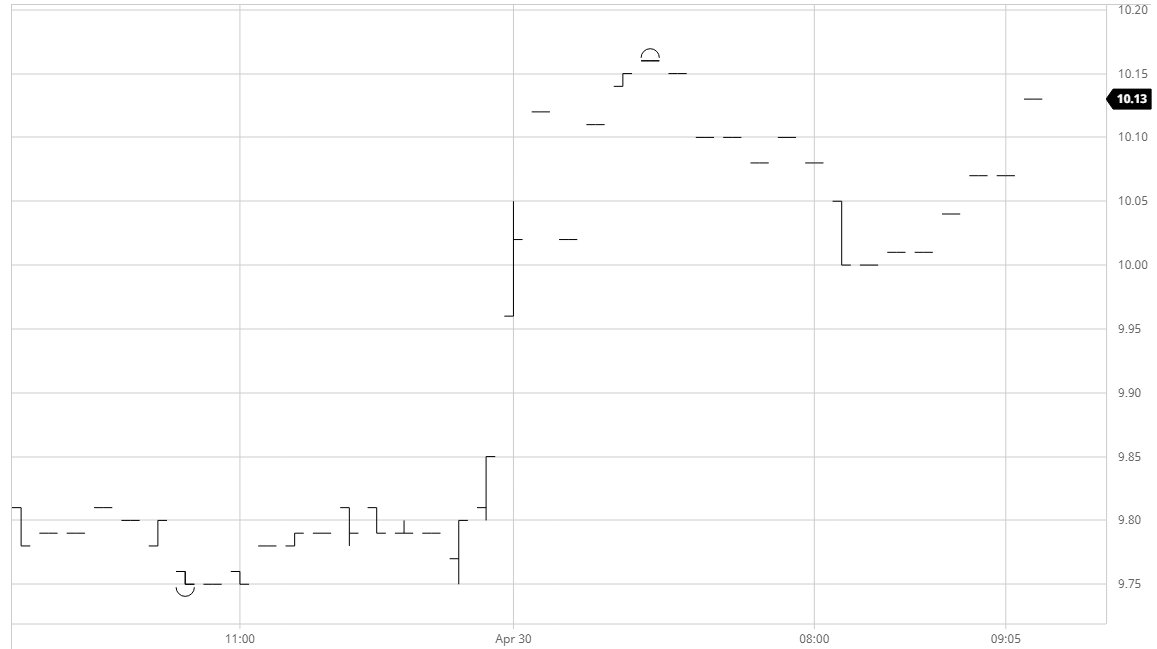

• The market continued to forge its way higher today, building upon the sharp recovery of the previous two sessions to climb back to 10.34 basis Jul’20 and close the small technical gap established on Tuesday last week. The majority of the gains were made during the first 15 minutes with macro stability again providing the impetus as markets found strength on positive news from the US that there is being FastTrack approval for Covid-19 treatment. This alongside the news that increasingly more countries are moving past peak and seeing the number of new infections decrease provides more confidence as we move forward. Prices held the gains reasonably consistently apart from a brief mid-session dip to 10.04, with macro factors winning the day today despite a weaker USDBRL which returned to 5.46 to undo some of the recent gains. New session highs were recorded during the closing stages as specs covered some more of their shorts to conclude another strong performance. After three consecutive strong days we merely find ourselves where we were at the start of last week. This still represents a strong recovery however unless the macro can continue to drive ahead we may well stall in the face of the ongoing fundamental picture.

• Whites were even firmer than the raws with WP values rocketing to reach $112.50 intra-day for Aug/Jul’20. It appeared that the higher levels encouraged out pricing from refiners to bring us back away later in the session, though we still remained firm at around $108.

• Tonight’s May’20 No.11 expiry has seen a record delivery of 44,449 lots tendered, expected to be primarily of Brazilian origin. Delivering are Cofco and Wilmar with Dreyfus, Alvean and Glencore receivers. Full details and splits will be published by the exchange tomorrow.

No.11 Futures