164 words / 1 minute reading time

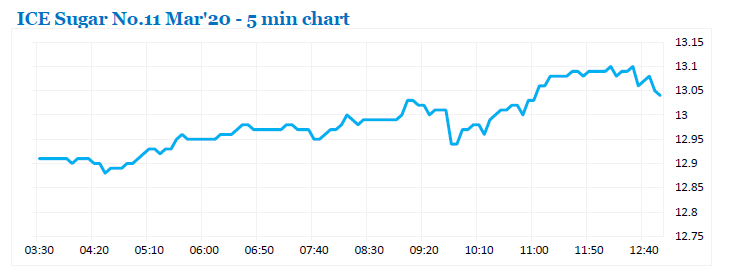

Following on from yesterday’s stable performance, we commenced positively as March’20 edged above 12.90 during early trading. Volume was light during the morning, with selling thin on the ground ahead of 13c and this enabled values to continue climbing and challenge the recent 13.01 high once the arrival of US based traders had brought the inevitable increase in speculative activity. Following pauses at 13.01 and then at 13.03 there were buy stops triggered on route to 13.10 where the next chunk of significant selling lay in wait. It was noticeable however, that while there was steady pricing being done by producers at each point higher the volumes changing hands were lower than have been seen of late with scales increasingly taking over now that they have locked in a reasonable percentage of their pricing. The latter stages saw some position squaring to drop back marginally from the highs though settlement remained technically constructive at 13.06 comfortably above the previous recent high mark of 13.01.

If you have any questions please feel free to contact the derivatives team at jwhybrow@czarnikow.com.