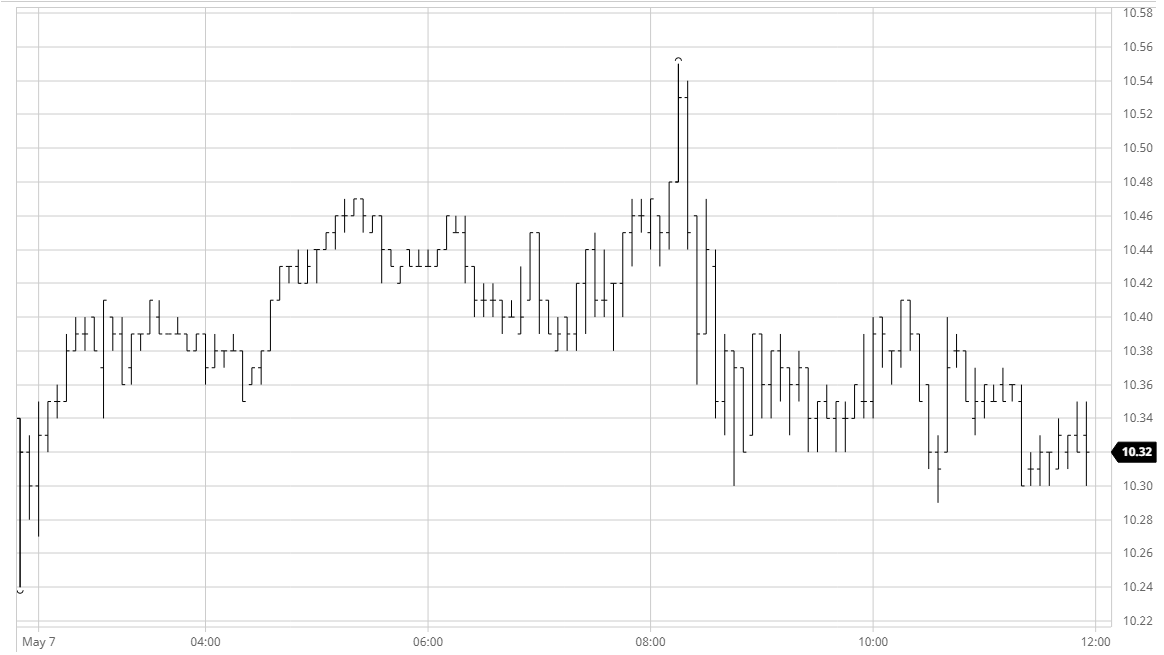

• A much flatter morning saw prices maintaining early gains to edge along a little way above last night’s closing levels. Volume was only moderate and it was noticeable that buyers were less aggressive than in recent sessions, possibly due to increasing concerns over the Brazilian economy. Here the combination of the recent Fitch downgrade and central bank action continues to undermine confidence, and with Coronavirus cases also rising in the face of inaction by Bolsanaro there are concerns that the USDBRL is heading to 6 and maybe beyond. There was a brief spike upward to 10.55 during the early afternoon which came as a surprise give the USDBRL had commenced the day at 5.80, though this rally was very short-lived as sellers jumped in keen to take advantage of the rally. The resultant move to session lows was then maintained for the rest of the session as prices struggled against the macro background (BRL new all-time low at 5.8757), though with producers largely priced they had negligible interest at the lower levels. Jul’20 settled at 10.33 to represent a small net gain despite the relatively uninspiring performance, though the rest of the board fared less well to leave losses showing for 2021 and 2022 positions.

• London whites are closed tomorrow for the UK holiday. No.11 will open late at 7:30am NY time for a shortened trading session.

No.11 Futures