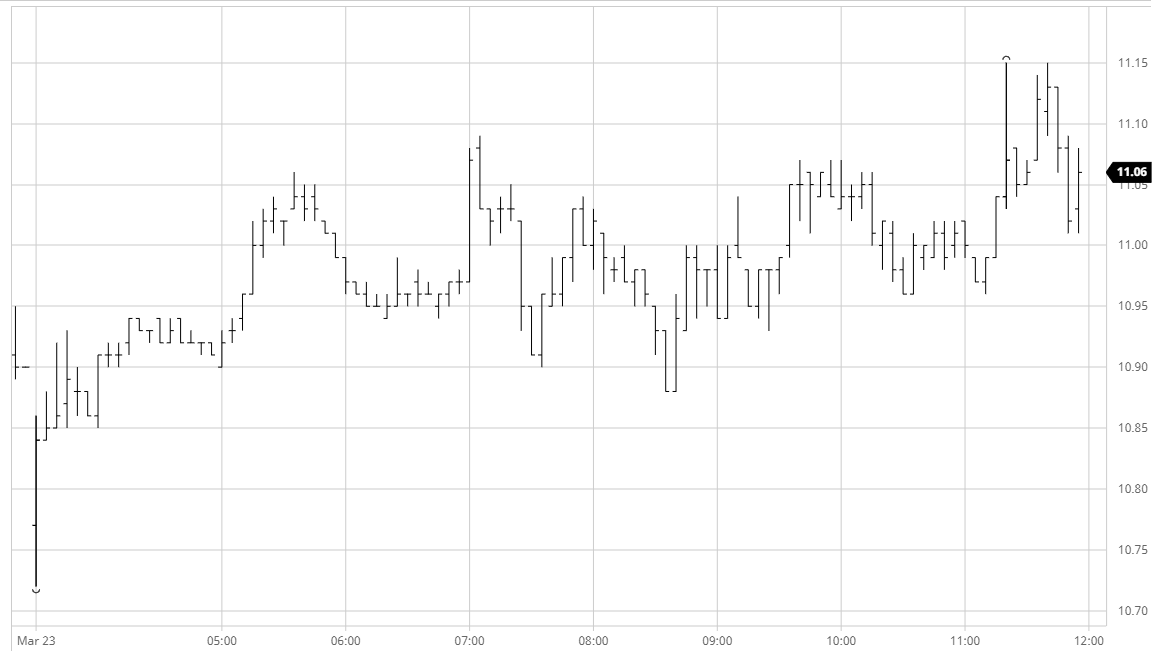

The market commenced lower in line with some further macro concerns over the weekend, however the fall was relatively short-lived and we soon pulled back to hold near to unchanged levels. The calmer environment was maybe in part due to the neutral fund position now thought to prevail with last Tuesdays COT showing the net long at around 7,500 lots only. Further spec selling since Wednesday would be expected to have turned this to a small net short however in a de-risked environment one would expect the larger funds to remain rather quiet for the time being. As the day progressed we continued to delve either side of 11c basis May’20 with no traction being gained in either direction, and while the final hour saw a little more aggressive buying take us to a session high 11.15 this still fell a few points shy of the mark reached on Friday. Settlement was fairly neutral at 11.04 and assuming the specs remain quiet we may well see a continuation of this consolidation.

No.11 Futures