• A day of quiet consolidation ensued for No.11, maintaining nearby positions in positive ground for the majority of the session. With the macro having a rather flat day there was little outside influence on proceedings and in a quiet news environment holding the recent range seemed the best that we could hope for. Perhaps the most worrying sign was that the May spreads gave back a chunk of yesterday’s recovery as May/Jul traded back out to -0.18 with nearby spread weakness generally a precursor to flat price weakness that could see us looking back into the 9’s moving forward. May’20 ended the day trading little changed, somehow rather apt given the dull nature of proceedings.

• Aug’20 took over as spot month and pushed ahead with some gusto, with strength seen for the Aug/Oct’20 spread which reached $12.50 and the Aug/Jul’20 WP that was pushing towards $110 by late afternoon. This pulled the rest of the board up to show strength that the No.11 can only dream of right now. The move higher for WP values potentially encourages refiner pricing back in, and they will no doubt be keenly watching how the May’20 delivery develops as they plan their next moves.

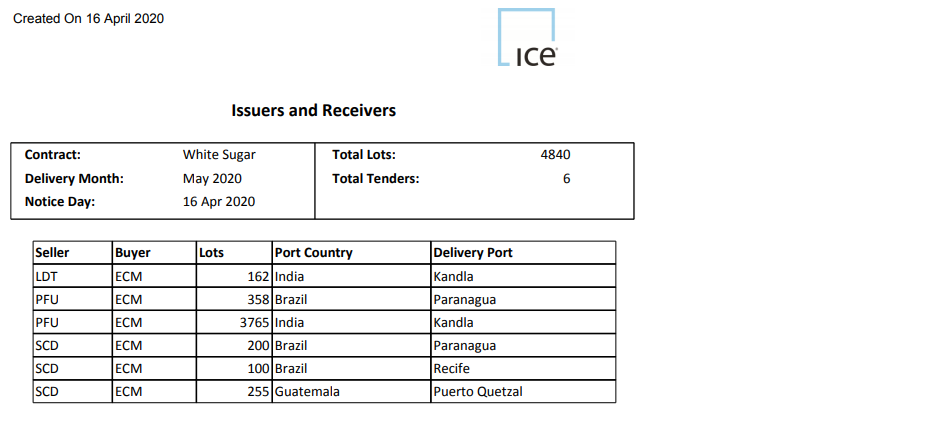

• May’20 saw 4,840 lots tendered against the expiry, with Indian origin sugars the largest proportion of the tonnage. Details are below.

No.11 Futures