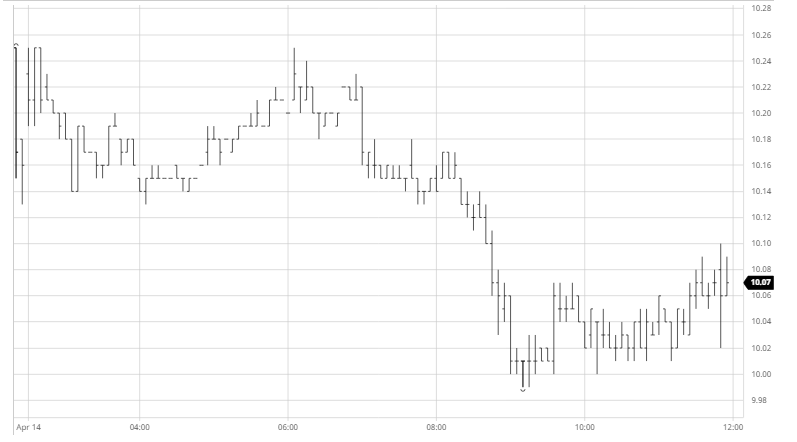

The market was a little firmer this morning however given the disappointing nature of yesterday’s shortened session that may simply have been against some renewed consumer interest at the lower levels. Prices edged along between unchanged and a little higher throughout the morning however the Americas brought with it a fresh burst of selling that saw May’20 pushed down to challenge the 10c area, and in so doing briefly register a 9 handle with prints at 9.99, another new contract low. Spread weakness again prevailed and it seems that with Ethanol parity remaining significantly below market levels and the crude price continuing to struggle despite the Opec announcement of the expected 9.7m bpd cut further forays into the 9’s may well be on the cards. USDBRL back at 5.20 following last week’s recovery to 5.05 was not aiding the markets cause either and we held near the lows for the rest of the day to settle at 10.05 and conclude another disappointing performance

May’20 saw wild swings once more on its penultimate day. May/May’20 WP was well into the $120’s once again while May/Aug saw swings between $12 and $23.10 as traders tidy positions ahead of expiry. Premiums were firm down the board with Aug/Jul’20 at $105 and Oct/Oct’20 touching $90 late on.

No.11 Futures