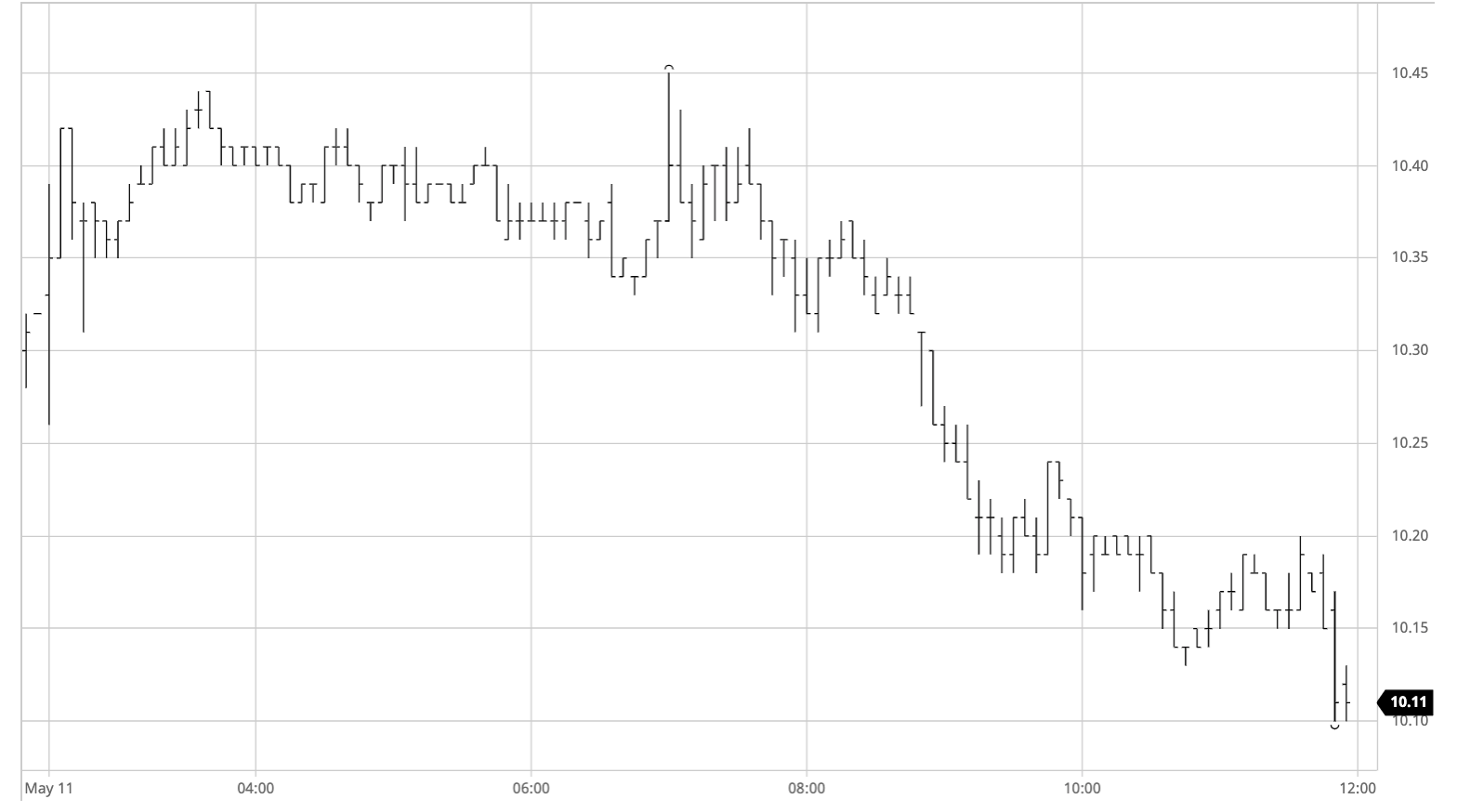

There was little in the way of fresh impetus to spark the market this morning, Fridays shortened No.11 session having seen relatively little movement and then the COT report showing a widely expected reduction in the fund short holding to -47,844 lots as at cob 5th May. We did at least emerge slightly higher on the back of a broadly supportive macro with the gains consolidated throughout the morning in relatively quiet conditions. Mid-session saw the front month top out at 10.45 with a little more selling beginning to emerge following the BRL opening with the currency showing signs of weakening back towards last week’s lows, and though it stopped a small way short of this market it was sufficient to push prices down to make new session lows and play out the final three hours in negative territory. There was a little spec/algo activity as they looked to play from the short side on the dip, and while the larger funds were quiet one suspects that they will be in no hurry to continue reducing shorts while the BRL continues to dominate the narrative. MOC selling ensured that we settled right around session lows to conclude a rather weak performance.

No.11 Futures