133 words / 1 minute reading time

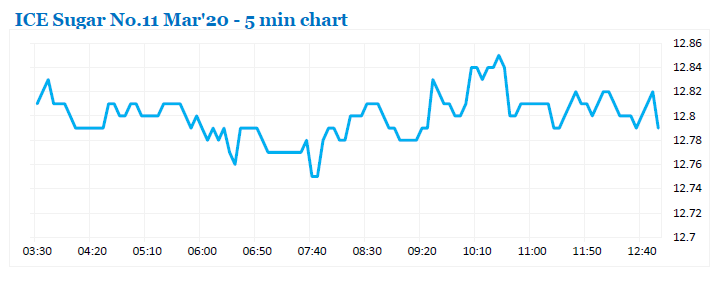

Last Friday’s COT report raised a few eyebrows, showing that as at last Tuesday the hedge fund short position had reduced by more than anticipated, standing at -111,570 lots. Given the flat nature of the market, it was no surprise that this reduction coincided with a large increase in the commercial gross short position with Producers seemingly content to continue hedging around current levels. Thoughts that this data may prompt values to pull back were unfounded however as we started the week with another day within the confines of last week’s range, trading between 12.86c/lb and 12.74c/lb for March’20. There remains a wall of selling above the market across the 2020 positions, and with this unlikely to change we seem set to continue along now familiar lines for the near term.

No.11 Futures

If you have any questions please feel free to contact the derivatives team at website@czarnikow.com.