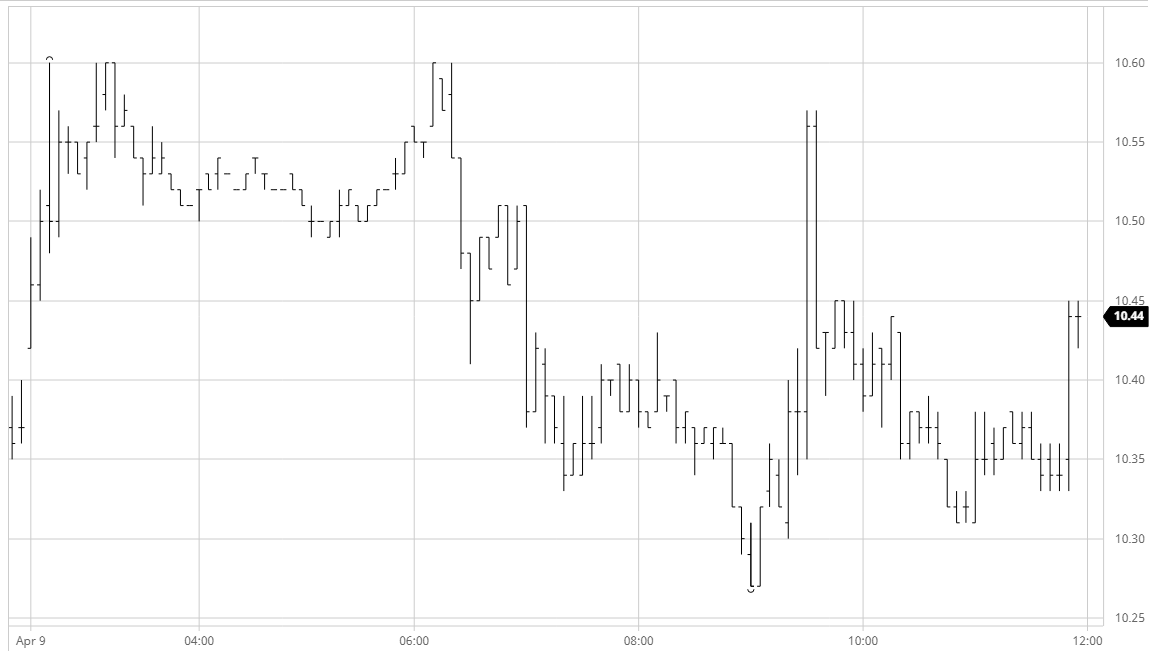

• The day began on a positive footing in response to the macro picture and the gains were held throughout the morning though various efforts to push beyond the initial 10.60 high proved fruitless. Recent frailties in the 2020 prompts then began to reappear as the early afternoon saw nearby values pushed back to unchanged levels with spread values versus 2021 and 2022 being hit once again. It seems that we cannot get beyond the feeling that the increased sugar supply from Brazil this year will send us lower still at some stage, evidenced by the fact that a sharp push back to the morning highs on the news that Opec is nearing a deal to cut crude production was so short-lived. Some end of week position squaring took prices up on the close to conclude a range bound week showing modest gains.

• May’20 continues its rollercoaster ride towards expiry, with May/Aug seeing some wide movements again today. Morning highs at $20.20 were eroded mid-session and we printed all the way back to $9.50 before mounting a recovery to the upper end of the range this afternoon. White premium values were relatively static save for the May/May which moved alongside the spread volatility to trade between $106 and $120.

• White sugar is closed for the Easter holiday on both Friday and Monday. No.11 is closed on Friday but will reopen for a shortened session on Monday at 12.30pm London / 07.30am NY time.

No.11 Futures