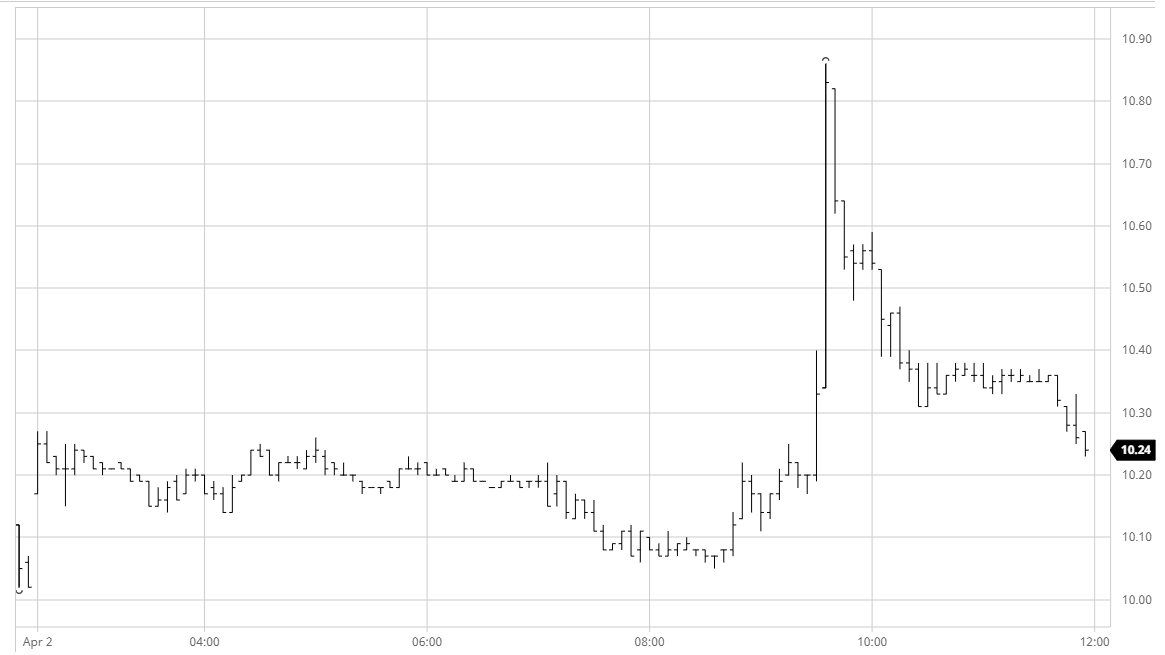

Following the recent haemorrhaging of No.11 values which has seen us fall as low as 10.02 on last nights close there was a glimmer of support this morning as buying from consumers emerged to bring prices in a little firmer. In relatively quiet conditions this allowed May’20 to consolidate between the teens and mid 10.20’s throughout the morning with the main early activity seen for the whites where WP values were being pushed down from their opening highs led by what appeared to be spec selling of the May’20 ahead of the forthcoming expiry. Fresh pressure was only brought to bear upon No.11 following the USDBRL opening and with the currency continuing in the low to mid 5.20’s the May’20 pushed back to 10.05 to sit just ahead of the contract lows once more. Buying did creep back in at these levels to pull us back away from the lows, however what was to follow came as a shock to all. May’20 spiked to 10.86 in reaction to the energy sector move following Donald Trump’s announcement that a 10-15m barrel oil supply cut had been agreed, however the highs were seen only briefly as we stepped back to ultimately consolidate the news in the 10.30’s. This was a larger pullback of the gains than was seen in crude and possibly reflects the fundamental story for sugar being given some respect, while with the BRL remaining at 5.26 there was no doubt producer interest being seen also to cap things off. More aggressive selling during the latter stages pushed May back into the 10.20’s to conclude an eventful afternoon showing only steady net gains.

No.11 Futures