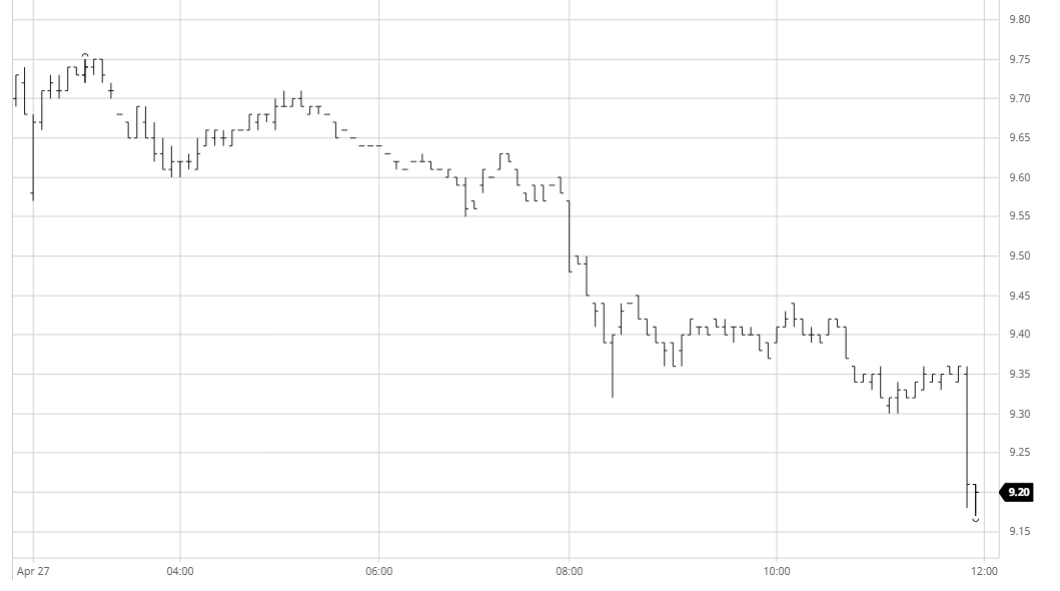

Friday evening news that the COT was showing that funds have amassed a 65,138 lot short position seemed to merely suggest that further weakness was to follow as we started the new week in the red with immediate losses for nearby prompts. Some light consumer buying interest did follow which very briefly lifted July20 back above unchanged to 9.84 but no sooner was it concluded that we resumed the downward path once more. Pressure continues to emerge from all quarters with WTI crude back on a downward path, Brazilian currency worries escalating and from a fundamental perspective we continue to hear of reducing consumption from India amongst others while the weaker currency and continuing low ethanol parity is leading to increasing sugar production in Brazil. A mid-session pause in the mid-9.60’s merely held until Americas based traders kicked prices lower again during the afternoon while a further period of consolidation was busted during the final 10 minutes as July’20 was sold aggressively to 9.34 while the spot May’20 reached 9.17 as yet more new contract lows were recorded. Values are now lower than they have been for more than 10 years and despite the oversold picture the chances of any significant recovery remain limited.

No.11 Futures