Price Action

Market Commentary

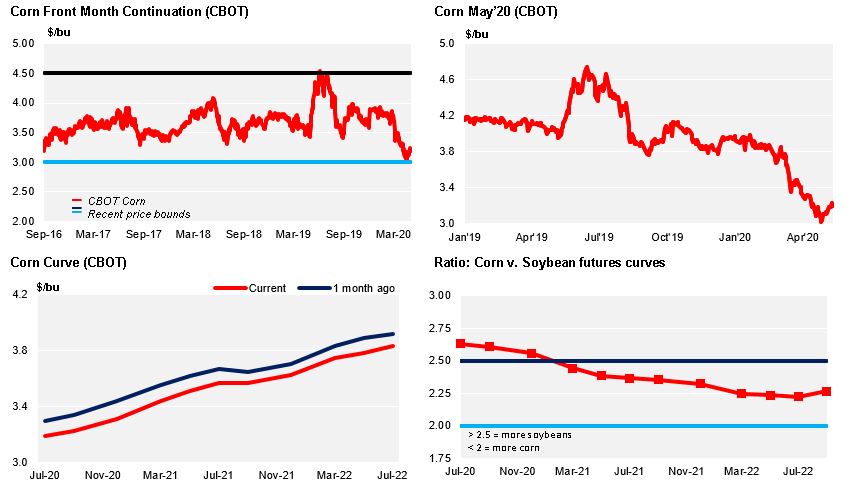

Chicago Corn had a flat week after the May WASDE forecasted a sizable stock build in their first estimate of the 20/21 crop. EU Corn was down by 1% week on week while BR Corn made gains of 2%. Wheat was down both in the US and EU but basically due to the expiry of the May contract.

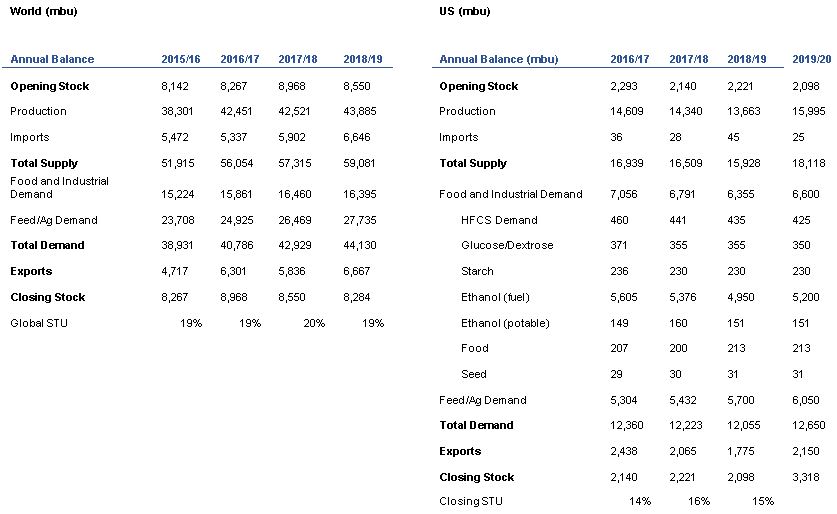

The first USDA forecast for the new 20/21 crop showed Corn ending stocks at 3,317 bill bu vs. 3,389 expected. The lower number vs. the trade estimate gave support to the market which closed positive after the release of the report. But by the end of the week prices gave back all the gains and closed the week unchanged.

The huge ending stocks leaves stocks to use at 22,4% vs. the 15,2% forecasted for this year and is a combination of higher supply partially offset by higher demand.

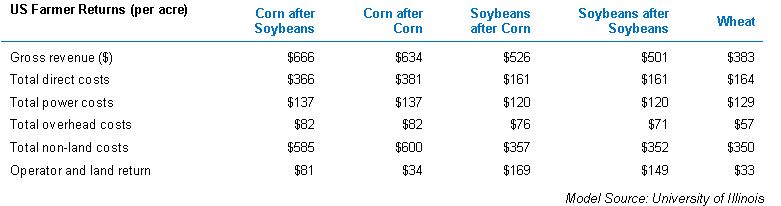

On the supply side they forecast 97 mill acres vs. 89,7 from the actual crop, in line with the prospect planning report. And a huge yield of 178,4 bpa vs. 167,8 last year, which is not a good reference due to poor weather. The forecasted yield is to compare with the 176,4 bpd of the previous crop. They are basically forecasting a trend yield eliminating the abnormal 19/21 number. The question mark is if farmers will change their planting decisions due to plummeting demand for Ethanol and instead of 97 mill acres we end up closer to 95.

Planting progress continues at an excellent pace with 67% completed vs. 56% of the five year avg. The forecasted number of acres should not be a problem at the actual pace.

Interesting is that the USDA said they are re surveying some areas for potential non harvested acres for the actual crop. They made small changes to the actual Corn crop slightly reducing harvested acres and yield. As a result production fell by 29 mill bu. But demand was also reduced resulting in almost no changes to ending stocks which finish 9 mill bu higher.

On the demand side they forecast higher local demand by 500 mill bu vs. the actual crop and also higher exports. The growth in local demand is equally shared between feed and Ethanol usage vs. the actual crop which we don’t think is doable (higher Ethanol means more DDGS thus less Corn for feed). The export number is also questionable as it only depends on China.

World Corn supply was forecasted at 1187 mill ton vs. 1115 last year. World ending stocks are at 339,6 mill ton vs. 319,6 expected.

Wheat ending stocks for the new 20/21 crop were projected at 0,909 bill bu vs. 0,814 expected. Production is forecasted at 1,866 bill bu vs. 1,92 of the actual crop.

World Wheat supply is forecasted at 768,5 mill ton vs. 764,3 last year. World ending stocks are 310,1 mill ton vs. 292,5 expected.

Soybeans ending stocks were 0,405 bill bu vs. 0,43 expected.

Weather and acreage are the key parameters to look at now. The big picture is that supply is ample and unless we have a weather event there should be limited upside for Chicago Corn.

But despite the dry Weather and the poor Wheat condition in France, the MARS bulleting left Wheat yield projection basically unchanged from last month’s report at 5,65 ton/ha (-0,2%).

Russia allocated all its 7 mill ton Wheat export quota last week.

The IGC did lower their global Wheat production forecast in 20/21 by 4 mill ton to 764 mill ton still well above last years’ 762 mill ton. The revision was due to lower production in the areas hit by a mild winter and a dry April: EU and Black Sea area.

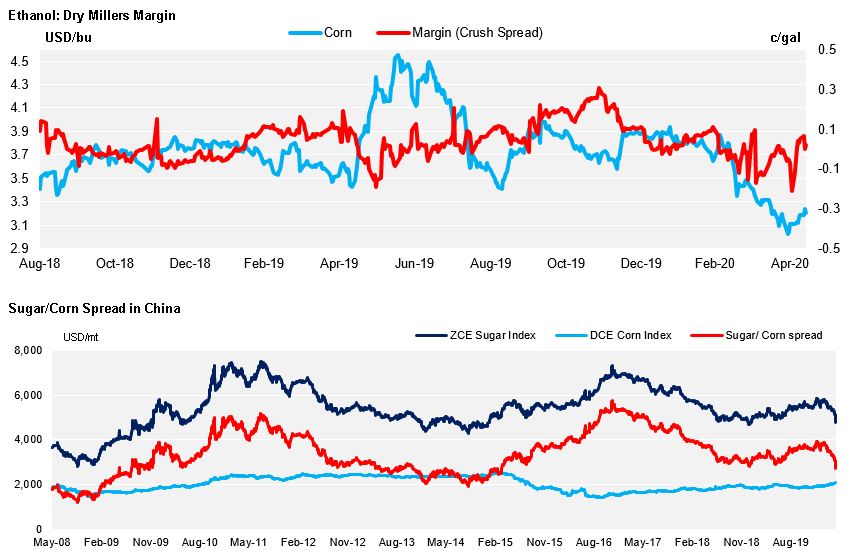

We have a negative view on Crude Oil for the next couple of months and demand for Ethanol will continue to suffer thus expect Corn in Chicago to remain rangebound with no reason for the market to trade higher.

Supply

WASDE Projections

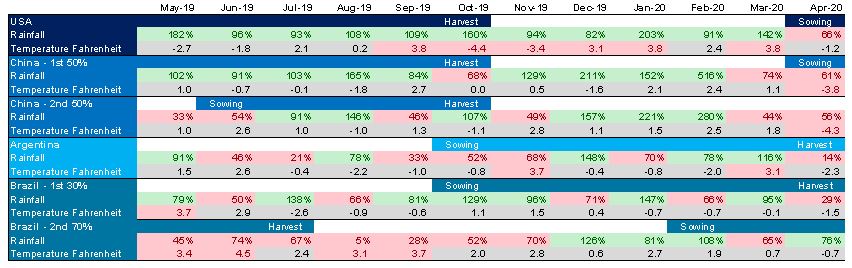

Weather in Main Corn Growing Regions

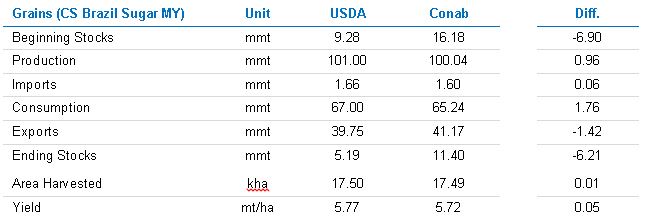

Brazil Balance

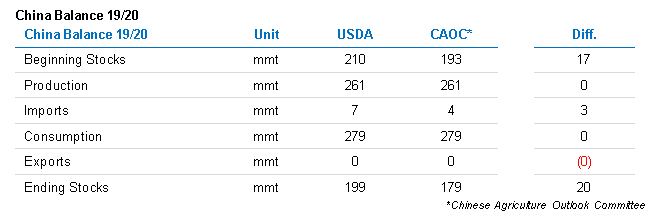

China

Demand

EU