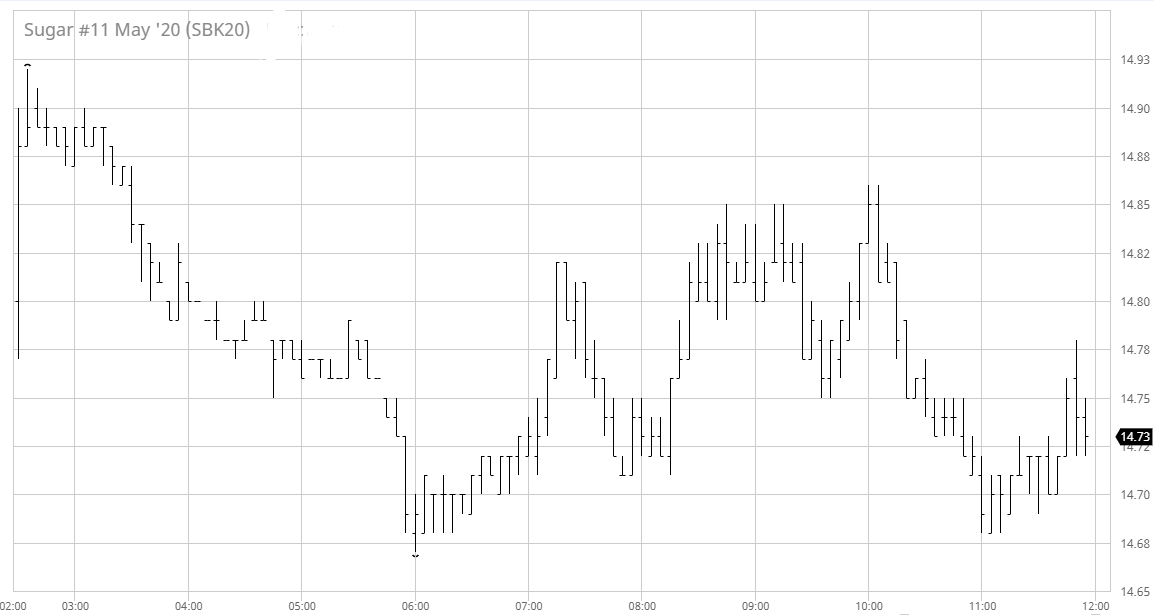

Following yesterday’s macro led decline we somewhat unexpectedly popped higher this morning as early buying helped May’20 up to 14.92. This gain proved unsustainable for the biggest month on the board, while the soon to expire March’20 forged ahead regardless as it traded all the way to 15.49 while the March/May spread widened to 0.65 points premium. Late morning saw a retreat to session lows however it was rather short-lived as specs stepped in to buy on the “US opening” and take May’20 back into the 14.80’s. What then followed was something of a yo-yo performance from May with prices ranging between the 14.70’s and 14.80’s as light spec and algo activity had prices reversing within the earlier range. May did push back towards the earlier lows before finding defensive support which ensured we remained marginally high during the closing stages. The same could not be said of March though with aggressive selling of the March/May’20 spread sending the differential all the way back into 0.38 points before settling at 0.41. Overall something of a quiet day within the range with macro factors likely to continue holding sway for the near term.