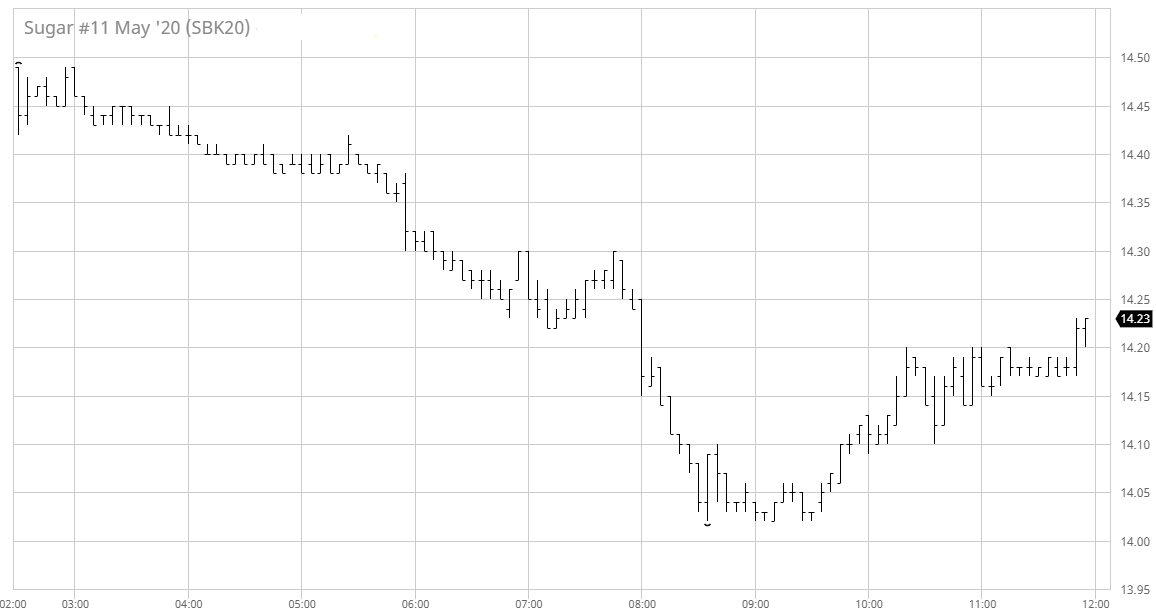

The market continued lower today as Coronavirus concerns escalate leading the macro picture to make continuing losses with equities under huge pressure again while WTI crude headed down beneath $47. We From our modest 5 lower opening May’20 continued down to a morning low of 14.22, placing it right on the lower Bollinger band where it found some moderate support. This enabled values to pick up a little as Americas based traders reached their desks although with the energy sector making fresh lows and the USDBRL trading down towards 4.50 the appetite from the long side soon faded. Instead we punched through this and traded lower still as May reached 14.02, placing it just ahead of the 13.98 low from 28th January while also maintaining psychological support at 14c. Given that losses now exceeded 50 points it was not overly surprising to find some support/bargain hunting emerge, and for the final couple of hours we traded away from the lows, eventually settling at 14.20 basis May’20. Given the scale of the correction it would not be unexpected to see some further consolidation in the near term particularly having reached technical support levels, though with the macro remaining dominant that will continue to hold a huge influence over the near-term direction.