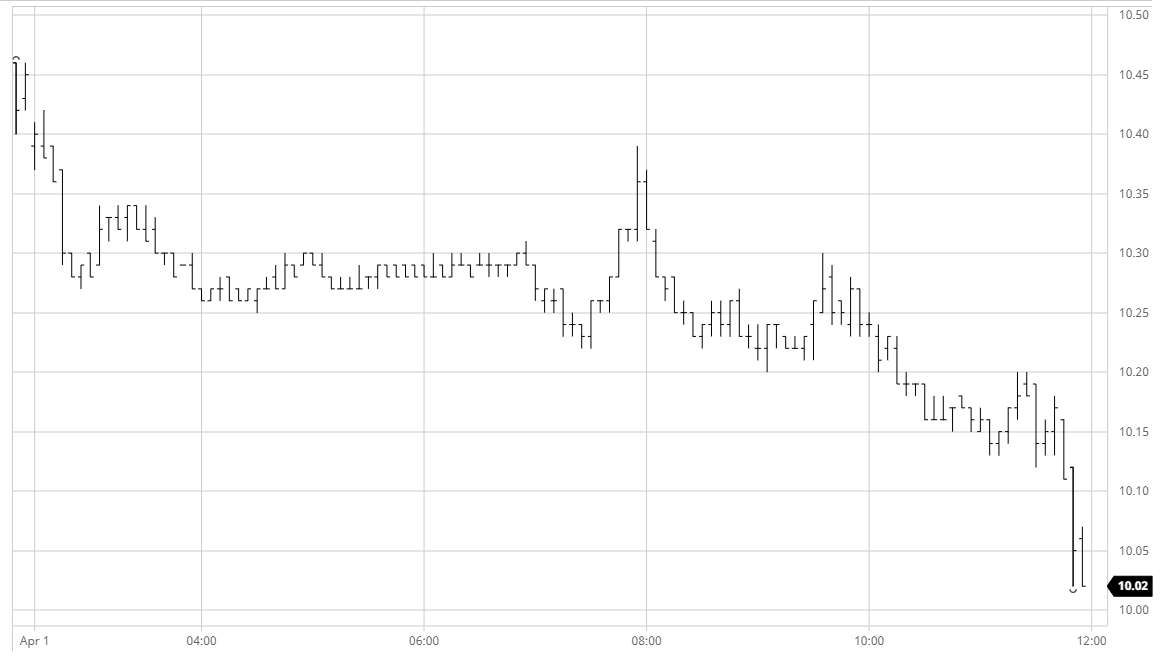

The lower trend continues as today saw the market under renewed pressure to make fresh life of contract lows once again. With the technical picture now showing a negative hue that is matched by the physical picture and the wider macro it is not surprising in the slightest that we worked lower during the morning. These lower levels did encourage out some buying from consumers which supported May’20 in the 10.20’s through the morning before we saw something of a bounce back up towards 10.40 that turned out to be incredibly short-lived. Returning to the lows we were now under the influence of lower crude values and further weakness in the USDBRL to 5.25, which seemed to be encouraging sellers back to the market with signs of some nearby producer pricing taking place ahead of the May’20 expiration at the end of this month. The culmination of this action was further session lows made on the closing call as aggressive selling looked set to bring up a 9 handle, though we stopped just short as May’20 recorded a low at 10.02. The whites were also not immune from this selling as the May/May WP bobbed back beneath $120 to register a poor conclusion for both markets which suggests that there is further downside to follow.