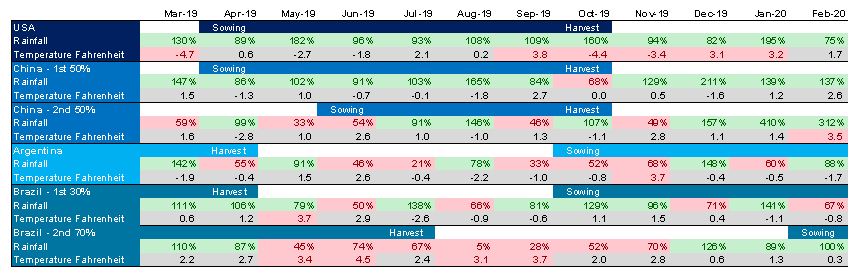

Weather in Main Corn Growing Regions

Brazil Balance

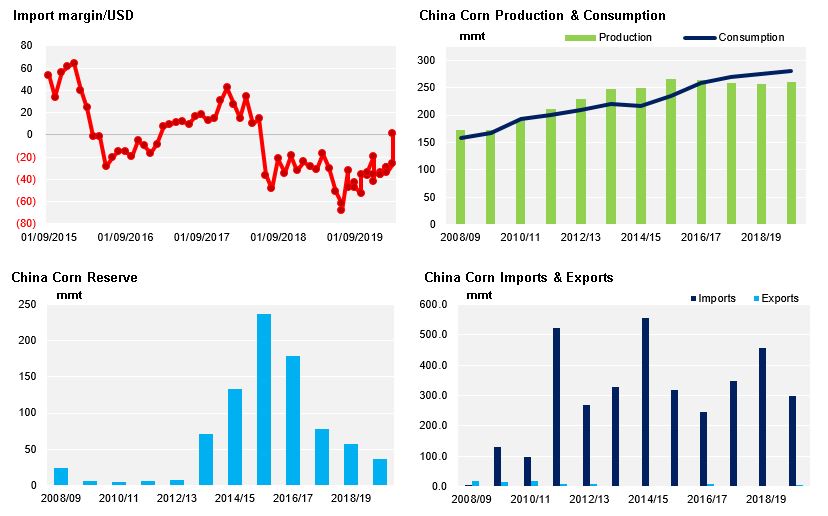

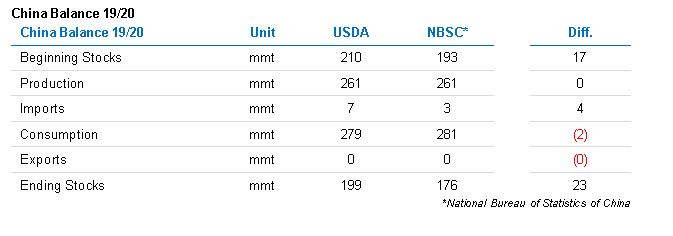

China

Demand

EU