The calm after the storm saw a more stable performance form the Jul’20 contract, working higher to briefly trade above yesterday’s high and eradicate the losses. The spark that drove us to the highs was almost inevitably provided by a Trump tweet as he threatened Iranian gunboats with the American military, this in turn pulling crude prices up a little from their very low levels and taking the macro along for the ride. Other more relevant sugar factors meanwhile remained negative, none more so than the USDBRL which returned from its one day holiday to record a fresh all-time low at 5.4137. The afternoon saw Jul’20 trading either side of 10c as specs flitted in and out of the market, and almost appropriately we were trading right around this figure on the closing call to be little changed. The rest of the board did not fare quite so well with losses of up to 15 points showing further forward, and it continues to feel that there may well be more struggles ahead.

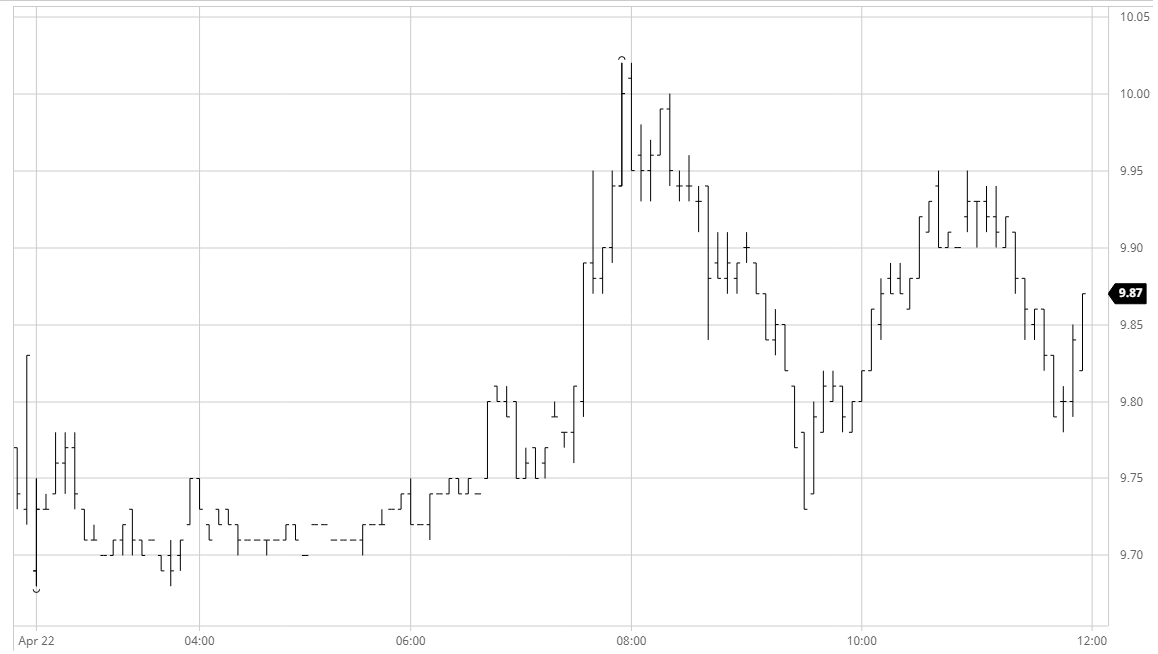

No.11 Futures