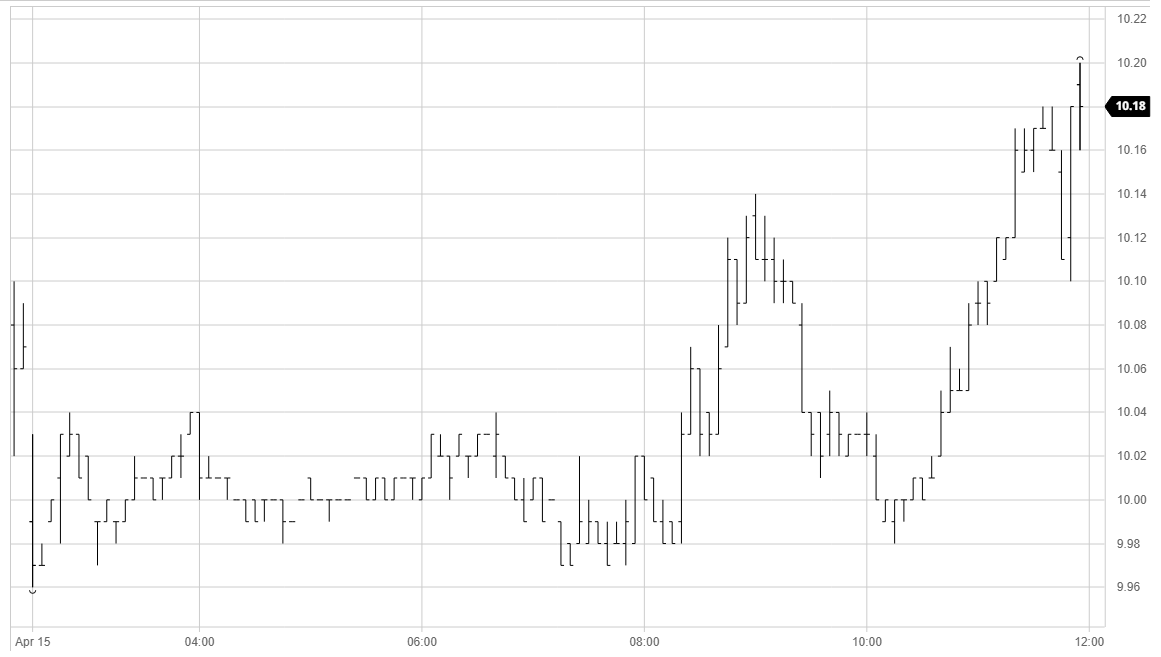

The recent weakness has clearly dented confidence further and the market saw its first sub 10c opening in a long while as May’20 printed straight down to 9.96. Consolidation around the 10c mark followed however with WTI crude now trading sub $20 and USDBRL futures indicating a weaker opening in the mid 5.20’s it was easy to see why values languished near to the lows. We continued either side of 10c during the early afternoon as the BRL made its call, with volume remaining light aside from the May/Jul’20 spread where we were continuing to generate some activity as buyers moved back into the ascendancy following the conclusion of the index roll. The day then took on a marginally more positive view, led by the May’20 spreads which had support through until the end of the session. This enabled the front month to pull up to 10.20 by the end of the day, though with May/Jul’20 trading back up to -0.10 the rest of the board was showing more modest changes.

May’20 expired at $11.50 premium to the Aug’20, having seen the spread trading out to $24 this afternoon before being aggressively pushed back lower ahead of the close. Expectation is that 4,838 lots (241,900mt) will be tendered against the expiry with details published by the exchange tomorrow.

No.11 Futures