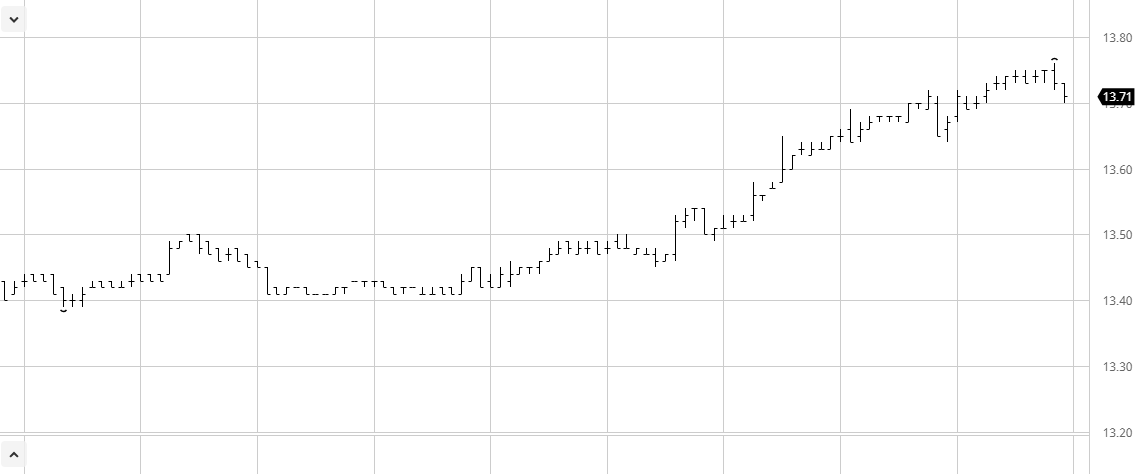

The market was higher from the get-go this morning and never looked back. The solid early platform provided specs with a basis to push higher throughout the afternoon, triggering some light buy stops in the 13.50’s and again as we passed through 13.60. The higher levels brought with them some stronger producer selling as one would expect, however this failed to make any real impact upon the specs who by now had the recent high mark of 13.67 (13th Dec) well within their sights. This was passed relatively comfortably with the final couple of hours seeing a new high mark of 13.76 before slipping back by a few points at the death as some end of day position management occurred.

There was talk from some brokers that the move is based on concerns that there will be reduced sugar availability should the situation in Iran escalate and Ethanol demand increase, though for today at least this concern did not extend to oil which remained little changed. There is also speculation that funds a pushing as they feel the commercial short cannot continue to grow at its present rate and there may be an opportunity to spring prices upward as the selling thins. Differing reasoning but after a prolonged quiet we have some discussion points.