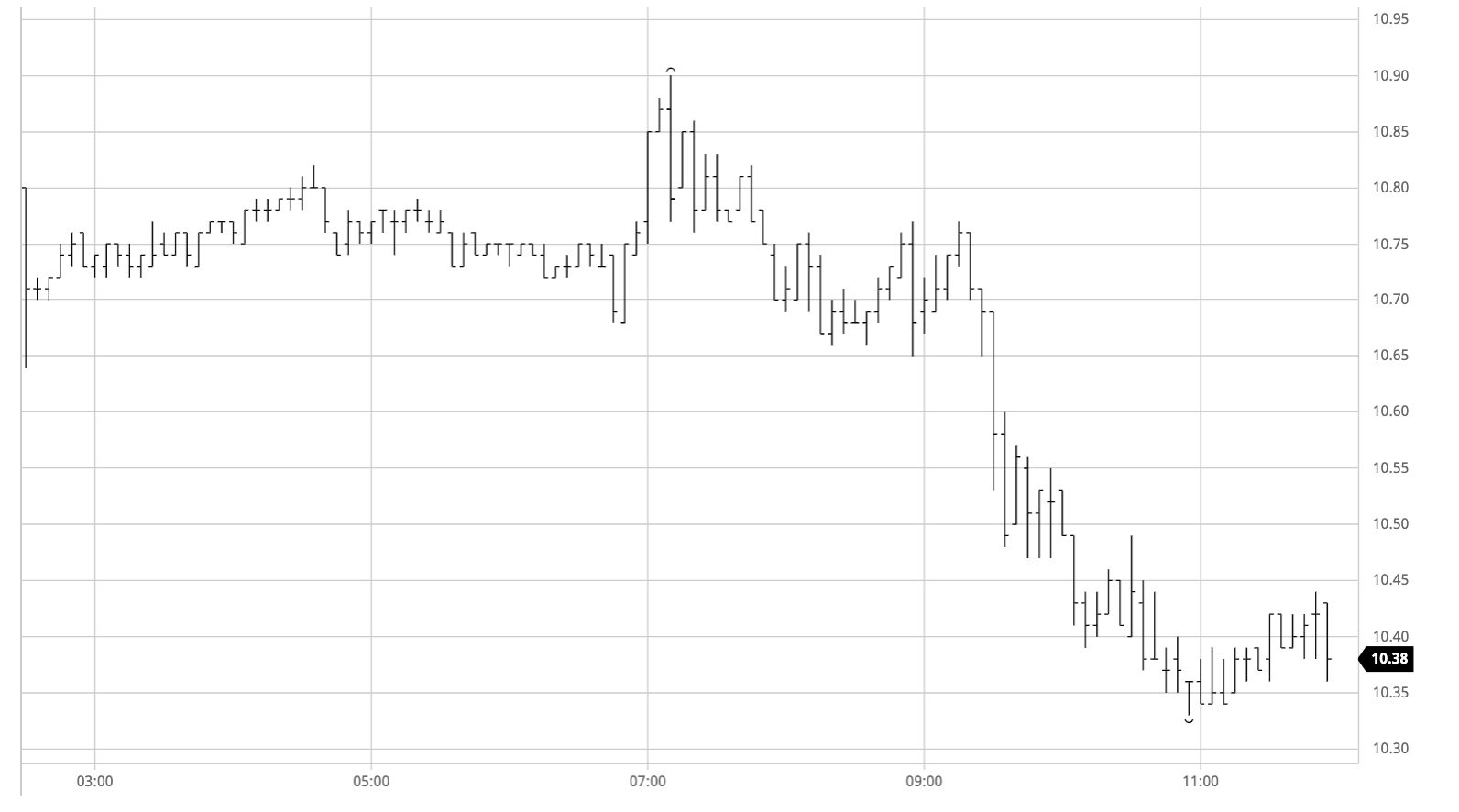

The week began with prices trading lower as macro factors set the market off on a negative footing following the remarkable recovery seen over the previous four sessions. A quiet morning of sideways consolidation was only brought to an end around 1pm as the “US opening” brought with it some spec activity that led Jul’20 upwards to briefly reach 10.90, still some 7 points beneath Friday’s closing level. Around the same time we also saw the USDBRL reopening at weaker levels (between 5.55 and 5.60) following Fridays national holiday and maybe this played some part in drawing out some producer selling that capped the market with prices moving back towards opening levels once again. It’s fair to say that recent action has moved the market from oversold to overbought on the very short term indicators and we saw more of this volatility when breaking the session lows in the mid 10.60’s as spec sell stops triggered to generate a decline into the 10.30’s and undo a large proportion of Fridays gains. This placed sugar at the bottom of the CRB for the day but maybe surprisingly still represented an inside day, illustrating the volatile nature of recent movements. There was a little more buying at the lower levels however consumers are quiet in this area having seen far lower levels only last week and it seems that having pulled back from the highs we may see some spec driven choppiness within the broader range for the time being.

No.11 Futures